Individual to Three Individuals with Contingent Beneficiary Form

What is the Individual To Three Individuals With Contingent Beneficiary

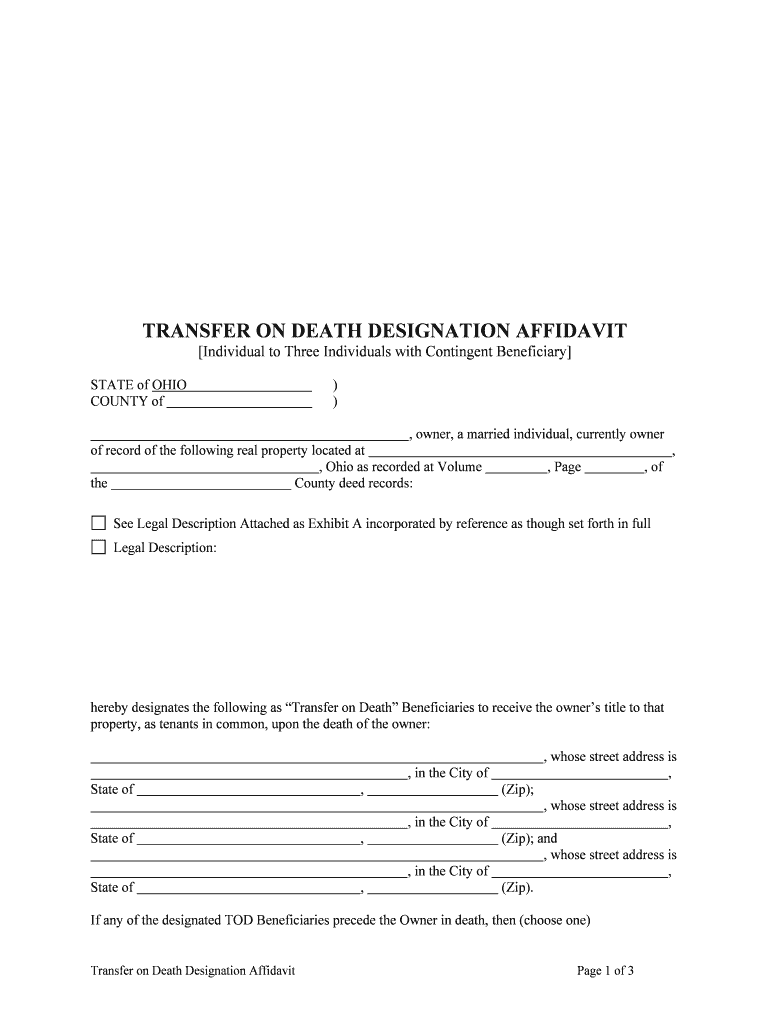

The Individual To Three Individuals With Contingent Beneficiary form is a legal document used to designate primary and contingent beneficiaries for an individual’s assets or accounts. This form allows an individual to specify up to three primary beneficiaries who will receive the assets directly upon the individual’s passing. Additionally, it provides for contingent beneficiaries who will inherit the assets if the primary beneficiaries are unable to do so. This structure ensures that the individual’s wishes regarding asset distribution are clearly documented and legally recognized.

How to use the Individual To Three Individuals With Contingent Beneficiary

Using the Individual To Three Individuals With Contingent Beneficiary form involves several straightforward steps. First, gather necessary information about the beneficiaries, including their full names, contact information, and relationship to the individual. Next, fill out the form accurately, ensuring that all details are correct. Specify the percentage of assets each primary beneficiary will receive, and indicate the contingent beneficiaries in case the primary ones cannot inherit. Finally, sign and date the form, ensuring compliance with any state-specific requirements for notarization or witness signatures.

Steps to complete the Individual To Three Individuals With Contingent Beneficiary

Completing the Individual To Three Individuals With Contingent Beneficiary form requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source.

- Fill in your personal information, including your full name and contact information.

- List the names and details of the primary beneficiaries, ensuring that their percentages add up to one hundred percent.

- Identify contingent beneficiaries with their relevant details.

- Review the completed form for accuracy.

- Sign and date the form, and consider having it notarized if required by your state.

Legal use of the Individual To Three Individuals With Contingent Beneficiary

The legal use of the Individual To Three Individuals With Contingent Beneficiary form is vital for ensuring that asset distribution aligns with the individual’s wishes after their death. For the form to be legally binding, it must comply with state laws regarding beneficiary designations. This includes proper signing, potential notarization, and adherence to any specific requirements set forth by financial institutions or state regulations. Ensuring legal compliance helps prevent disputes among heirs and ensures a smooth transfer of assets.

Key elements of the Individual To Three Individuals With Contingent Beneficiary

Key elements of the Individual To Three Individuals With Contingent Beneficiary form include:

- Personal Information: The individual’s full name and contact details.

- Primary Beneficiaries: Names, contact information, and percentage of assets designated to each primary beneficiary.

- Contingent Beneficiaries: Names and contact information for those who will inherit if the primary beneficiaries cannot.

- Signature and Date: The individual’s signature and the date of signing, which validate the form.

Examples of using the Individual To Three Individuals With Contingent Beneficiary

Examples of using the Individual To Three Individuals With Contingent Beneficiary form can vary widely. For instance, an individual may designate their spouse as the primary beneficiary, with their two children as secondary primary beneficiaries. In this scenario, if the spouse predeceases the individual, the children would inherit the assets. Alternatively, a single parent might designate their three children as primary beneficiaries, with a trusted friend as a contingent beneficiary to ensure that the assets are distributed according to their wishes in case one of the children cannot inherit.

Quick guide on how to complete individual to three individuals with contingent beneficiary

Prepare Individual To Three Individuals With Contingent Beneficiary seamlessly on any device

Digital document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents efficiently without delays. Manage Individual To Three Individuals With Contingent Beneficiary on any device via airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Individual To Three Individuals With Contingent Beneficiary effortlessly

- Obtain Individual To Three Individuals With Contingent Beneficiary and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click the Done button to save your updates.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Individual To Three Individuals With Contingent Beneficiary and maintain excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 'Individual To Three Individuals With Contingent Beneficiary' feature in airSlate SignNow?

The 'Individual To Three Individuals With Contingent Beneficiary' feature in airSlate SignNow allows users to designate multiple beneficiaries for their documents. This ensures that in the event something happens to the first beneficiary, the document can still be executed by the contingent beneficiaries. It provides a robust solution for managing important documents with multiple parties.

-

How does pricing work for the 'Individual To Three Individuals With Contingent Beneficiary' feature?

airSlate SignNow offers flexible pricing packages that include the 'Individual To Three Individuals With Contingent Beneficiary' feature. Pricing varies based on the number of users and functionalities required, making it accessible for both individuals and businesses. You can choose a plan that best fits your needs and the complexity of your document management.

-

What are the benefits of using airSlate SignNow for 'Individual To Three Individuals With Contingent Beneficiary'?

Using airSlate SignNow for 'Individual To Three Individuals With Contingent Beneficiary' ensures your documents are secure and efficiently managed. The solution is user-friendly, integrates seamlessly with other applications, and enhances legal compliance. With this feature, you can rest assured that your beneficiaries are well accounted for.

-

Are there any integrations available for 'Individual To Three Individuals With Contingent Beneficiary' in airSlate SignNow?

Yes, airSlate SignNow supports various integrations that enhance the functionality of the 'Individual To Three Individuals With Contingent Beneficiary' feature. You can easily connect with popular applications like Google Drive, Dropbox, and Salesforce for improved workflow. This integration capability helps streamline the process of document management.

-

Can the 'Individual To Three Individuals With Contingent Beneficiary' feature be customized?

Absolutely! The 'Individual To Three Individuals With Contingent Beneficiary' feature in airSlate SignNow can be tailored to meet specific user requirements. You can adjust settings and preferences based on how you want your beneficiaries to receive and execute documents. This flexibility enhances user experience and document efficiency.

-

What types of documents can utilize the 'Individual To Three Individuals With Contingent Beneficiary' feature?

The 'Individual To Three Individuals With Contingent Beneficiary' feature can be applied to various document types, including legal agreements, financial documents, and other important forms. This versatility allows users to manage important documents in a secure environment, ensuring all beneficiaries are properly involved in the process.

-

How does airSlate SignNow ensure security for the 'Individual To Three Individuals With Contingent Beneficiary' feature?

airSlate SignNow prioritizes security by implementing advanced encryption and authentication for all documents, including those utilizing the 'Individual To Three Individuals With Contingent Beneficiary' feature. This helps protect sensitive information and ensures that only authorized individuals can access and execute the documents. Your peace of mind is our top priority.

Get more for Individual To Three Individuals With Contingent Beneficiary

- Child care expenses deduction for 2017 canadaca form

- Grille dobservation 4 5 ans et demi milieu familial cpe magimuse form

- Nhs pensions application for a refund of pension contributions rf12 form

- Michigan state police form 2017 2019

- Bof 1008 new serial number application california department form

- Ncaeop membership 2016 form

- Top illinois lake michigan association of independent schools private form

- Rke key fob attack using roll jam form

Find out other Individual To Three Individuals With Contingent Beneficiary

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document