Nc 1099 Form

What is the NC 1099 Form

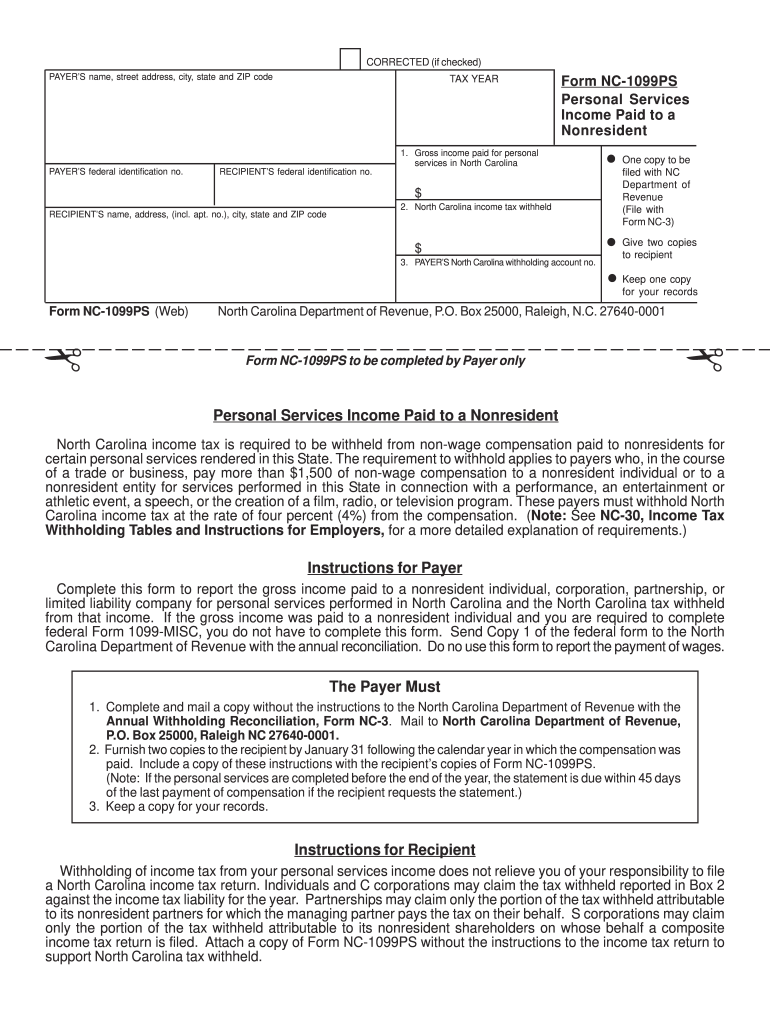

The NC 1099 form, also known as the 1099ps, is a tax document used in North Carolina to report income that is not subject to withholding. This form is essential for individuals and businesses that have made payments to independent contractors, freelancers, or other non-employees. The information reported on the NC 1099 form helps the state tax authorities track income and ensure proper tax compliance.

How to use the NC 1099 Form

Using the NC 1099 form involves several steps to ensure accurate reporting. First, gather all necessary information about the payee, including their name, address, and Social Security number or Employer Identification Number (EIN). Next, determine the total amount paid to the individual or entity during the tax year. Finally, complete the form by filling in the required fields, ensuring that all information is correct before submission.

Steps to complete the NC 1099 Form

Completing the NC 1099 form requires careful attention to detail. Follow these steps:

- Obtain the NC 1099 form from the North Carolina Department of Revenue website or through authorized distributors.

- Fill in the payer's information, including name, address, and tax identification number.

- Enter the payee's details, ensuring accuracy in their name and identification number.

- Report the total payments made during the tax year in the appropriate box.

- Review the completed form for any errors before submitting it.

Legal use of the NC 1099 Form

The NC 1099 form is legally binding when filled out correctly and submitted on time. It must comply with both federal and state regulations regarding income reporting. Proper use of this form ensures that both the payer and payee fulfill their tax obligations, helping to avoid potential penalties or audits from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the NC 1099 form are crucial to ensure compliance. Typically, the form must be submitted to the North Carolina Department of Revenue by January thirty-first of the year following the tax year in which payments were made. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to keep track of these dates to avoid late filing penalties.

Who Issues the Form

The NC 1099 form is issued by the payer, which can be an individual or a business entity that has made payments to a non-employee. It is the responsibility of the payer to ensure that the form is completed accurately and submitted to both the payee and the North Carolina Department of Revenue. This ensures that all parties are aware of the reported income for tax purposes.

Quick guide on how to complete nc 1099 form

Complete Nc 1099 Form effortlessly on any device

Digital document management has become increasingly favored among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly and without delays. Manage Nc 1099 Form across any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Nc 1099 Form with ease

- Locate Nc 1099 Form and click Get Form to initiate the process.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that functionality.

- Create your signature with the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to share your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Nc 1099 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nc 1099 form

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is a 1099ps and how does it work with airSlate SignNow?

A 1099ps is a tax form used to report various types of income other than wages and salaries. With airSlate SignNow, you can easily fill out, send, and eSign your 1099ps documents within a secure environment, streamlining your tax document management and ensuring compliance.

-

How can airSlate SignNow help me with 1099ps document management?

airSlate SignNow offers a user-friendly platform that facilitates the seamless creation, sending, and signing of 1099ps forms. You can quickly send your forms for signature, keep track of their status, and store them safely, ensuring that you are organized and compliant come tax season.

-

What are the pricing options for airSlate SignNow for handling 1099ps?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs, starting from affordable monthly subscriptions. Each plan includes features to efficiently manage and eSign 1099ps, enabling businesses of all sizes to choose a suitable option based on their volume of document transactions.

-

Can I integrate airSlate SignNow with other platforms to manage my 1099ps?

Yes, airSlate SignNow provides integrations with various platforms such as Google Workspace, Salesforce, and more. This means you can easily import and manage your 1099ps documents within your existing workflows, enhancing productivity and ensuring all your documents are in one place.

-

What benefits does airSlate SignNow offer for managing 1099ps?

Using airSlate SignNow for your 1099ps provides numerous benefits, including enhanced security, faster turnaround times for signatures, and the ability to keep all your tax documents organized. This means you can focus more on your business while confidently managing your compliance requirements.

-

Is it easy to eSign a 1099ps using airSlate SignNow?

Absolutely! airSlate SignNow simplifies the eSigning process for 1099ps. Users can easily sign electronically with just a few clicks, ensuring swift transactions and eliminating the need for paper, which streamlines your workflow and saves time.

-

What features does airSlate SignNow offer specifically for 1099ps?

airSlate SignNow includes unique features for 1099ps such as customizable templates, robust tracking capabilities, and automated reminders. These features help ensure that your documents are completed on time and that all parties are kept informed throughout the signing process.

Get more for Nc 1099 Form

Find out other Nc 1099 Form

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document