Tax Alaska 2019

What is the Tax Alaska

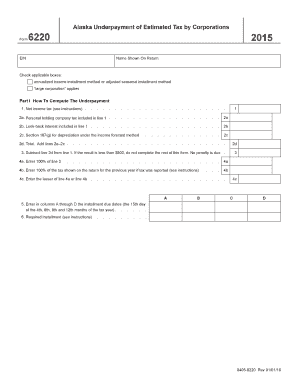

The Tax Alaska form is a specific document used for tax purposes within the state of Alaska. It is designed to collect information necessary for state tax assessments and compliance. This form is essential for individuals and businesses operating in Alaska to report their income, deductions, and credits accurately. Understanding the purpose and requirements of the Tax Alaska form is crucial for meeting state tax obligations.

How to use the Tax Alaska

Using the Tax Alaska form involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form accurately, ensuring that all required fields are completed. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the chosen method. Utilizing e-signature tools can streamline this process, making it easier to sign and submit the form securely.

Steps to complete the Tax Alaska

Completing the Tax Alaska form requires a systematic approach:

- Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Access the Tax Alaska form online or obtain a physical copy from the appropriate state agency.

- Fill in personal information, including your name, address, and Social Security number.

- Report your total income and any deductions or credits you are eligible for.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail, ensuring to keep a copy for your records.

Legal use of the Tax Alaska

The Tax Alaska form must be used in compliance with state tax laws and regulations. It is legally binding once submitted, and any inaccuracies or omissions can lead to penalties. To ensure legal use, it is important to follow the guidelines set forth by the Alaska Department of Revenue. Utilizing secure electronic signature platforms can also enhance the legal validity of the submitted form, as they comply with relevant eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of each year for individual taxpayers. However, there may be specific deadlines for businesses or special circumstances. Staying informed about these dates is essential for timely compliance. Checking the Alaska Department of Revenue’s website can provide the most current information regarding deadlines and any changes that may occur.

Required Documents

When completing the Tax Alaska form, several documents are required to ensure accurate reporting:

- W-2 forms from employers for reported income.

- 1099 forms for any freelance or contract work.

- Documentation of deductions, such as mortgage interest statements or medical expenses.

- Previous year’s tax return, which can serve as a reference.

Having these documents ready will facilitate a smoother completion process and help prevent errors.

Quick guide on how to complete tax alaska 6967203

Effortlessly Prepare Tax Alaska on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without any interruptions. Manage Tax Alaska on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Edit and eSign Tax Alaska with Ease

- Find Tax Alaska and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Alaska and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967203

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967203

The best way to create an eSignature for your PDF file online

The best way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Tax Alaska?

airSlate SignNow is a powerful eSigning solution designed to streamline document workflows. For businesses dealing with Tax Alaska, it offers quick and secure ways to sign and send tax documents electronically, ensuring compliance while saving time.

-

How much does airSlate SignNow cost for businesses focusing on Tax Alaska?

Pricing for airSlate SignNow is competitive and tailored to fit various business needs, including those specifically handling Tax Alaska. You can choose from different plans that cater to individual users or teams, ensuring you get the tools you need at a price that works for you.

-

What features does airSlate SignNow offer for managing Tax Alaska documentation?

airSlate SignNow provides robust features such as custom templates, audit trails, and real-time notifications, which are essential for managing Tax Alaska documentation efficiently. These features simplify the eSigning process and ensure that your tax documents are handled securely.

-

Can airSlate SignNow integrate with other software for Tax Alaska processes?

Yes, airSlate SignNow integrates seamlessly with various software solutions commonly used for Tax Alaska, including CRM systems and accounting software. This integration helps streamline your workflow, allowing for easy access to necessary tax documents as you manage your operations.

-

What are the main benefits of using airSlate SignNow for Tax Alaska?

Using airSlate SignNow for Tax Alaska can signNowly reduce the time spent on paperwork and improve overall efficiency. The platform not only speeds up the eSigning process but also enhances security and compliance, which are critical when handling sensitive tax information.

-

Is airSlate SignNow easy to use for Tax Alaska professionals?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for Tax Alaska professionals to navigate the platform. With intuitive tools and clear instructions, even those with minimal tech experience can manage their eSigning needs efficiently.

-

How secure is airSlate SignNow when dealing with Tax Alaska documents?

Security is a top priority for airSlate SignNow, especially for sensitive Tax Alaska documents. The platform employs advanced encryption and compliance measures to protect your data, ensuring that all transactions remain confidential and secure.

Get more for Tax Alaska

- Chase profit and loss statement form

- Ministrio das relaes exteriores mre recibo de entrega de requerimento rer form

- How to fill up rural bank form

- Northeast arc payroll login form

- B10 form pdf

- Gradual dose reduction worksheet form

- Wayside kidz camp registration form k5 through 8th grade phone 305 5956550 fax 305 2739922 www

- Bfa actingmusical theatre and mfa acting production audition jury evaluation form

Find out other Tax Alaska

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online