How to Get a Tax Exempt Certificate Florida Form 2017

What is the How To Get A Tax Exempt Certificate Florida Form

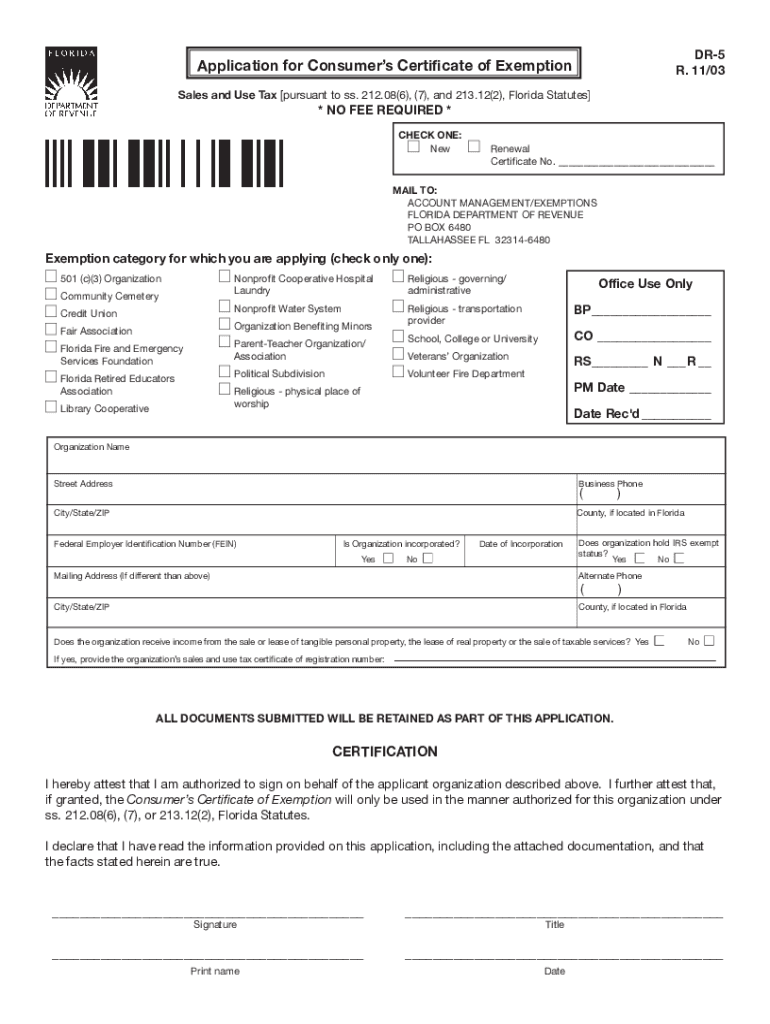

The How To Get A Tax Exempt Certificate Florida Form is a document that allows qualifying organizations to obtain exemption from sales tax in Florida. This form is essential for nonprofit organizations, government entities, and certain other groups that meet specific criteria set by the state. By completing this form, eligible entities can avoid paying sales tax on purchases related to their exempt activities, thereby saving money and resources.

How to obtain the How To Get A Tax Exempt Certificate Florida Form

To obtain the How To Get A Tax Exempt Certificate Florida Form, you can visit the Florida Department of Revenue's official website. The form is typically available for download in PDF format. Alternatively, you may request a physical copy by contacting the Department of Revenue directly. Ensure you have all necessary documentation ready to support your application, as this will facilitate a smoother process.

Steps to complete the How To Get A Tax Exempt Certificate Florida Form

Completing the How To Get A Tax Exempt Certificate Florida Form involves several key steps:

- Download the form from the Florida Department of Revenue website.

- Fill out the required fields, including the name of the organization and its federal employer identification number (EIN).

- Provide information about the type of organization and its purpose.

- Attach any supporting documents that demonstrate eligibility for tax exemption.

- Review the completed form for accuracy before submission.

Legal use of the How To Get A Tax Exempt Certificate Florida Form

The legal use of the How To Get A Tax Exempt Certificate Florida Form is governed by Florida state tax laws. Organizations must ensure they meet the eligibility criteria to utilize the exemption properly. Misuse of the form can lead to penalties, including back taxes and fines. It is important to keep the certificate on file and present it when making tax-exempt purchases to avoid complications.

Required Documents

When applying for the How To Get A Tax Exempt Certificate Florida Form, certain documents are typically required:

- Proof of the organization’s tax-exempt status, such as a letter from the IRS.

- Federal Employer Identification Number (EIN) documentation.

- Bylaws or articles of incorporation to verify the organization’s purpose.

- Any additional documentation that supports the claim for tax exemption.

Form Submission Methods

The How To Get A Tax Exempt Certificate Florida Form can be submitted through various methods:

- Online: Some organizations may have the option to submit the form electronically through the Florida Department of Revenue's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Organizations may also submit the form in person at designated Department of Revenue offices.

Quick guide on how to complete how to get a tax exempt certificate florida 2003 form

Prepare How To Get A Tax Exempt Certificate Florida Form effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without any delays. Handle How To Get A Tax Exempt Certificate Florida Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign How To Get A Tax Exempt Certificate Florida Form effortlessly

- Obtain How To Get A Tax Exempt Certificate Florida Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and has the same legal significance as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Modify and eSign How To Get A Tax Exempt Certificate Florida Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to get a tax exempt certificate florida 2003 form

Create this form in 5 minutes!

How to create an eSignature for the how to get a tax exempt certificate florida 2003 form

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is a Tax Exempt Certificate in Florida?

A Tax Exempt Certificate in Florida allows eligible businesses and organizations to make tax-free purchases on certain items. To understand how to get a Tax Exempt Certificate Florida form, you need to meet specific eligibility requirements set by the state. Obtaining this certificate can help save money on tax-exempt transactions.

-

How can I apply for a Tax Exempt Certificate in Florida?

To apply for a Tax Exempt Certificate in Florida, you must complete the necessary forms and provide required documentation regarding your business or organization. The process includes submitting the Tax Exempt Certificate Florida form to the appropriate state authority. It's recommended to check the Florida Department of Revenue's website for detailed instructions.

-

What documents are required for the Tax Exempt Certificate Florida form?

When applying for the Tax Exempt Certificate Florida form, you will typically need to provide proof of eligibility, such as a nonprofit status or a business license. Additional documents may include tax returns or other financial statements demonstrating your eligibility for tax exemption. Ensure that all paperwork is complete to avoid delays.

-

Is there a fee to obtain a Tax Exempt Certificate in Florida?

Applying for a Tax Exempt Certificate in Florida does not usually incur any fees. However, if additional documents or services are required during the application process, there may be costs associated with those. Always confirm any potential fees directly on the Florida Department of Revenue’s website when learning how to get a Tax Exempt Certificate Florida form.

-

How long does it take to receive the Tax Exempt Certificate in Florida?

The processing time for the Tax Exempt Certificate Florida form can vary based on the state’s workload and the completeness of your application. Generally, it may take several weeks to receive your certificate once submitted. To expedite the process, ensure that all forms are accurately filled out and required documents are included.

-

Can I use the Tax Exempt Certificate in other states?

No, the Tax Exempt Certificate Florida form is specific to the state of Florida and cannot be used in other states. Each state has its own tax exemption regulations and forms. If you operate in multiple states, you will need to familiarize yourself with their specific requirements for tax exempt certificates.

-

What benefits do I gain by using a Tax Exempt Certificate in Florida?

Using a Tax Exempt Certificate in Florida allows your business to save money on eligible purchases by avoiding sales tax. This can signNowly reduce operational costs, especially for nonprofits and organizations that frequently buy goods and services. Understanding how to get a Tax Exempt Certificate Florida form can lead to financial benefits for your business.

Get more for How To Get A Tax Exempt Certificate Florida Form

- N325 example form

- Bolo template form

- Rental agreement between parent and child template form

- Canon repair form

- Dl9108sc form

- Eohhs ri govreference centerforms applicationsmedicaid ltss applicationexecutive office rhode island

- Hospital visit report form first united methodist church

- Center for music therapy intake form

Find out other How To Get A Tax Exempt Certificate Florida Form

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online