F 7004 Form 2017

What is the F 7004 Form

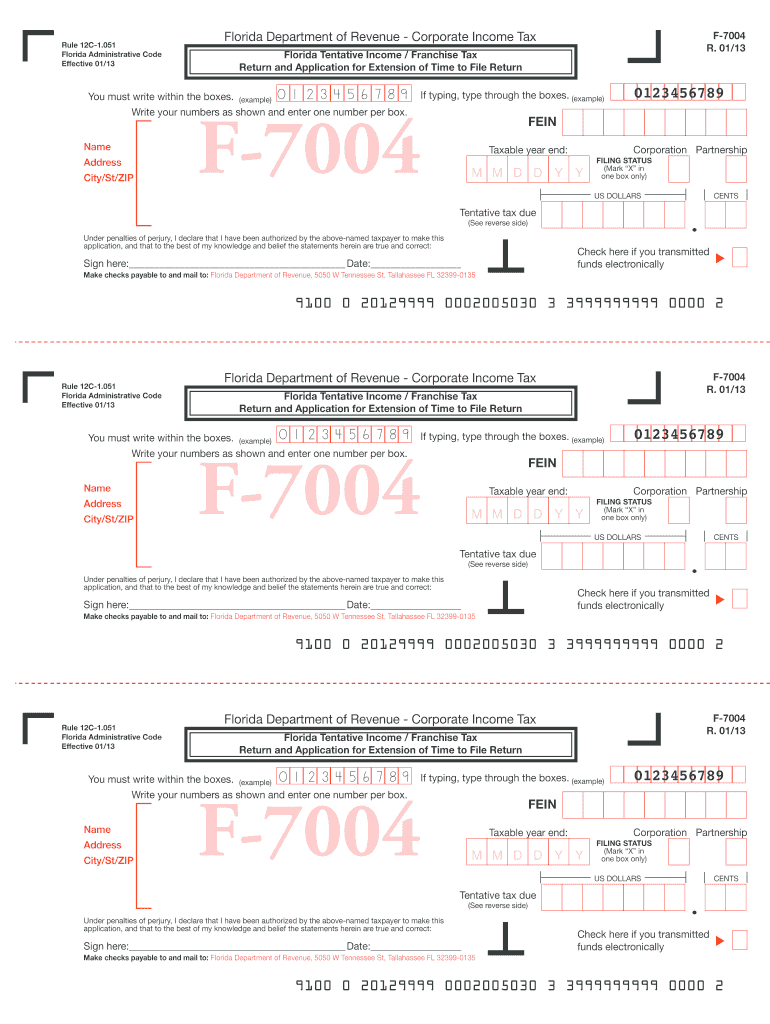

The F 7004 Form, officially known as the Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, is a crucial document for businesses in the United States. This form allows entities such as corporations and partnerships to request an automatic extension of time to file their tax returns. By submitting the F 7004 Form, businesses can gain an additional six months to complete their tax filings without incurring penalties for late submission, provided they meet the necessary criteria.

How to obtain the F 7004 Form

The F 7004 Form can be easily obtained from the official IRS website. It is available in a downloadable PDF format, which can be printed and filled out manually. Additionally, many tax preparation software programs offer the option to generate this form electronically. Businesses can also consult their tax professionals to ensure they have the correct version of the form and understand the requirements for submission.

Steps to complete the F 7004 Form

Completing the F 7004 Form involves several straightforward steps:

- Begin by entering the name of the business and its Employer Identification Number (EIN).

- Indicate the type of entity filing for the extension, such as a corporation or partnership.

- Provide the address of the business, including city, state, and ZIP code.

- Specify the tax year for which the extension is being requested.

- Sign and date the form, ensuring that the person authorized to sign on behalf of the business completes this section.

Once completed, the form should be submitted according to the instructions provided by the IRS, either electronically or via mail.

Legal use of the F 7004 Form

The F 7004 Form is legally recognized as a valid request for an extension of time to file certain business tax returns. To ensure its legal standing, it is essential that the form is completed accurately and submitted within the designated timeframe. The IRS accepts this form as a legitimate means for businesses to avoid penalties for late filing, provided that the business also pays any taxes owed by the original due date.

Filing Deadlines / Important Dates

Filing deadlines for the F 7004 Form are critical for businesses to avoid penalties. Generally, the form must be filed by the original due date of the tax return for which the extension is being requested. For most corporations, this is the fifteenth day of the fourth month following the end of their tax year. For partnerships, the deadline is typically the fifteenth day of the third month after the end of the tax year. It is important for businesses to mark these dates on their calendars to ensure timely submission.

Penalties for Non-Compliance

Failure to file the F 7004 Form by the deadline may result in penalties imposed by the IRS. If a business does not file for an extension and subsequently submits its tax return late, it may face a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, if the business does not pay its taxes by the original due date, interest will accrue on the unpaid amount. Understanding these penalties emphasizes the importance of timely filing.

Quick guide on how to complete 2013 f 7004 form

Effortlessly Prepare F 7004 Form on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to generate, alter, and electronically sign your documents quickly and without delays. Manage F 7004 Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The easiest way to modify and electronically sign F 7004 Form with ease

- Find F 7004 Form and click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and electronically sign F 7004 Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 f 7004 form

Create this form in 5 minutes!

How to create an eSignature for the 2013 f 7004 form

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the F 7004 Form and why is it important?

The F 7004 Form is a crucial document used by businesses to request an extension for filing their income tax returns. Understanding how to properly complete and submit the F 7004 Form can help you avoid penalties and ensure you have ample time to organize your financial records.

-

How can airSlate SignNow help with the F 7004 Form?

airSlate SignNow streamlines the process of completing and signing the F 7004 Form by providing an intuitive interface for document management. With our platform, you can easily fill out, eSign, and send the F 7004 Form securely, making tax season less stressful.

-

Are there any costs associated with using airSlate SignNow for the F 7004 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans allow users to effectively manage documents like the F 7004 Form while providing a cost-effective solution for eSigning and document management.

-

What features does airSlate SignNow offer for handling the F 7004 Form?

airSlate SignNow includes features like customizable templates, automated workflows, and secure cloud storage to simplify the management of the F 7004 Form. These tools enhance productivity and ensure that your tax documents can be completed and signed efficiently.

-

Is airSlate SignNow secure for submitting the F 7004 Form?

Absolutely! airSlate SignNow prioritizes security, using encryption and compliance standards to safeguard your documents. This ensures that your F 7004 Form and any sensitive information are protected throughout the signing and submission process.

-

Can I track the status of my F 7004 Form using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your F 7004 Form after sending it for signatures. This real-time monitoring helps you keep tabs on who has signed the document and ensures timely completion.

-

What integrations does airSlate SignNow provide for handling the F 7004 Form?

airSlate SignNow seamlessly integrates with various productivity tools such as Google Drive, Dropbox, and Microsoft Office. This allows you to access and manage your F 7004 Form and other relevant documents from your preferred platforms without any hassle.

Get more for F 7004 Form

- Eft mandate for gem form

- Cwb date meaning form

- Red mountain weight loss new patient paperwork form

- Mass distance charges namibia form

- Statutory declaration nsw sample form

- Ma school health record form cambridge public schools

- United states court of appeals for the tenth forms

- Application for concealed handgun license chl dps texas form

Find out other F 7004 Form

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract