Tax Alaska Form

What is the Tax Alaska

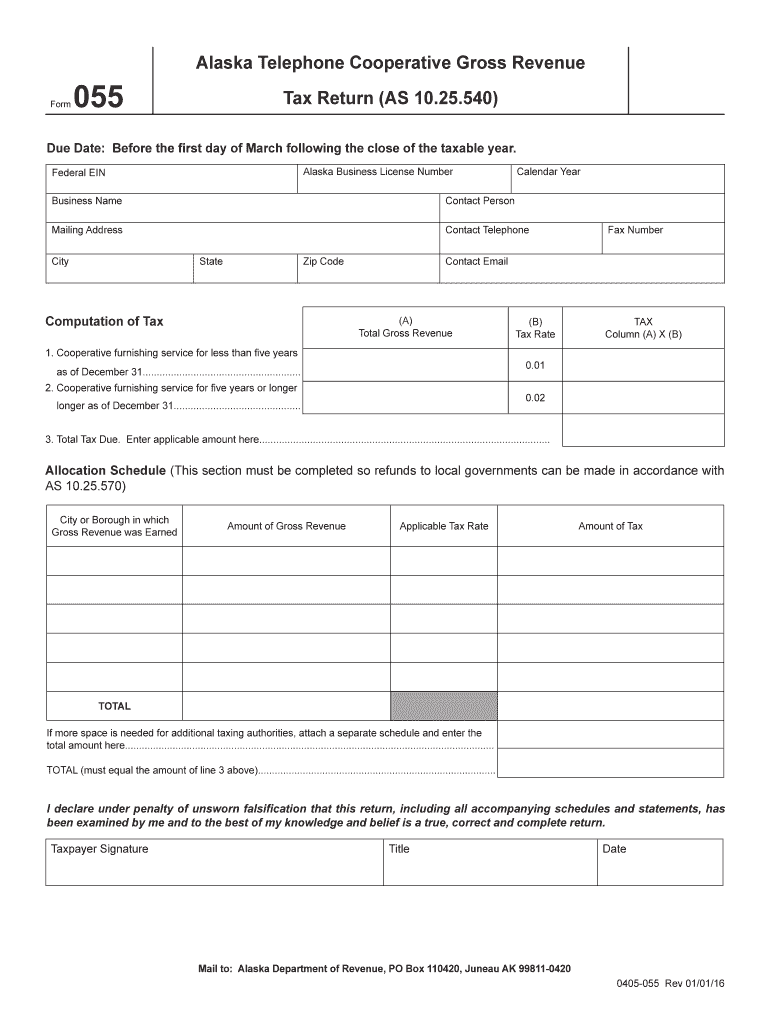

The Tax Alaska form is a specific document used for various tax-related purposes within the state of Alaska. It serves as a means for residents and businesses to report income, claim deductions, and fulfill their tax obligations. Understanding the purpose of this form is essential for ensuring compliance with state tax laws and regulations.

Steps to complete the Tax Alaska

Completing the Tax Alaska form involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with accurate information, ensuring that all sections are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form according to the specified submission methods, which may include online, by mail, or in person.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws. To be considered valid, the form must be filled out accurately and submitted within the designated filing deadlines. Additionally, the form must be signed, and electronic signatures are accepted if they comply with the relevant eSignature regulations. Ensuring that the form is used legally helps avoid penalties and ensures that tax obligations are met.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are crucial for taxpayers to meet. Typically, the deadline aligns with the federal tax filing date, which is usually April 15. However, specific dates may vary based on individual circumstances or extensions. It is important to stay informed about any changes in deadlines to avoid late filing penalties.

Required Documents

To complete the Tax Alaska form, several documents are required. These typically include proof of income, such as W-2s or 1099 forms, documentation of any deductions or credits being claimed, and identification information. Having these documents ready can streamline the process and help ensure that the form is filled out accurately.

Form Submission Methods (Online / Mail / In-Person)

The Tax Alaska form can be submitted through various methods, providing flexibility for taxpayers. Options typically include online submission through the state’s tax website, mailing the completed form to the appropriate tax office, or submitting it in person at designated locations. Each method has its own guidelines, so it is important to follow the instructions carefully to ensure timely processing.

IRS Guidelines

While the Tax Alaska form is specific to state tax obligations, it is important to consider IRS guidelines as they may influence state tax filings. Taxpayers should be aware of how federal tax laws interact with state regulations, particularly regarding deductions, credits, and overall tax liability. Staying informed about IRS guidelines can help ensure compliance and optimize tax outcomes.

Quick guide on how to complete tax alaska 6967244

Complete Tax Alaska effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the features needed to create, modify, and eSign your documents swiftly without delays. Manage Tax Alaska on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The simplest way to modify and eSign Tax Alaska without hassle

- Obtain Tax Alaska and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight essential sections of the documents or black out sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Alaska and ensure outstanding communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967244

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is airSlate SignNow's pricing for businesses needing to manage Tax Alaska documents?

airSlate SignNow offers flexible pricing plans tailored for businesses handling Tax Alaska-related documents. You can choose from various tiers based on your team's size and the features you require. This cost-effective solution ensures you have the tools needed for efficient eSigning and document management at an affordable rate.

-

How can airSlate SignNow help with eSigning Tax Alaska forms?

With airSlate SignNow, you can easily eSign Tax Alaska forms online, streamlining the filing and submission process. The platform allows users to upload documents, add signatures, and send them securely. This ensures compliance with Alaska's tax regulations while saving time and reducing paperwork.

-

What features does airSlate SignNow offer for Tax Alaska document management?

airSlate SignNow provides various features for managing Tax Alaska documents, including customizable templates, automated workflows, and real-time document tracking. These features enhance collaboration and ensure that everyone involved in the tax process can stay informed and organized. The platform is designed to make your tax documentation process seamless.

-

Are there integrations available to connect airSlate SignNow with Tax Alaska software?

Yes, airSlate SignNow has integrations with popular accounting and tax software that can assist with Tax Alaska filings. These integrations enable automatic data transfer and help maintain consistency across platforms, minimizing the risk of errors. You can easily connect your existing tools for a more efficient workflow.

-

Is airSlate SignNow secure for handling Tax Alaska sensitive information?

Absolutely! airSlate SignNow prioritizes security when it comes to handling Tax Alaska sensitive information. The platform uses advanced encryption methods and compliance protocols to protect your data, ensuring that documents remain confidential and secure throughout the signing process.

-

Can small businesses use airSlate SignNow for Tax Alaska forms?

Yes, airSlate SignNow is an excellent choice for small businesses dealing with Tax Alaska forms. The user-friendly interface and cost-effective pricing make it accessible for organizations of all sizes. Small businesses can benefit from this solution without extensive investment in document management systems.

-

What are the benefits of using airSlate SignNow for Tax Alaska submissions?

Using airSlate SignNow for Tax Alaska submissions offers numerous benefits, including increased speed, reduced paperwork, and enhanced accuracy. The platform ensures that you can submit your tax documents electronically, making the process more efficient and less prone to errors. Additionally, with document tracking, you can easily verify submission statuses.

Get more for Tax Alaska

Find out other Tax Alaska

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors