Tax Alaska Form

What is the Alaska resource landing tax CDQ credit?

The Alaska resource landing tax CDQ credit is a financial incentive designed to support communities in Alaska, particularly those involved in commercial fishing and other resource-based industries. This credit allows eligible businesses to reduce their tax liability based on the value of resources landed in Alaska. The program aims to promote economic development and sustainability in coastal communities, ensuring that local populations benefit from the natural resources available in their regions.

How to use the Alaska resource landing tax CDQ credit

To utilize the Alaska resource landing tax CDQ credit, businesses must first determine their eligibility. This involves assessing the amount of resources landed and ensuring compliance with state regulations. Once eligibility is confirmed, businesses can apply the credit against their tax liabilities on their tax returns. Proper documentation and records of resource landings must be maintained to substantiate claims for the credit during audits or reviews by tax authorities.

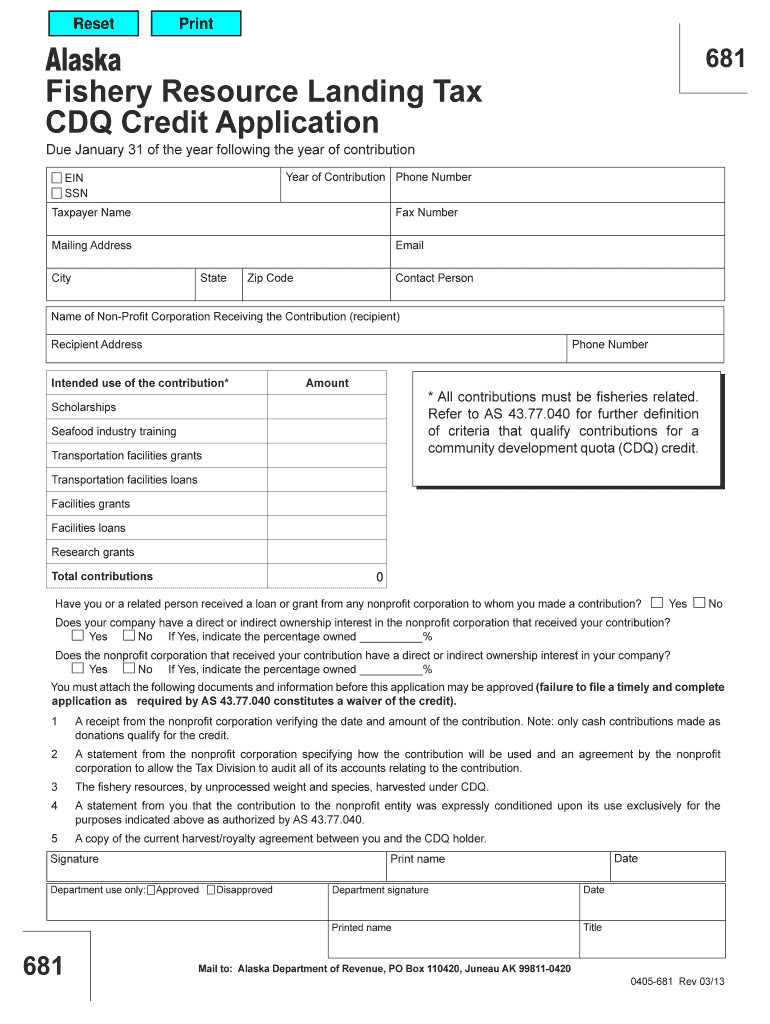

Steps to complete the Alaska resource landing tax CDQ credit application

Completing the application for the Alaska resource landing tax CDQ credit involves several key steps:

- Gather necessary documentation, including proof of resource landings and any relevant tax forms.

- Determine eligibility based on the specific criteria set forth by the state.

- Complete the appropriate tax forms, ensuring all information is accurate and up to date.

- Submit the application along with supporting documents to the relevant tax authority.

- Keep copies of all submitted materials for your records and future reference.

Legal use of the Alaska resource landing tax CDQ credit

The legal use of the Alaska resource landing tax CDQ credit is governed by state tax laws and regulations. Businesses must adhere to the guidelines established by the Alaska Department of Revenue to ensure compliance. This includes accurately reporting resource landings and maintaining records that demonstrate eligibility for the credit. Failure to comply with these regulations can result in penalties or disqualification from the program.

Eligibility criteria for the Alaska resource landing tax CDQ credit

Eligibility for the Alaska resource landing tax CDQ credit typically requires that businesses engage in commercial fishing or related activities within Alaska. Specific criteria may include:

- Proof of resource landings in Alaska.

- Compliance with state tax regulations.

- Active participation in community development programs.

Businesses should consult the Alaska Department of Revenue for detailed eligibility requirements and any updates to the program.

Required documents for the Alaska resource landing tax CDQ credit

To apply for the Alaska resource landing tax CDQ credit, businesses must prepare and submit several key documents. These may include:

- Proof of resource landings, such as landing receipts or fish tickets.

- Completed tax forms relevant to the credit application.

- Financial statements that demonstrate the business's operations and tax liabilities.

It is essential to ensure that all documents are accurate and complete to facilitate the application process and avoid delays.

Quick guide on how to complete tax alaska 6967158

Effortlessly Prepare Tax Alaska on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Tax Alaska on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Tax Alaska with Ease

- Obtain Tax Alaska and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and then click the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign Tax Alaska and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967158

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Alaska resource landing tax CDQ credit?

The Alaska resource landing tax CDQ credit is a financial incentive designed to support local businesses involved in fishing and resource landing in Alaska. It aims to provide tax relief and stimulate economic growth in communities that participate in the Community Development Quota (CDQ) program.

-

How can airSlate SignNow help with applying for the Alaska resource landing tax CDQ credit?

airSlate SignNow simplifies the document management process, allowing businesses to efficiently gather and sign necessary paperwork for the Alaska resource landing tax CDQ credit. With easy-to-use eSignature tools, you can ensure that all forms are correctly completed and submitted promptly.

-

What are the key features of airSlate SignNow relevant to the Alaska resource landing tax CDQ credit?

Key features of airSlate SignNow include secure eSigning, document templates, and seamless collaboration tools. These features enable businesses handling the Alaska resource landing tax CDQ credit to streamline the document workflow, ensuring compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow for the Alaska resource landing tax CDQ credit?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost-effective solution is designed to help businesses access the essential tools they need for handling the Alaska resource landing tax CDQ credit efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing the Alaska resource landing tax CDQ credit?

Absolutely! airSlate SignNow offers integrations with numerous business applications, making it easier to manage the complete process for the Alaska resource landing tax CDQ credit. You can link it with your existing software for an optimized workflow.

-

What benefits does airSlate SignNow provide for handling the Alaska resource landing tax CDQ credit?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced collaboration. For those dealing with the Alaska resource landing tax CDQ credit, these advantages translate into quicker response times and improved accuracy in document handling.

-

Is airSlate SignNow user-friendly for businesses new to the Alaska resource landing tax CDQ credit?

Yes, airSlate SignNow is designed with user experience in mind, making it accessible for businesses unfamiliar with the Alaska resource landing tax CDQ credit. Its intuitive interface ensures that users can easily navigate the platform and complete their tasks with minimal training.

Get more for Tax Alaska

Find out other Tax Alaska

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now