Rts10 Form Florida

What is the RTS10 Form Florida

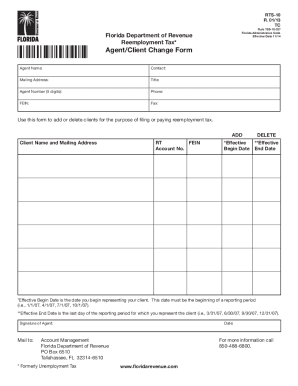

The RTS10 form, also known as the Florida RTS10, is a crucial document used for reporting reemployment tax in the state of Florida. This form is primarily utilized by employers to report wages and calculate the amount of reemployment tax owed to the Florida Department of Revenue. The RTS10 form ensures that employers comply with state tax regulations, helping to fund the reemployment assistance program for unemployed workers. Understanding the RTS10 form is essential for maintaining compliance and avoiding potential penalties.

How to use the RTS10 Form Florida

Using the RTS10 form involves several key steps to ensure accurate reporting of reemployment tax. Employers must first gather all necessary wage information for their employees. This includes total wages paid during the reporting period and any applicable deductions. Once the data is collected, it can be entered into the RTS10 form, which typically requires details such as the employer's identification number, the reporting period, and total taxable wages. After completing the form, it must be submitted to the Florida Department of Revenue by the specified deadline.

Steps to complete the RTS10 Form Florida

Completing the RTS10 form involves a systematic approach to ensure accuracy. Follow these steps:

- Gather all employee wage information for the reporting period.

- Obtain the RTS10 form from the Florida Department of Revenue website or through authorized channels.

- Fill in the required fields, including the employer's identification number and total taxable wages.

- Review the information for accuracy to prevent errors.

- Submit the completed form by the deadline, either online or via mail.

Legal use of the RTS10 Form Florida

The RTS10 form is legally binding and must be completed accurately to meet Florida state tax laws. Employers are required to file this form to report reemployment tax, and failure to do so can result in penalties. The form must be submitted on time to avoid late fees and ensure compliance with the Florida Department of Revenue. Additionally, maintaining accurate records related to the RTS10 form can help protect employers in case of audits or inquiries from tax authorities.

Required Documents

To complete the RTS10 form, employers need to have several documents on hand. These include:

- Employee wage records for the reporting period.

- Employer identification number (EIN).

- Previous RTS10 forms, if applicable, for reference.

- Any relevant tax documents that may affect the reemployment tax calculation.

Filing Deadlines / Important Dates

Filing deadlines for the RTS10 form are critical for compliance. Employers must submit the RTS10 form quarterly, with specific due dates based on the reporting period. Typically, the deadlines are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31

It is essential for employers to adhere to these deadlines to avoid penalties and ensure timely contributions to the reemployment assistance program.

Quick guide on how to complete rts10 form florida

Easily prepare Rts10 Form Florida on any device

Managing documents online has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage Rts10 Form Florida on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The easiest method to edit and electronically sign Rts10 Form Florida effortlessly

- Locate Rts10 Form Florida and click Get Form to begin.

- Make use of the tools available to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Rts10 Form Florida to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rts10 form florida

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is Florida RTS 10 and how does it work with airSlate SignNow?

Florida RTS 10 is an advanced document management system that allows users to efficiently handle their electronic signatures. With airSlate SignNow, businesses can seamlessly integrate Florida RTS 10 to streamline their signing process and ensure compliance with Florida's regulations.

-

How much does airSlate SignNow cost for Florida RTS 10 users?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains competitively priced for Florida RTS 10 users. We offer flexible plans that cater to businesses of all sizes, ensuring that you receive the best value while enjoying robust features tailored for document management.

-

What features does airSlate SignNow offer for Florida RTS 10 integration?

AirSlate SignNow offers several features that enhance the functionality of Florida RTS 10, including document templates, real-time tracking, and automated reminders. These features help simplify the signing process, making it easier for businesses to manage their documents effectively.

-

Can I integrate airSlate SignNow with other software while using Florida RTS 10?

Yes, airSlate SignNow can be easily integrated with various software applications alongside Florida RTS 10. This flexibility allows businesses to create a more cohesive workflow, making document management more efficient and enhancing overall productivity.

-

What are the benefits of using airSlate SignNow with Florida RTS 10?

Using airSlate SignNow with Florida RTS 10 provides several benefits, such as improved efficiency in document handling and enhanced security for electronic signatures. Additionally, it allows businesses to save time and reduce operational costs by streamlining the signing process.

-

Is airSlate SignNow easy to use for first-time Florida RTS 10 users?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible for first-time users of Florida RTS 10. Our intuitive interface ensures that anyone can quickly learn how to send, sign, and manage documents effectively.

-

How does airSlate SignNow ensure compliance for Florida RTS 10 users?

AirSlate SignNow provides features that ensure compliance with Florida RTS 10 regulations, including secure signatures and an audit trail for all document transactions. This helps businesses maintain legal standing while utilizing electronic signatures.

Get more for Rts10 Form Florida

- Big o tires credit card form

- Understanding stem and leaf plots worksheet 1 answer key form

- The circuit book pdf form

- Little flock police department employment application form

- New hire worksheet form

- Motion for appropriate relief defendant form

- Evanston insurance company form

- Preauthorization request form univera healthcare

Find out other Rts10 Form Florida

- Sign Virginia Claim Myself

- Sign New York Permission Slip Free

- Sign Vermont Permission Slip Fast

- Sign Arizona Work Order Safe

- Sign Nebraska Work Order Now

- Sign Colorado Profit Sharing Agreement Template Secure

- Sign Connecticut Profit Sharing Agreement Template Computer

- How Can I Sign Maryland Profit Sharing Agreement Template

- How To Sign New York Profit Sharing Agreement Template

- Sign Pennsylvania Profit Sharing Agreement Template Simple

- Help Me With Sign Delaware Electrical Services Contract

- Sign Louisiana Electrical Services Contract Safe

- How Can I Sign Mississippi Electrical Services Contract

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement