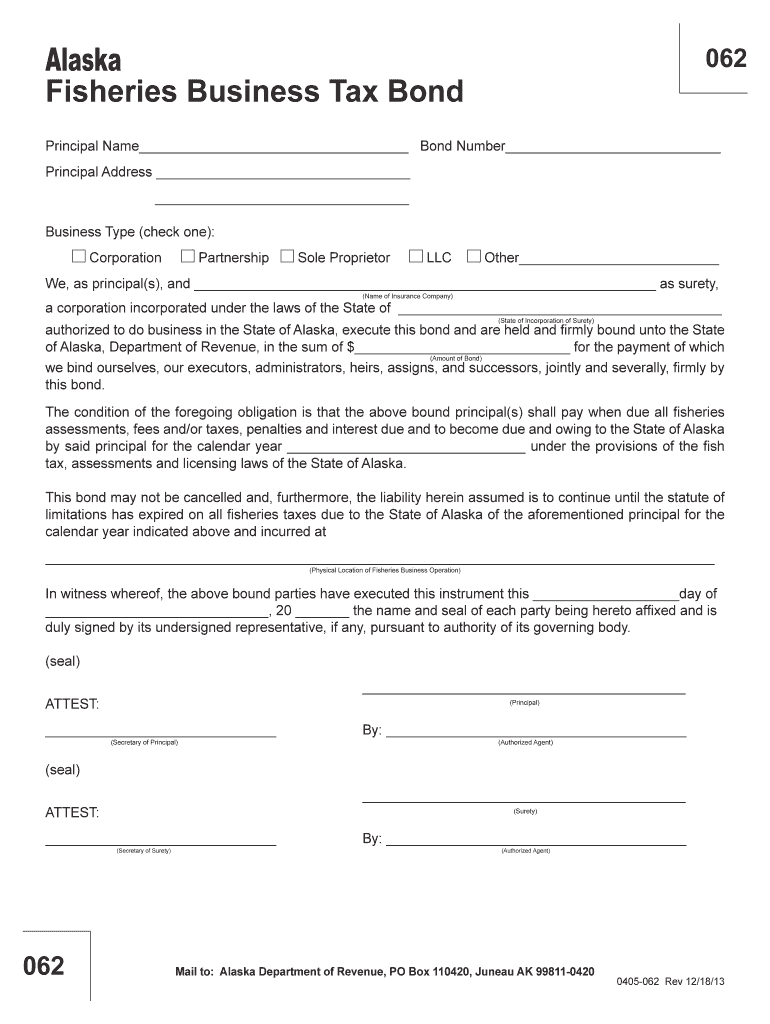

Fisheries Business Tax Form

What is the fisheries business tax?

The fisheries business tax is a specific tax levied on businesses engaged in commercial fishing activities. This tax is typically assessed based on the revenue generated from fishing operations, including the sale of fish and seafood products. Understanding this tax is crucial for compliance and financial planning for fisheries businesses. Each state may have its own regulations and rates concerning this tax, so it is essential to be aware of local laws.

Steps to complete the fisheries business tax

Completing the fisheries business tax involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports related to your fishing operations. Next, calculate your total revenue from fishing activities, as this will form the basis of your tax liability. After that, fill out the fisheries business tax form, ensuring all information is accurate and complete. Finally, submit the form by the designated deadline, either online or through traditional mail, depending on your state's requirements.

Legal use of the fisheries business tax

To legally use the fisheries business tax, businesses must adhere to the regulations set forth by state tax authorities. This includes accurately reporting income, maintaining proper records, and filing taxes on time. Compliance with these laws not only avoids penalties but also ensures that the business operates within the legal framework. It is advisable to consult with a tax professional familiar with fisheries business tax regulations to navigate complex requirements effectively.

Required documents

When filing the fisheries business tax, specific documents are required to substantiate your claims. These documents typically include:

- Income statements detailing revenue from fishing activities.

- Expense reports for costs incurred during fishing operations.

- Previous tax returns, if applicable, for reference.

- Any licenses or permits required for commercial fishing.

Having these documents ready can streamline the filing process and ensure compliance with tax regulations.

Filing deadlines / Important dates

Filing deadlines for the fisheries business tax vary by state, but it is generally required to be submitted annually. Most states have specific dates by which the tax must be filed, often aligned with the end of the fiscal year. It is essential to keep track of these deadlines to avoid late fees and penalties. Additionally, some states may require estimated tax payments throughout the year, so staying informed about all relevant dates is crucial for compliance.

Who issues the form?

The fisheries business tax form is typically issued by the state tax authority or department of revenue where the business operates. Each state has its own process for issuing these forms, and they may be available online for easy access. It is important for businesses to ensure they are using the correct form for their specific state and to stay updated on any changes in tax regulations or forms issued by the state authorities.

Quick guide on how to complete fisheries business tax

Complete Fisheries Business Tax effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents quickly without delays. Manage Fisheries Business Tax on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Fisheries Business Tax without effort

- Locate Fisheries Business Tax and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight signNow sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Fisheries Business Tax and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fisheries business tax

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is fisheries business tax and how does it affect my business?

Fisheries business tax refers to the taxation of income generated from fishing-related activities. Understanding this tax is crucial for fisheries businesses as it can impact profitability. Properly managing fisheries business tax allows companies to allocate resources effectively and ensure compliance with local regulations.

-

How can airSlate SignNow help streamline my fisheries business tax documentation?

AirSlate SignNow provides an efficient platform for eSigning and managing documents related to fisheries business tax. Our solution simplifies the approval process for tax forms, allowing you to focus on your business operations instead of paperwork. With secure storage and easy access, you can keep vital tax documents at your fingertips.

-

What features does airSlate SignNow offer for managing fisheries business tax?

AirSlate SignNow offers features like customizable templates, automatic reminders, and audit trails that are essential for managing fisheries business tax documents. These tools ensure that you never miss a deadline and maintain compliance with tax regulations. Additionally, real-time collaboration features help you work with accountants and partners seamlessly.

-

Is airSlate SignNow cost-effective for my fisheries business tax needs?

Yes, airSlate SignNow offers affordable pricing plans tailored to meet the needs of businesses dealing with fisheries business tax. By using our cost-effective solution, you can save both time and money on document management. This allows you to reinvest in your core fishing activities while ensuring compliance with tax requirements.

-

Can I integrate airSlate SignNow with other tools for managing fisheries business tax?

Absolutely! AirSlate SignNow can be integrated with various accounting and management software to enhance your fisheries business tax management. This integration allows for seamless data transfer and more efficient document handling. By connecting your systems, you can streamline workflows and ensure all tax-related documents are managed effectively.

-

What are the benefits of using airSlate SignNow for fisheries business tax management?

Using airSlate SignNow for fisheries business tax management helps reduce the time spent on paperwork, allowing you to concentrate on your fishing operations. Our eSigning platform ensures quick and secure handling of tax documents, minimizing delays. Enhanced organization and accessibility of your tax documents can lead to better compliance and potential savings.

-

How does airSlate SignNow ensure the security of my fisheries business tax documents?

AirSlate SignNow employs advanced security measures to protect your fisheries business tax documents. We utilize encryption and secure servers to ensure that your sensitive information remains confidential. This commitment to security allows you to manage your tax-related documents with confidence, knowing that your data is safe from unauthorized access.

Get more for Fisheries Business Tax

Find out other Fisheries Business Tax

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast