Form Wh 1 2015-2026

What is the Form WH-1?

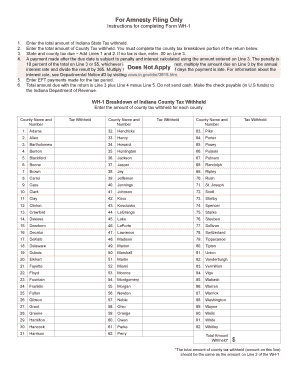

The WH-1 form, also known as the Indiana withholding exemption certificate, is a critical document used by employers in Indiana. This form enables employees to claim exemptions from state income tax withholding. By completing the WH-1 form, employees can inform their employers of their eligibility for exemption, which can lead to higher take-home pay. It is essential for both employers and employees to understand the implications of this form to ensure accurate tax withholding.

How to Use the Form WH-1

Using the WH-1 form involves several straightforward steps. First, employees must fill out their personal information, including their name, address, and Social Security number. Next, they need to indicate the number of exemptions they are claiming. This information helps employers determine the correct amount of state income tax to withhold from their paychecks. Once completed, the form should be submitted to the employer, who will then use it to adjust the withholding accordingly.

Steps to Complete the Form WH-1

Completing the WH-1 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary personal information, including your Social Security number.

- Indicate your filing status and the number of exemptions you wish to claim.

- Review the form for accuracy to avoid any errors that could affect your tax withholding.

- Submit the completed form to your employer's payroll department.

It's advisable to keep a copy of the submitted form for your records.

Legal Use of the Form WH-1

The WH-1 form is legally recognized as a valid method for employees to claim exemptions from state income tax withholding in Indiana. To ensure compliance with state tax laws, it is crucial that the form is filled out accurately and submitted on time. Employers are responsible for maintaining records of the WH-1 forms they receive, as these documents may be subject to review by state tax authorities.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the WH-1 form. Employees should submit the form to their employer as soon as they begin employment or when their tax situation changes. Additionally, if an employee wishes to change their withholding status, they should submit a new WH-1 form promptly. Employers are required to process these forms in a timely manner to ensure correct tax withholding throughout the year.

Who Issues the Form WH-1

The WH-1 form is issued by the Indiana Department of Revenue. This state agency is responsible for providing the necessary forms and guidelines for tax withholding and other tax-related matters. Employees can typically obtain the WH-1 form from their employer or directly from the Indiana Department of Revenue's website.

Quick guide on how to complete form wh 1

Prepare Form Wh 1 effortlessly on any device

Digital document management has become increasingly popular with organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Handle Form Wh 1 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and eSign Form Wh 1 without hassle

- Locate Form Wh 1 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Wh 1 and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form wh 1

Create this form in 5 minutes!

How to create an eSignature for the form wh 1

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the Indiana WH 1 form?

The Indiana WH 1 form is used by employers to report withholding tax for employees in the state of Indiana. This form helps ensure compliance with state tax laws. Understanding this form is crucial for any business operating in Indiana.

-

How can airSlate SignNow simplify the completion of the Indiana WH 1?

airSlate SignNow offers a streamlined approach to complete the Indiana WH 1 form digitally. By using our eSigning solution, businesses can fill out, sign, and send the form without paper clutter, making the process efficient and error-free.

-

What features does airSlate SignNow provide for the Indiana WH 1?

One of the standout features of airSlate SignNow is its ability to create templates for the Indiana WH 1 form. This allows users to easily access and reuse the form as needed, ensuring that all necessary information is collected consistently.

-

Is there a cost associated with using airSlate SignNow for the Indiana WH 1 form?

Yes, airSlate SignNow offers different pricing plans suitable for various business needs, including options for those specifically needing to manage the Indiana WH 1 form. With competitive pricing and features tailored for compliance, it's a cost-effective solution.

-

Can airSlate SignNow integrate with my existing systems for the Indiana WH 1?

Absolutely! airSlate SignNow supports a wide variety of integrations that can help streamline your workflow for the Indiana WH 1. Whether you use CRM, HR software, or accounting systems, our platform is designed to fit seamlessly with your existing tools.

-

What are the benefits of using airSlate SignNow for Indiana WH 1 submissions?

Using airSlate SignNow for Indiana WH 1 submissions increases efficiency and accuracy, reducing the time spent on compliance tasks. The electronic signature feature ensures that all documents are legally binding and securely stored.

-

How secure is airSlate SignNow for processing the Indiana WH 1 form?

airSlate SignNow prioritizes the security of your documents. Our platform uses advanced encryption and security measures to protect your data while handling forms like the Indiana WH 1, ensuring compliance with privacy regulations.

Get more for Form Wh 1

Find out other Form Wh 1

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT