APPLICATION for WORKING WATERFRONT PROPERTY TAX DEFERRAL Form

What is the application for working waterfront property tax deferral?

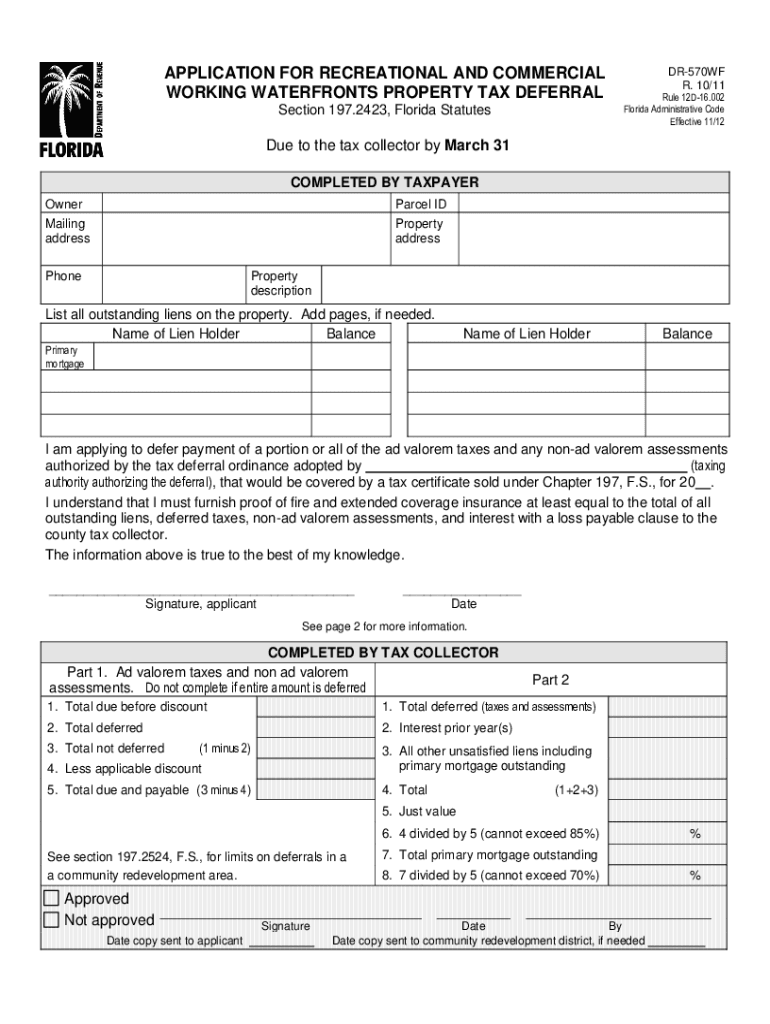

The application for working waterfront property tax deferral is a specific form designed for property owners engaged in waterfront activities. This application allows eligible individuals to defer property taxes on their waterfront properties, provided they meet certain criteria established by state regulations. The intent is to support businesses that contribute to the local economy through water-related activities, ensuring they can maintain operations without the immediate burden of property taxes.

Eligibility criteria for the application

To qualify for the working waterfront property tax deferral, applicants must meet specific eligibility requirements. Generally, these include:

- The property must be used primarily for commercial waterfront activities.

- Applicants must demonstrate a commitment to maintaining the property for its intended use.

- Compliance with local zoning laws and regulations is essential.

- Property owners must submit the application within the designated filing period.

Steps to complete the application for working waterfront property tax deferral

Completing the application involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including proof of property use and ownership.

- Fill out the application form, ensuring all required fields are completed.

- Review the application for accuracy and completeness.

- Submit the application by the deadline, either online or via mail, depending on state guidelines.

How to use the application for working waterfront property tax deferral

Using the application effectively involves understanding its purpose and ensuring compliance with state regulations. Property owners should follow these guidelines:

- Read the instructions carefully to understand the requirements.

- Provide accurate information to avoid delays or rejections.

- Keep a copy of the submitted application for personal records.

Legal use of the application for working waterfront property tax deferral

The legal framework surrounding the application ensures that it is recognized as a valid document for tax deferral purposes. This includes adherence to federal and state laws regarding property use and taxation. Properly executed applications can protect property owners from immediate tax liabilities, allowing them to focus on their business operations.

Required documents for the application

When submitting the application for working waterfront property tax deferral, applicants typically need to provide several key documents:

- Proof of property ownership, such as a deed or title.

- Documentation demonstrating the property's use for commercial waterfront activities.

- Any additional forms required by state or local authorities.

Quick guide on how to complete application for working waterfront property tax deferral

Effortlessly Prepare APPLICATION FOR WORKING WATERFRONT PROPERTY TAX DEFERRAL on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage APPLICATION FOR WORKING WATERFRONT PROPERTY TAX DEFERRAL on any device using the airSlate SignNow applications for Android or iOS and enhance any document-oriented process today.

Modify and eSign APPLICATION FOR WORKING WATERFRONT PROPERTY TAX DEFERRAL with Ease

- Find APPLICATION FOR WORKING WATERFRONT PROPERTY TAX DEFERRAL and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that reason.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign APPLICATION FOR WORKING WATERFRONT PROPERTY TAX DEFERRAL while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for working waterfront property tax deferral

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the 570wf application waterfronts property deferral fill?

The 570wf application waterfronts property deferral fill is a specific form designed for property owners in waterfront areas seeking tax deferrals. This application allows eligible individuals to defer property taxes while maintaining their property. By using this form, you can easily manage your tax obligations and keep more funds available for investment.

-

How do I complete the 570wf application waterfronts property deferral fill?

To complete the 570wf application waterfronts property deferral fill, you need to provide your property's details and financial information. Our platform offers step-by-step guidance to simplify this process. Additionally, airSlate SignNow facilitates eSigning for a seamless experience, ensuring your application is submitted effortlessly.

-

What are the benefits of using airSlate SignNow for my 570wf application waterfronts property deferral fill?

Using airSlate SignNow for your 570wf application waterfronts property deferral fill provides numerous benefits, including enhanced security and faster processing times. Our easy-to-use platform allows you to eSign documents from anywhere, which speeds up your application process. You'll also enjoy cost-effectiveness compared to traditional methods of document handling.

-

Are there any integration options available with airSlate SignNow for the 570wf application waterfronts property deferral fill?

Yes, airSlate SignNow offers integration options that allow you to connect with various applications and services. This ensures a smooth workflow when filling out your 570wf application waterfronts property deferral fill. Compatibility with popular tools enhances efficiency, making document management a breeze.

-

What is the pricing structure for airSlate SignNow in relation to the 570wf application waterfronts property deferral fill?

Our pricing for utilizing airSlate SignNow is competitive and tailored to fit the needs of individuals and businesses. We offer various subscription plans that cater to different volumes of document handling, including support for the 570wf application waterfronts property deferral fill. Contact our sales team for a detailed quote based on your needs.

-

How secure is my data when using the 570wf application waterfronts property deferral fill on airSlate SignNow?

Your data security is our top priority at airSlate SignNow. We employ advanced encryption protocols and secure servers to protect information submitted through the 570wf application waterfronts property deferral fill. You can confidently manage your property deferrals knowing that your data is safe with us.

-

Can I track the status of my 570wf application waterfronts property deferral fill?

Absolutely! With airSlate SignNow, you can easily track the status of your 570wf application waterfronts property deferral fill. The platform provides notifications and updates, allowing you to stay informed about the progress of your application and ensuring that nothing falls through the cracks.

Get more for APPLICATION FOR WORKING WATERFRONT PROPERTY TAX DEFERRAL

- How to make a home made explosives pdf form

- Psa marriage certificate form pdf

- Step parent adoption forms

- House rules addendum to lease agreement form

- Al8453 17180936 form

- Us nonimmigrant visa form

- Tarrant county service request form

- Bcia 8690 application for record review processing fee waiver claim and proof of indigence pdf form

Find out other APPLICATION FOR WORKING WATERFRONT PROPERTY TAX DEFERRAL

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online