Ar 1r Form 2015

What is the Ar 1r Form

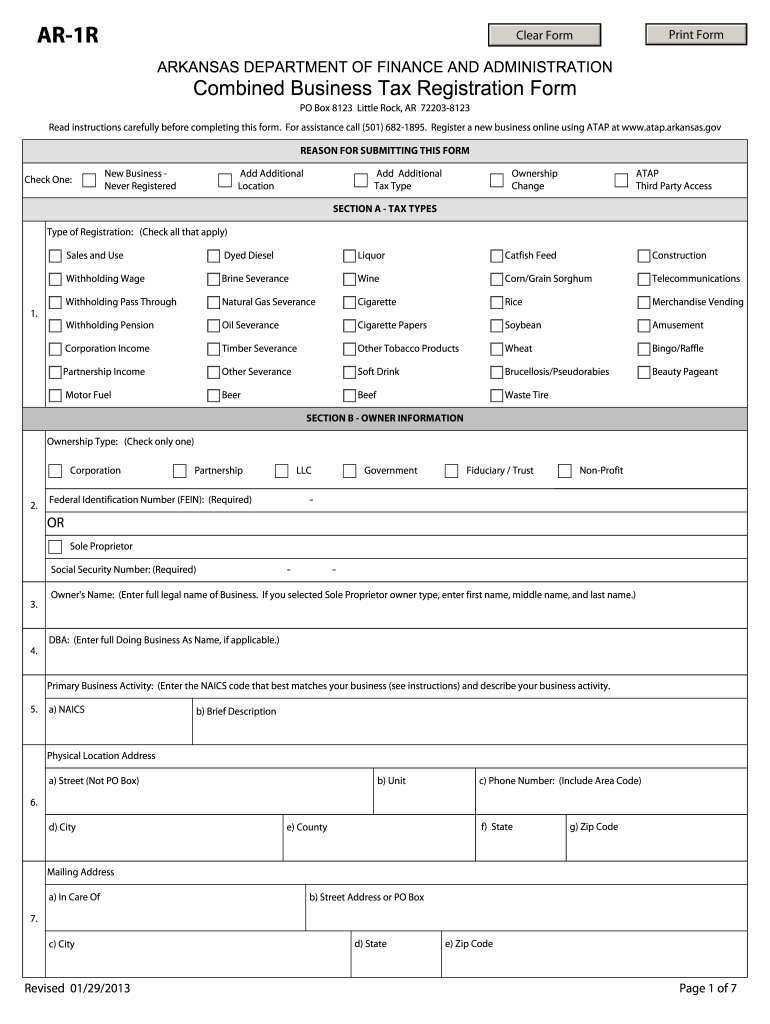

The Ar 1r Form is a specific document used primarily for tax reporting purposes in the United States. It is essential for individuals and businesses to accurately report their income and expenses to the Internal Revenue Service (IRS). This form is particularly relevant for those who may have unique tax situations or specific deductions that need to be documented. Understanding the purpose and requirements of the Ar 1r Form can help ensure compliance with federal tax laws.

How to use the Ar 1r Form

Using the Ar 1r Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is crucial to double-check your entries to avoid errors that could lead to penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific guidelines provided by the IRS.

Steps to complete the Ar 1r Form

Completing the Ar 1r Form requires a systematic approach:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts.

- Read the instructions carefully to understand each section of the form.

- Fill in personal information, including your name, address, and Social Security number.

- Report income accurately, ensuring to include all sources of earnings.

- List any eligible deductions and credits to reduce your taxable income.

- Review the completed form for any errors or omissions.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the Ar 1r Form

The legal use of the Ar 1r Form is governed by IRS regulations. To ensure that the form is legally binding, it must be filled out accurately and submitted within the specified deadlines. Failure to comply with these regulations can result in penalties or audits. It is important to keep a copy of the submitted form and any supporting documents for your records, as they may be needed for future reference or in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Ar 1r Form are crucial to avoid penalties. Typically, the form must be submitted by April fifteenth of each year for individual taxpayers. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to deadlines or additional requirements that may arise, especially in light of any recent tax law updates.

Required Documents

To complete the Ar 1r Form accurately, several documents are typically required:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Bank statements for income verification.

- Any relevant tax documents from previous years.

Who Issues the Form

The Ar 1r Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines on how to obtain the form, as well as detailed instructions on how to complete it. Keeping up to date with IRS communications can help ensure that you have the latest information regarding the form and its requirements.

Quick guide on how to complete ar 1r 2013 form

Easily create Ar 1r Form on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent environmentally-friendly alternative to traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents efficiently without any delays. Handle Ar 1r Form on any device with the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

The simplest way to edit and electronically sign Ar 1r Form effortlessly

- Obtain Ar 1r Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the features that airSlate SignNow provides for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, through email, text message (SMS), or a sharing link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ar 1r Form and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar 1r 2013 form

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the Ar 1r Form and why is it important?

The Ar 1r Form is a vital document used for various business transactions, particularly in compliance and reporting. By leveraging the airSlate SignNow platform, you can effortlessly create, send, and eSign these forms, ensuring fast and effective processing.

-

How can I create an Ar 1r Form using airSlate SignNow?

Creating an Ar 1r Form using airSlate SignNow is straightforward. Simply log into your account, select the template for the Ar 1r Form, and customize it as needed before sending it out for eSignature to streamline the workflow.

-

What are the pricing options for using airSlate SignNow for Ar 1r Forms?

AirSlate SignNow offers various pricing plans tailored to fit different business needs, starting from a basic package that covers essential features for managing Ar 1r Forms to more advanced options with comprehensive tools and integrations. You can choose a plan that aligns with your budget and usage requirements.

-

What features does airSlate SignNow provide for Ar 1r Forms?

AirSlate SignNow provides a range of features for managing Ar 1r Forms, including customizable templates, automated workflows, secure eSignatures, and real-time tracking. These tools empower businesses to streamline their document processes more efficiently.

-

Can I integrate airSlate SignNow with other applications for handling Ar 1r Forms?

Yes, airSlate SignNow offers seamless integrations with various applications such as CRM systems, project management tools, and cloud storage services. This interoperability allows you to manage your Ar 1r Forms effortlessly within your existing workflows.

-

What are the benefits of using airSlate SignNow for your Ar 1r Form?

Using airSlate SignNow for your Ar 1r Form enhances efficiency and reduces turnaround times. The platform offers easy access to documents, ensures compliance through secure eSignatures, and helps in maintaining an organized digital record of all signed forms.

-

Is airSlate SignNow secure for storing Ar 1r Forms?

Absolutely! AirSlate SignNow employs robust security measures, including encryption and multi-factor authentication, to safeguard your Ar 1r Forms and user data. You can trust that your sensitive information is well-protected while using the platform.

Get more for Ar 1r Form

- Caste validity certificate download pdf form

- Letter of dependency form

- Ttd nadaneerajanam form

- Test your english vocabulary in use elementary with answers second edition pdf form

- Santander direct debit mandate form

- Powered scooter share program permit spin skinny sfmta form

- Fillable online michigan fis 2053 515 department of form

- Claim for tax relief for vehicles purchased acqu form

Find out other Ar 1r Form

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter