Ad Valorem Tax Exemption Application Form

What is the ad valorem tax exemption application?

The ad valorem tax exemption application is a formal request submitted by property owners to seek exemption from property taxes based on the assessed value of their property. This application is crucial for individuals and businesses who qualify for specific exemptions, such as those related to homestead, agricultural use, or nonprofit status. By completing this application, property owners can potentially reduce their tax burden, ensuring that they are only taxed on the fair value of their property as determined by local tax authorities.

Steps to complete the ad valorem tax exemption application

Completing the ad valorem tax exemption application involves several key steps:

- Gather necessary documentation, including proof of ownership, income statements, and any relevant identification.

- Obtain the correct application form from your local tax authority or their website.

- Fill out the application form accurately, ensuring all required fields are completed.

- Attach any supporting documents that demonstrate your eligibility for the exemption.

- Review the application for accuracy before submission.

- Submit the application by the specified deadline, either online, by mail, or in person, depending on local regulations.

Eligibility criteria for the ad valorem tax exemption application

To qualify for an ad valorem tax exemption, applicants must meet specific eligibility criteria, which can vary by state and local jurisdiction. Common criteria include:

- Ownership of the property for which the exemption is being sought.

- Residency requirements, particularly for homestead exemptions.

- Income limitations that may apply to certain exemptions.

- Compliance with local zoning and land use regulations.

It is essential for applicants to review their local tax authority's guidelines to understand the specific requirements applicable to their situation.

Required documents for the ad valorem tax exemption application

When applying for an ad valorem tax exemption, several documents may be required to support your application. These documents typically include:

- Proof of property ownership, such as a deed or title.

- Identification documents, including a driver's license or state ID.

- Income verification documents, such as tax returns or pay stubs, if applicable.

- Any additional forms or affidavits required by the local tax authority.

Ensuring that all necessary documentation is provided can expedite the review process and improve the chances of approval.

Form submission methods for the ad valorem tax exemption application

Submitting the ad valorem tax exemption application can typically be done through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax authority's website, where available.

- Mailing the completed application and supporting documents to the designated address.

- In-person submission at the local tax office, allowing for immediate confirmation of receipt.

It is advisable to check with the local tax authority for the preferred submission method and any specific requirements associated with each option.

Key elements of the ad valorem tax exemption application

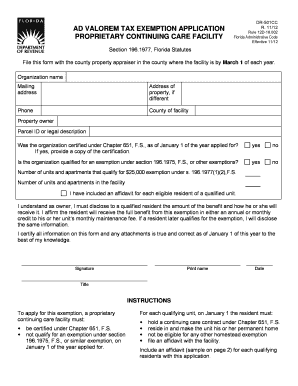

The ad valorem tax exemption application typically includes several key elements that applicants must complete. These elements often consist of:

- Property details, including the address and parcel number.

- Owner information, including names and contact details.

- Type of exemption being requested, such as homestead or agricultural.

- Signature and date to certify the accuracy of the information provided.

Completing these elements accurately is crucial for ensuring that the application is processed without delays.

Quick guide on how to complete ad valorem tax exemption application

Effortlessly Prepare Ad Valorem Tax Exemption Application on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can obtain the correct form and securely store it on the internet. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Ad Valorem Tax Exemption Application on any device using airSlate SignNow's Android or iOS applications to enhance any document-related process today.

The Easiest Way to Modify and eSign Ad Valorem Tax Exemption Application Seamlessly

- Find Ad Valorem Tax Exemption Application and click on Get Form to begin.

- Utilize the tools we provide to submit your form.

- Emphasize relevant sections of the documents or conceal sensitive data using the features that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced paperwork, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Ad Valorem Tax Exemption Application, ensuring effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ad valorem tax exemption application

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is ad valorem and how does it relate to airSlate SignNow?

Ad valorem is a Latin term meaning 'according to value,' often used in the context of taxation and pricing. In relation to airSlate SignNow, it means that our pricing model is based on the value and features you require for eSigning and document management. This ensures you only pay for what you need while benefiting from our comprehensive solutions.

-

How does airSlate SignNow handle ad valorem taxation in documents?

AirSlate SignNow allows you to include ad valorem tax calculations within your documents easily. By utilizing our customizable templates, you can integrate accurate tax information automatically, ensuring compliance and clarity in financial documents. This feature saves time and reduces errors in tax reporting.

-

What are the key features of airSlate SignNow for managing ad valorem documents?

Key features of airSlate SignNow include advanced eSigning capabilities, reusable templates, and the ability to add custom fields for ad valorem tax calculations. Our platform streamlines document workflows and enhances collaboration, enabling businesses to manage ad valorem-related documents efficiently and securely.

-

Does airSlate SignNow offer any integrations for managing ad valorem processes?

Yes, airSlate SignNow integrates seamlessly with various applications like CRM systems, accounting software, and cloud storage solutions to manage ad valorem processes. These integrations ensure that your document workflow remains efficient while keeping all relevant data synchronized across platforms.

-

Is airSlate SignNow a cost-effective solution for businesses dealing with ad valorem documents?

Absolutely! AirSlate SignNow provides a cost-effective solution for businesses managing ad valorem documents by offering competitive pricing plans that suit different needs. With our subscription options, you can take advantage of our robust features without breaking your budget, ultimately saving your business both time and money.

-

Can I customize templates in airSlate SignNow for ad valorem-related documents?

Yes, airSlate SignNow allows users to fully customize templates for ad valorem-related documents. You can tailor each template to meet your specific business needs, including inserting fields for tax calculations and adding pertinent clauses. This flexibility ensures that your documents remain relevant and compliant with industry standards.

-

What benefits does airSlate SignNow provide for businesses dealing with ad valorem-related transactions?

AirSlate SignNow offers numerous benefits for businesses handling ad valorem transactions, such as improved accuracy in tax documentation, expedited signing processes, and enhanced security features. Our platform automates workflows, allowing users to focus on more critical tasks while ensuring all ad valorem documents are processed swiftly and securely.

Get more for Ad Valorem Tax Exemption Application

Find out other Ad Valorem Tax Exemption Application

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe