Chapter 12c 1 Florida Administrative Code 2018-2026

What is the Chapter 12c 1 Florida Administrative Code

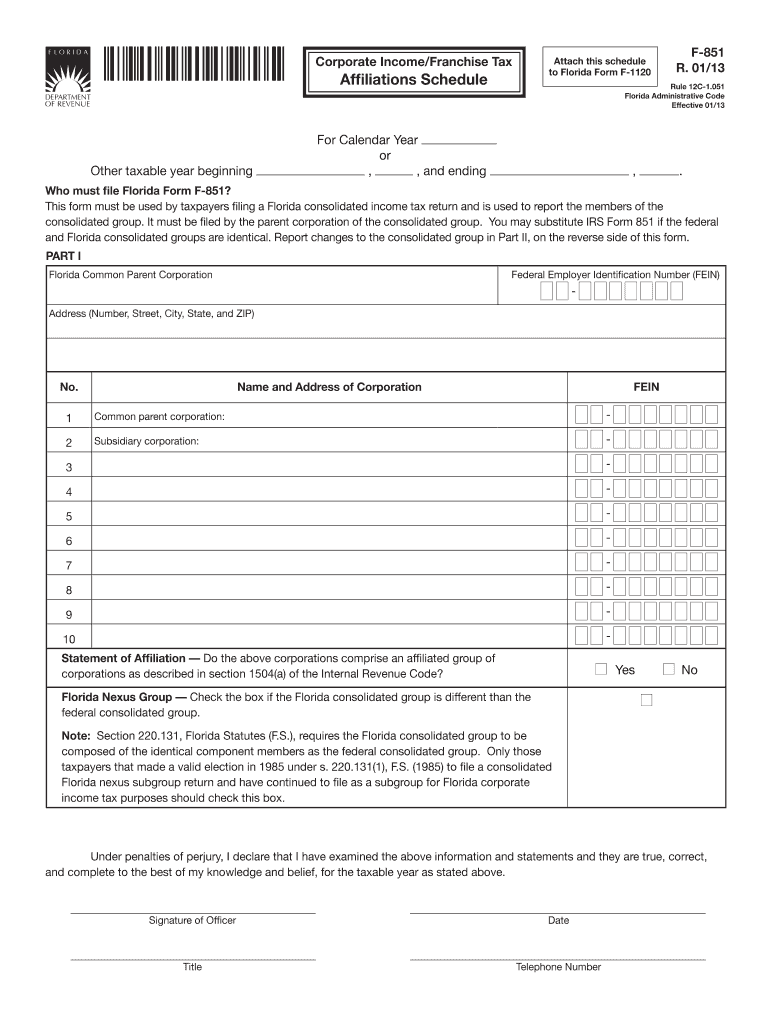

The Chapter 12c 1 Florida Administrative Code outlines the regulations governing the Florida corporate franchise tax. This code provides essential guidelines for businesses operating within the state, detailing the requirements for compliance, tax obligations, and the processes involved in filing necessary documents. Understanding this code is crucial for ensuring that your Florida corporation meets all legal requirements and maintains good standing with state authorities.

Steps to Complete the Chapter 12c 1 Florida Administrative Code

Completing the Chapter 12c 1 Florida Administrative Code involves several key steps. First, gather all necessary information regarding your business, including its legal structure, financial records, and any previous tax filings. Next, accurately fill out the required forms, ensuring that all information is complete and correct. It is important to review the forms for any errors before submission. Finally, submit the forms through the appropriate channels, whether online, by mail, or in person, to ensure timely processing.

Filing Deadlines / Important Dates

Filing deadlines for the Chapter 12c 1 Florida Administrative Code are crucial for compliance. Typically, the deadline for submitting your Florida corporate income form aligns with the end of your fiscal year. It is essential to be aware of these dates to avoid penalties and ensure your corporation remains in good standing. Mark your calendar with these important dates to facilitate timely submissions and avoid any last-minute issues.

Required Documents

When completing the Chapter 12c 1 Florida Administrative Code, specific documents are required for submission. These may include your Florida corporate income form, financial statements, records of previous tax filings, and any supporting documentation that verifies your business activities and income. Having these documents organized and readily available will streamline the filing process and help ensure compliance with state regulations.

Penalties for Non-Compliance

Failure to comply with the Chapter 12c 1 Florida Administrative Code can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action against your corporation. It is crucial to understand the implications of non-compliance and to take proactive measures to meet all filing requirements and deadlines. Maintaining compliance not only protects your business but also fosters trust with stakeholders and clients.

Digital vs. Paper Version

When considering the submission of the Chapter 12c 1 Florida Administrative Code, businesses can choose between digital and paper versions. The digital version offers advantages such as faster processing times and the ability to track submissions electronically. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the choice, ensure that all information is accurate and complete to avoid delays in processing.

Eligibility Criteria

Eligibility criteria for filing under the Chapter 12c 1 Florida Administrative Code vary based on the type of business entity. Generally, corporations operating in Florida must meet specific requirements regarding their formation, structure, and tax obligations. Understanding these criteria is essential for ensuring that your business qualifies for filing and complies with all necessary regulations. Review the criteria carefully to determine your eligibility and prepare for the filing process.

Quick guide on how to complete chapter 12c 1 florida administrative code

Effortlessly Prepare Chapter 12c 1 Florida Administrative Code on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Manage Chapter 12c 1 Florida Administrative Code on any platform using airSlate SignNow's Android or iOS applications and elevate any document-centric process today.

How to Modify and eSign Chapter 12c 1 Florida Administrative Code with Ease

- Find Chapter 12c 1 Florida Administrative Code and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or blackout confidential information with the instruments that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Put aside worries of lost or misfiled documents, tiring form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and eSign Chapter 12c 1 Florida Administrative Code while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct chapter 12c 1 florida administrative code

Create this form in 5 minutes!

How to create an eSignature for the chapter 12c 1 florida administrative code

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the Florida tax schedule?

The Florida tax schedule outlines the deadlines and requirements for filing taxes in the state of Florida. It includes important dates for various tax types, such as corporate income tax, sales tax, and property tax. Understanding the Florida tax schedule is crucial for businesses to ensure compliance and timely filing.

-

How can airSlate SignNow help me manage my Florida tax schedule?

airSlate SignNow can help you manage your Florida tax schedule by providing a platform to digitally sign and send all your tax-related documents. With its user-friendly interface, you can easily track deadlines and ensure that all required forms are completed and sent on time. This can reduce the risk of late submissions and fines related to your Florida tax schedule.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers several features that enhance tax document management, such as customizable templates, secure eSigning, and document storage. These features can streamline your workflow, making it easy to adhere to the Florida tax schedule. Additionally, you can automate reminders for important tax deadlines within the platform.

-

Is airSlate SignNow affordable for small businesses in Florida?

Yes, airSlate SignNow provides a cost-effective solution that fits the budgets of small businesses in Florida. Its pricing plans are designed to accommodate various business sizes, making it accessible while ensuring you can easily manage your Florida tax schedule. The value provided through time savings and efficiency justifies the investment.

-

Can I integrate airSlate SignNow with my accounting software for better tax management?

Absolutely! airSlate SignNow offers integrations with popular accounting software. This feature enables seamless data transfer and helps you stay organized while managing your Florida tax schedule, ultimately making tax preparation smoother and more efficient.

-

What are the benefits of using airSlate SignNow for my Florida tax filings?

Using airSlate SignNow simplifies the eSigning process, allowing for quick and efficient tax filings. The platform's features reduce paperwork and provide instant access to your documents, which is vital for managing your Florida tax schedule effectively. Moreover, document security ensures that your sensitive tax data remains protected.

-

How does airSlate SignNow ensure compliance with Florida tax laws?

airSlate SignNow stays updated with the latest Florida tax laws and regulations, ensuring your documents meet compliance standards. With features like audit trails and secure document storage, you can confidently manage your Florida tax schedule without worrying about compliance issues. This level of security helps safeguard your business against potential legal challenges.

Get more for Chapter 12c 1 Florida Administrative Code

Find out other Chapter 12c 1 Florida Administrative Code

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document