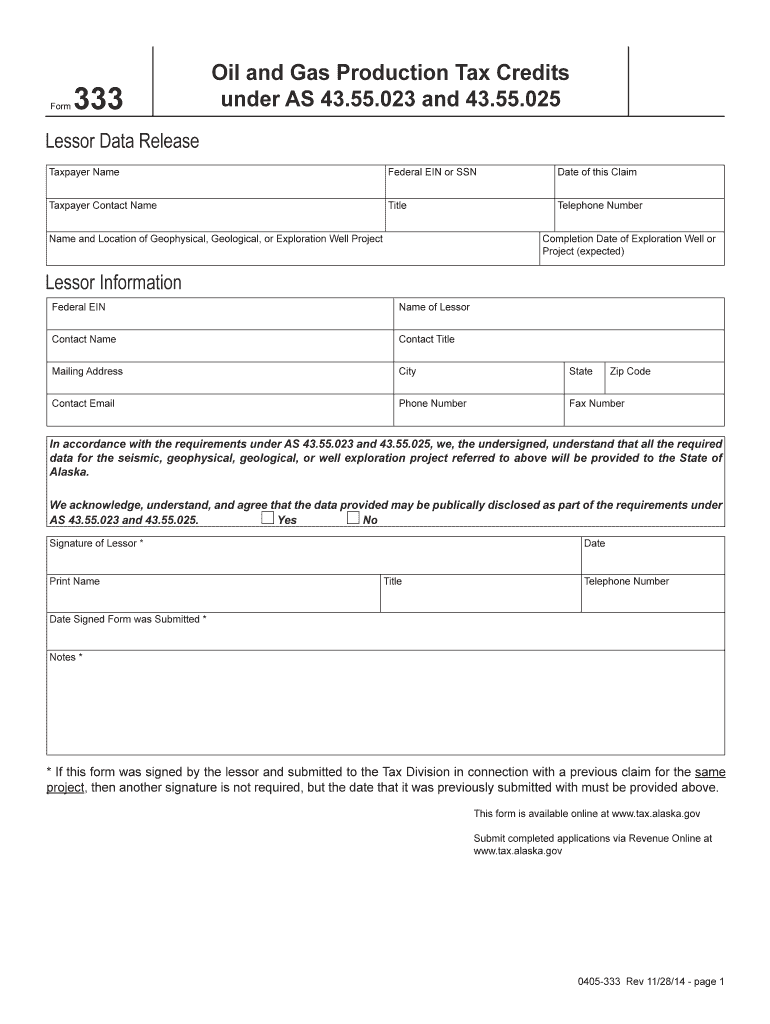

Tax Alaska Form

What is the Tax Alaska

The Tax Alaska refers to specific tax forms and regulations applicable to residents and businesses in Alaska. These forms are essential for reporting income, claiming deductions, and ensuring compliance with state tax laws. Understanding the Tax Alaska is crucial for accurate tax reporting and avoiding penalties.

How to use the Tax Alaska

Using the Tax Alaska involves several steps, including gathering necessary documentation, filling out the required forms, and submitting them to the appropriate state agency. It is important to follow the guidelines provided by the Alaska Department of Revenue to ensure that all information is accurate and complete. Utilizing digital tools can streamline this process, making it easier to fill out and submit forms electronically.

Steps to complete the Tax Alaska

Completing the Tax Alaska typically involves the following steps:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Choose the appropriate tax form based on your filing status and income type.

- Fill out the form carefully, ensuring all information is accurate.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, following the submission guidelines provided by the state.

Legal use of the Tax Alaska

The legal use of the Tax Alaska is governed by state laws and regulations. It is important to ensure that all forms are filled out accurately and submitted on time to avoid legal repercussions. eSignatures are considered legally binding under federal and state laws, provided that the signing process meets specific requirements. Using a reliable eSigning solution can help ensure compliance with these legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska are typically aligned with federal tax deadlines, but there may be specific dates unique to the state. It is essential to be aware of these deadlines to avoid late fees and penalties. Key dates often include the due date for filing individual income tax returns and deadlines for estimated tax payments.

Required Documents

When preparing to file the Tax Alaska, certain documents are required. Commonly needed documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

Form Submission Methods (Online / Mail / In-Person)

Submitting the Tax Alaska can be done through various methods. Options typically include:

- Online submission through the Alaska Department of Revenue's website

- Mailing the completed forms to the designated tax office

- In-person submission at local tax offices, if available

Quick guide on how to complete tax alaska 6967296

Easily prepare Tax Alaska on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Tax Alaska on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The simplest method to edit and eSign Tax Alaska effortlessly

- Find Tax Alaska and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form—via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or mistakes that require new copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Tax Alaska and ensure effective communication at every stage of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967296

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Tax Alaska?

airSlate SignNow is a powerful eSignature platform that allows businesses to manage documents digitally. In the context of Tax Alaska, it helps streamline the process of signing tax documents and forms, making tax filing more efficient and reducing paper waste.

-

How can airSlate SignNow help businesses with their Tax Alaska filings?

Using airSlate SignNow, businesses can easily send, sign, and manage necessary tax documents online. This simplifies the Tax Alaska filing process, ensuring that important documents are signed and submitted on time, minimizing the risk of delays or errors.

-

Is airSlate SignNow cost-effective for managing Tax Alaska documents?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for managing Tax Alaska documents. With its economical pricing structure, businesses can benefit from unlimited eSignatures without incurring high costs.

-

What features does airSlate SignNow offer that are beneficial for Tax Alaska?

airSlate SignNow provides a range of features ideal for Tax Alaska, including customizable templates, automated reminders, and a user-friendly interface. These features enhance productivity and ensure prompt handling of tax documents, reducing the time spent on administrative tasks.

-

Can airSlate SignNow integrate with other tools for Tax Alaska management?

Absolutely! airSlate SignNow seamlessly integrates with various tools such as accounting software and CRM systems, which are crucial for effectively managing Tax Alaska. This integration helps ensure that your tax-related workflows are smooth and efficient.

-

How secure is airSlate SignNow when handling Tax Alaska documents?

Security is a priority for airSlate SignNow. The platform employs advanced encryption and complies with regulations to protect sensitive Tax Alaska documents, ensuring that all data remains secure during transmission and storage.

-

In what ways does airSlate SignNow enhance the overall experience for Tax Alaska customers?

airSlate SignNow enhances the experience for Tax Alaska customers by providing a user-friendly platform that simplifies document handling. Users can easily track the status of their signed documents and receive notifications, leading to improved organization and peace of mind.

Get more for Tax Alaska

Find out other Tax Alaska

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed