Tax Alaska Form

What is the Tax Alaska

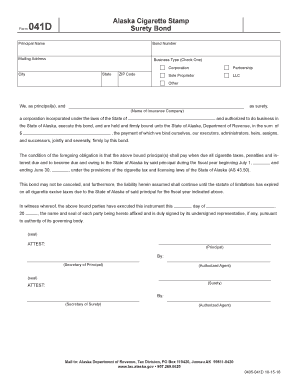

The Tax Alaska form is a specific document used for reporting and filing taxes in the state of Alaska. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax regulations. The form collects various information, including income, deductions, and credits, which are necessary for calculating tax liabilities. Understanding the purpose and requirements of the Tax Alaska form is crucial for effective tax management.

Steps to complete the Tax Alaska

Completing the Tax Alaska form involves several detailed steps to ensure accuracy and compliance. Here is a straightforward outline of the process:

- Gather necessary documents, including income statements and previous tax returns.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and investment earnings.

- Claim eligible deductions and credits to reduce your taxable income.

- Review the completed form for accuracy and completeness.

- Submit the form either electronically or via mail, depending on your preference.

Legal use of the Tax Alaska

The Tax Alaska form must be used in accordance with state laws and regulations. It is legally binding when completed accurately and submitted within the designated deadlines. To ensure that your submission is valid, it is important to adhere to the guidelines set forth by the Alaska Department of Revenue. This includes maintaining proper documentation and ensuring that all information reported is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are critical to avoid penalties and interest on unpaid taxes. Typically, the deadline for individual tax returns is April fifteenth. However, specific dates may vary based on individual circumstances, such as extensions or special filing situations. It is advisable to check the Alaska Department of Revenue's official calendar for any updates or changes to these deadlines.

Required Documents

To complete the Tax Alaska form effectively, certain documents are necessary. These may include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Records of deductible expenses

- Previous year’s tax return for reference

Having these documents ready will streamline the filing process and help ensure accuracy in reporting.

Examples of using the Tax Alaska

Understanding how to use the Tax Alaska form can be enhanced by looking at various scenarios. For instance, a self-employed individual would report income differently than a salaried employee. Additionally, a retired individual may have different deductions available compared to someone actively working. Each scenario requires careful consideration of applicable tax laws and regulations to ensure proper completion of the form.

Who Issues the Form

The Tax Alaska form is issued by the Alaska Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with tax laws. They provide resources and guidance to taxpayers on how to properly complete and submit the form, as well as information on any changes to tax laws that may affect filing.

Quick guide on how to complete tax alaska 6967189

Complete Tax Alaska effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely keep it online. airSlate SignNow offers you all the tools required to create, edit, and electronically sign your documents swiftly without complications. Manage Tax Alaska on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Tax Alaska with ease

- Find Tax Alaska and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and then click on the Done button to preserve your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, cumbersome form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Tax Alaska and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967189

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the best way to manage Tax Alaska documents using airSlate SignNow?

With airSlate SignNow, you can seamlessly manage your Tax Alaska documents by sending, signing, and storing them electronically. Our platform enables you to customize document workflows that ensure compliance while saving time and improving efficiency. The user-friendly interface makes it easy for anyone to navigate and use for their tax-related needs.

-

How does airSlate SignNow ensure security for Tax Alaska transactions?

Security is a top priority for airSlate SignNow, especially for sensitive documents like Tax Alaska transactions. We implement advanced encryption protocols and offer secure cloud storage to keep your documents safe. Additionally, our electronic signature solution is legally binding and complies with e-signature laws for maximum security.

-

What features does airSlate SignNow offer to assist with Tax Alaska filings?

airSlate SignNow offers a variety of features specifically designed for Tax Alaska filings, including customizable templates, bulk sending options, and real-time tracking. These features streamline the documentation process, making it easier to manage multiple forms and signatures at once. This efficiency helps reduce the stress often associated with tax season.

-

Is airSlate SignNow compliant with Tax Alaska regulations?

Yes, airSlate SignNow is fully compliant with all applicable Tax Alaska regulations, ensuring that your e-signatures and documents are legally valid. Our platform is built to meet industry standards and provides you with peace of mind that your important tax documents are handled correctly. You can confidently utilize our services for your Tax Alaska needs.

-

What are the pricing plans for airSlate SignNow for Tax Alaska services?

airSlate SignNow offers flexible pricing plans to accommodate various business sizes and needs related to Tax Alaska services. You can choose from monthly or annual subscriptions, with options that vary based on features and user limits. This affordability allows businesses to manage their tax documentation without breaking the bank.

-

Can airSlate SignNow integrate with other software for Tax Alaska management?

Absolutely! airSlate SignNow can integrate with various software solutions commonly used for Tax Alaska management, such as accounting and CRM systems. These integrations streamline your workflows, allowing for automatic updates and document sharing, which makes handling your tax processes more efficient. It is a key benefit for businesses looking to simplify their operations.

-

What benefits do users see when using airSlate SignNow for Tax Alaska?

Users of airSlate SignNow for Tax Alaska report signNow benefits, including increased efficiency, reduced processing times, and lower operational costs. The ease of use and collaboration features help teams work together seamlessly on tax-related documents. Ultimately, this leads to improved accuracy and a smoother tax filing experience.

Get more for Tax Alaska

Find out other Tax Alaska

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors