Claim for Tax Relief for Vehicles Purchased Acqu 2024-2026

What is the Claim For Tax Relief For Vehicles Purchased Acqu

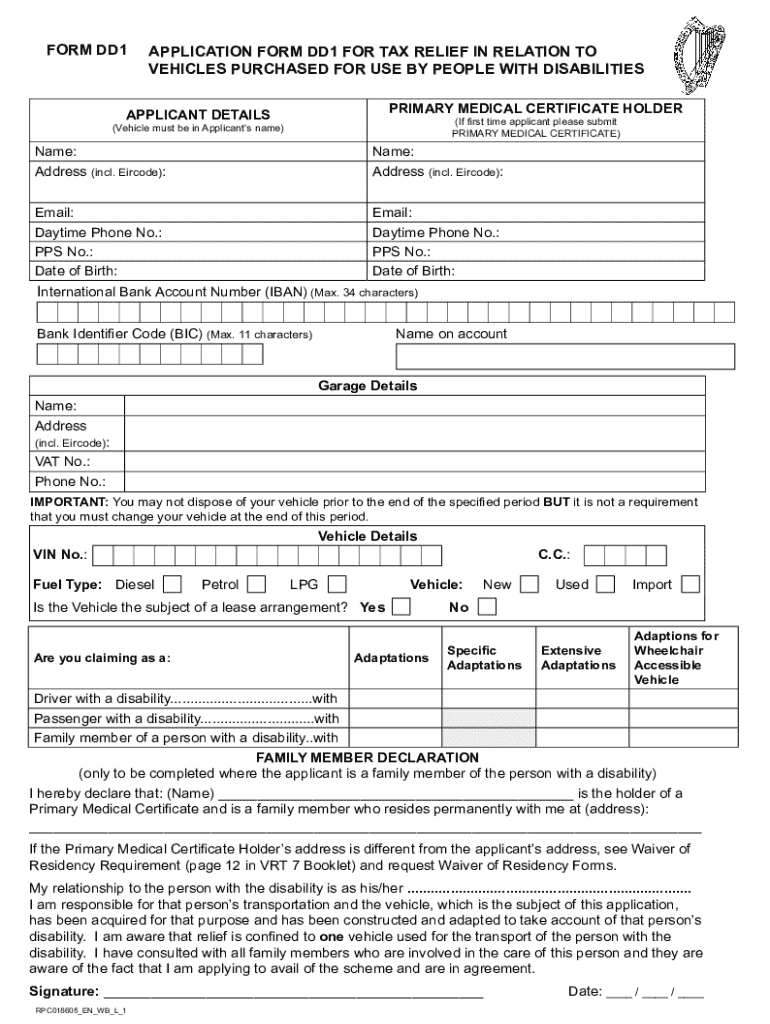

The Claim For Tax Relief For Vehicles Purchased Acqu is a specific tax form that allows taxpayers to seek relief on taxes related to vehicles they have purchased. This form is particularly relevant for individuals and businesses that have incurred expenses associated with vehicle purchases, which may qualify for tax deductions or credits. Understanding the purpose of this form is essential for ensuring compliance with tax regulations and maximizing potential tax benefits.

How to use the Claim For Tax Relief For Vehicles Purchased Acqu

Using the Claim For Tax Relief For Vehicles Purchased Acqu involves several steps. First, gather all necessary documentation related to the vehicle purchase, including purchase agreements, invoices, and any financing documents. Next, complete the form accurately, ensuring that all required fields are filled out. After completing the form, review it for any errors before submitting it to the appropriate tax authority. This process helps ensure that your claim is processed smoothly and efficiently.

Steps to complete the Claim For Tax Relief For Vehicles Purchased Acqu

Completing the Claim For Tax Relief For Vehicles Purchased Acqu requires careful attention to detail. Follow these steps:

- Collect all relevant documents, such as proof of purchase and financing agreements.

- Fill out the form, providing accurate information about the vehicle and the purchase details.

- Double-check all entries to ensure there are no mistakes.

- Submit the completed form along with any required documentation to the designated tax authority.

Required Documents

To successfully file the Claim For Tax Relief For Vehicles Purchased Acqu, certain documents are necessary. These typically include:

- Proof of vehicle purchase, such as a bill of sale or purchase agreement.

- Financing documents if applicable, detailing any loans or leases.

- Receipts for any modifications or enhancements made to the vehicle that may qualify for deductions.

Eligibility Criteria

Eligibility for the Claim For Tax Relief For Vehicles Purchased Acqu depends on several factors. Taxpayers must demonstrate that the vehicle was purchased for business use or other qualifying purposes. Additionally, the vehicle must meet specific criteria set forth by the IRS, such as being used primarily for business activities. Understanding these eligibility requirements is crucial for successfully filing the claim.

IRS Guidelines

The IRS provides specific guidelines regarding the Claim For Tax Relief For Vehicles Purchased Acqu. These guidelines outline the conditions under which taxpayers can claim tax relief, the types of vehicles that qualify, and the necessary documentation required. Familiarizing yourself with these guidelines ensures compliance and helps maximize potential tax benefits.

Create this form in 5 minutes or less

Find and fill out the correct claim for tax relief for vehicles purchased acqu

Create this form in 5 minutes!

How to create an eSignature for the claim for tax relief for vehicles purchased acqu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Claim For Tax Relief For Vehicles Purchased Acqu.?

To Claim For Tax Relief For Vehicles Purchased Acqu., you need to gather all necessary documentation related to your vehicle purchase. This includes invoices, proof of payment, and any relevant tax forms. Once you have all the documents, you can submit your claim through the appropriate tax authority channels.

-

How can airSlate SignNow help with my Claim For Tax Relief For Vehicles Purchased Acqu.?

airSlate SignNow provides a streamlined solution for managing and signing documents related to your Claim For Tax Relief For Vehicles Purchased Acqu. With our platform, you can easily create, send, and eSign necessary documents, ensuring a smooth and efficient process.

-

Are there any fees associated with using airSlate SignNow for my tax relief claims?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. While there may be a nominal fee for using our services, the efficiency and time saved in processing your Claim For Tax Relief For Vehicles Purchased Acqu. can outweigh these costs.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking of document status. These features are particularly beneficial when you need to manage your Claim For Tax Relief For Vehicles Purchased Acqu. efficiently and securely.

-

Can I integrate airSlate SignNow with other software for my tax claims?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easier to manage your Claim For Tax Relief For Vehicles Purchased Acqu. You can connect with accounting software, CRM systems, and more to streamline your workflow.

-

What are the benefits of using airSlate SignNow for tax relief claims?

Using airSlate SignNow for your Claim For Tax Relief For Vehicles Purchased Acqu. provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the entire process, allowing you to focus on your business.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Yes, airSlate SignNow is designed with user-friendliness in mind. Even if you're unfamiliar with eSigning, our intuitive interface makes it easy to navigate and complete your Claim For Tax Relief For Vehicles Purchased Acqu. without any hassle.

Get more for Claim For Tax Relief For Vehicles Purchased Acqu

- Az website form

- Cdc 3 year old milestones form

- Risk profiling questionnaire sample form

- Mclaren hospice and home care foundation donation form

- Verification of birth facts form

- Verification of birth facts form

- New patient biote form female swc female new patient biote health assessment form

- Outpatient test order form redmond regional medical center

Find out other Claim For Tax Relief For Vehicles Purchased Acqu

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application