150 101 159 2017

What is the 150 101 159

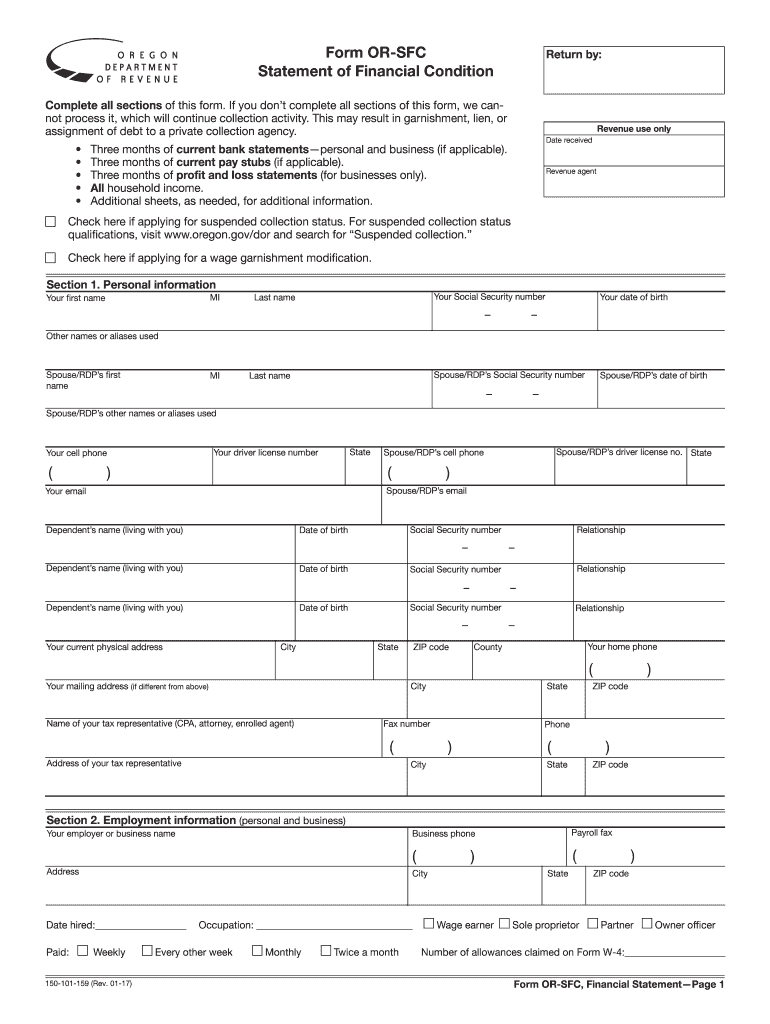

The 150 101 159 form is a financial document used in the state of Oregon, primarily for reporting specific financial information related to probate proceedings. This form helps ensure transparency and compliance with state regulations during the probate process. It is essential for individuals involved in estate management, as it outlines the financial status of the estate and provides necessary details for the court's review.

How to use the 150 101 159

Using the 150 101 159 form requires careful attention to detail. First, gather all relevant financial information regarding the estate, including assets, liabilities, and any income generated. Once you have compiled this data, fill out the form accurately, ensuring that all sections are completed. It is crucial to review the information for accuracy before submission, as discrepancies can lead to delays or legal complications.

Steps to complete the 150 101 159

Completing the 150 101 159 form involves several key steps:

- Collect all necessary financial documents related to the estate.

- Fill out the form, ensuring all required fields are completed.

- Double-check the accuracy of your entries, including numbers and descriptions.

- Sign and date the form to validate your submission.

- Submit the form to the appropriate court or agency as instructed.

Legal use of the 150 101 159

The legal use of the 150 101 159 form is crucial in the probate process. This form must be completed in accordance with Oregon state laws to be considered valid. It serves as an official record of the financial status of an estate, which can be reviewed by the court. Failure to use this form correctly can lead to legal penalties or complications in the probate process.

Required Documents

When preparing to complete the 150 101 159 form, it is important to have the following documents on hand:

- Death certificate of the deceased.

- List of all assets and liabilities of the estate.

- Bank statements and financial records.

- Any relevant tax documents.

- Previous wills or trusts, if applicable.

Form Submission Methods

The 150 101 159 form can be submitted through various methods, depending on the requirements of the local court. Common submission methods include:

- Online submission through the court's electronic filing system.

- Mailing the completed form to the appropriate court address.

- In-person filing at the local probate court office.

Quick guide on how to complete 150 101 159

Effortlessly Prepare 150 101 159 on Any Device

Managing online documents has gained immense popularity among companies and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed paper documents, as you can easily locate the required form and securely store it online. airSlate SignNow provides all the resources you need to swiftly create, modify, and eSign your documents without delays. Handle 150 101 159 on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Modify and eSign 150 101 159 Seamlessly

- Locate 150 101 159 and then select Get Form to begin.

- Utilize our tools to fill out your document.

- Emphasize important sections of your documents or obscure sensitive data with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully, then click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, painstaking form searches, or corrections that call for reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 150 101 159 while ensuring outstanding communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 150 101 159

Create this form in 5 minutes!

How to create an eSignature for the 150 101 159

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What are the primary benefits of using airSlate SignNow for state of oregon financial forms?

Using airSlate SignNow for state of oregon financial forms streamlines your document signing process by allowing you to send, eSign, and manage forms electronically. This solution saves time and reduces errors, making it easier to collect important signatures efficiently. Furthermore, the platform is user-friendly and designed to meet compliance requirements for financial documents.

-

Are there any integration options available for airSlate SignNow with state of oregon financial forms?

Yes, airSlate SignNow offers various integrations with popular applications to enhance your experience with state of oregon financial forms. You can easily connect with tools like Google Drive, Salesforce, and Microsoft Office to streamline your workflows. These integrations ensure your financial forms are always accessible and efficiently managed.

-

What pricing plans does airSlate SignNow offer for managing state of oregon financial forms?

airSlate SignNow provides flexible pricing plans to cater to different business needs when managing state of oregon financial forms. You can choose from individual, business, or enterprise plans, each designed to offer valuable features at competitive rates. A free trial is also available to explore the platform before committing to a subscription.

-

How secure is the airSlate SignNow platform for state of oregon financial forms?

Security is a top priority for airSlate SignNow, especially when handling sensitive state of oregon financial forms. The platform uses advanced encryption and complies with security standards such as GDPR and HIPAA, ensuring your documents and data remain safe. Additionally, user authentication measures help prevent unauthorized access.

-

Can I customize my state of oregon financial forms in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize state of oregon financial forms to fit their specific needs. You can add fields, change layouts, and integrate branding elements, making your forms more recognizable and user-friendly. Customization options ensure that your financial documents meet both compliance and aesthetic standards.

-

Is airSlate SignNow mobile-friendly for managing state of oregon financial forms?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to manage state of oregon financial forms on the go. Whether you are using a tablet or smartphone, you can send, sign, and track your documents easily. This flexibility enhances productivity, making it convenient to handle financial forms from anywhere.

-

What support options are available for troubleshooting airSlate SignNow with state of oregon financial forms?

airSlate SignNow offers a variety of support options for users needing assistance with state of oregon financial forms. You can access an extensive knowledge base, community forums, and customer support via email or chat. The dedicated support team is available to help resolve any queries or issues you may encounter.

Get more for 150 101 159

- Sub fee protection agreement template form

- How fill out form gc 080 tutorial

- Srp net apply compensation form

- Fontana unified school district transfer form

- Georgia board of nursing license renewal form

- Panunumpa ng propesyonal sample filled up form

- Appaloosa horse club transfer form

- Symbols of st patricks day answer key form

Find out other 150 101 159

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free