W 3n Form

What is the W-3n Form

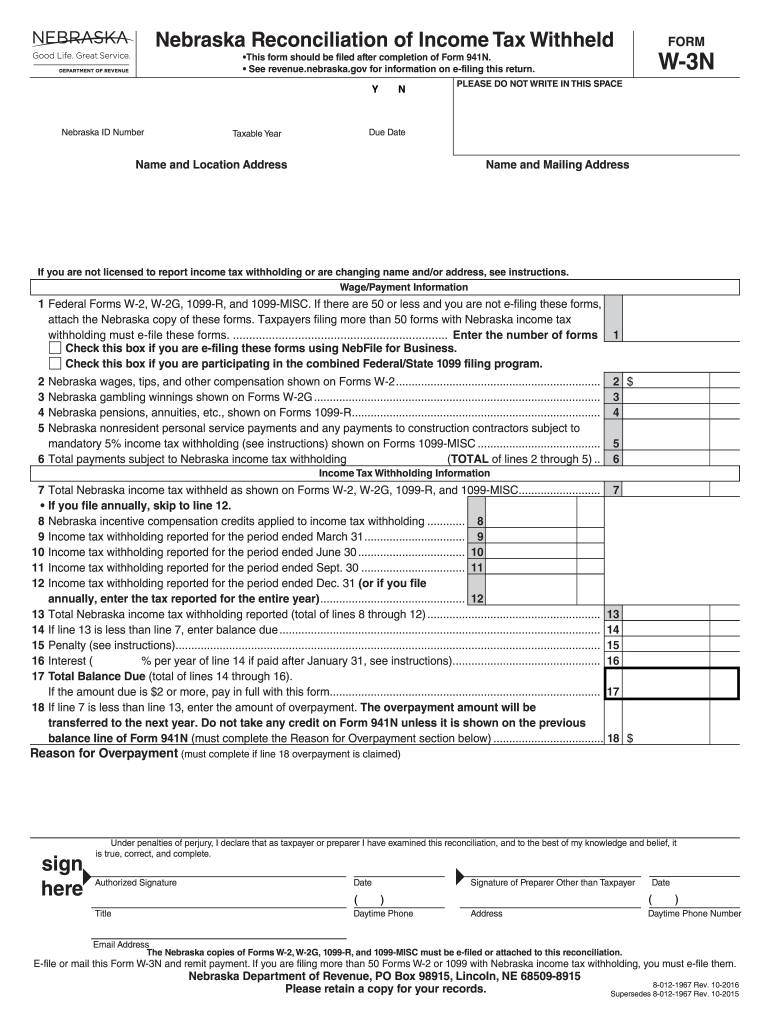

The W-3n form is a tax document used by employers in the United States to report income withheld from employees for state tax purposes. Specifically, it is designed for use in Nebraska and is associated with the state’s income tax system. This form summarizes the total amount of state income tax withheld from an employee’s wages throughout the year. Employers must file this form with the Nebraska Department of Revenue to ensure compliance with state tax regulations.

How to use the W-3n Form

To effectively use the W-3n form, employers need to gather all relevant payroll information for the tax year. This includes total wages paid to employees and the total state income tax withheld. After completing the form, employers must submit it to the Nebraska Department of Revenue, typically alongside individual W-2 forms for each employee. This process ensures that both the employer and the state have accurate records of income tax withholdings.

Steps to complete the W-3n Form

Completing the W-3n form involves several key steps:

- Gather all payroll records for the tax year, including W-2 forms for each employee.

- Calculate the total wages paid to employees and the total state income tax withheld.

- Fill out the W-3n form with the required information, including employer details and totals.

- Review the form for accuracy to avoid any discrepancies.

- Submit the completed form to the Nebraska Department of Revenue by the specified deadline.

Legal use of the W-3n Form

The W-3n form is legally required for employers in Nebraska to report state income tax withholdings. Compliance with state tax laws is essential to avoid penalties and ensure that employees receive proper credit for taxes withheld. The form must be filed accurately and on time, as specified by the Nebraska Department of Revenue, to maintain legal standing and avoid potential audits.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines related to the W-3n form. Typically, the form is due on January thirty-first of the year following the tax year being reported. Employers should also note that any W-2 forms must be submitted at the same time, ensuring all tax documents are filed together to avoid delays or penalties.

Required Documents

To complete the W-3n form, employers need several documents:

- Payroll records for the tax year, including the total wages paid.

- W-2 forms for each employee, which detail individual earnings and withholdings.

- Employer identification number (EIN) to accurately identify the business.

Penalties for Non-Compliance

Failure to file the W-3n form on time or submitting inaccurate information can result in penalties imposed by the Nebraska Department of Revenue. These penalties may include fines and interest on unpaid taxes. It is crucial for employers to ensure timely and accurate filings to avoid these consequences and maintain compliance with state tax laws.

Quick guide on how to complete w 3n form

Complete W 3n Form effortlessly on any device

Digital document management has gained tremendous popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed forms, as users can easily locate the necessary template and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents promptly without delays. Handle W 3n Form on any device with airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The simplest way to edit and electronically sign W 3n Form with ease

- Find W 3n Form and click Get Form to begin the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this task.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or incorrectly stored files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign W 3n Form and ensure effective communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 3n form

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is w3n and how does it relate to airSlate SignNow?

W3n is a key feature of airSlate SignNow that ensures secure and efficient electronic signing of documents. It enhances workflow automation, allowing users to streamline their document management processes with ease while ensuring compliance with legal standards.

-

How much does airSlate SignNow cost for using the w3n feature?

airSlate SignNow offers various pricing plans that cater to different business needs. The w3n feature is included in all plans, allowing you to enjoy a cost-effective solution for managing and signing documents electronically without hidden fees.

-

What are the main features of the w3n functionality in airSlate SignNow?

The w3n functionality in airSlate SignNow includes intuitive document editing, customizable templates, and real-time tracking of document statuses. These features empower businesses to enhance their efficiency while ensuring the security and integrity of signed documents.

-

Can I integrate airSlate SignNow with other tools I use for w3n?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, making it easy to incorporate the w3n feature into your existing workflow. Popular integrations include Google Drive, Salesforce, and Dropbox, enhancing your document management capabilities.

-

What benefits does the w3n feature provide to businesses?

The w3n feature allows businesses to reduce paperwork, speed up the signing process, and improve overall operational efficiency. This leads to faster turnaround times for contracts and agreements, ultimately enhancing customer satisfaction and business growth.

-

Is the w3n feature secure for sensitive documents?

Absolutely! The w3n feature in airSlate SignNow employs advanced security protocols, including encryption and secure access controls, to protect your sensitive documents. This ensures that your data remains confidential and safe throughout the entire signing process.

-

How can I get started with airSlate SignNow and the w3n feature?

Getting started with airSlate SignNow is simple! Sign up for a free trial to explore the w3n feature and understand its benefits firsthand. Once you're ready, you can choose the plan that suits your business needs best.

Get more for W 3n Form

Find out other W 3n Form

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe