State Form 49176 R27 05

What is the State Form 49176 R27 05

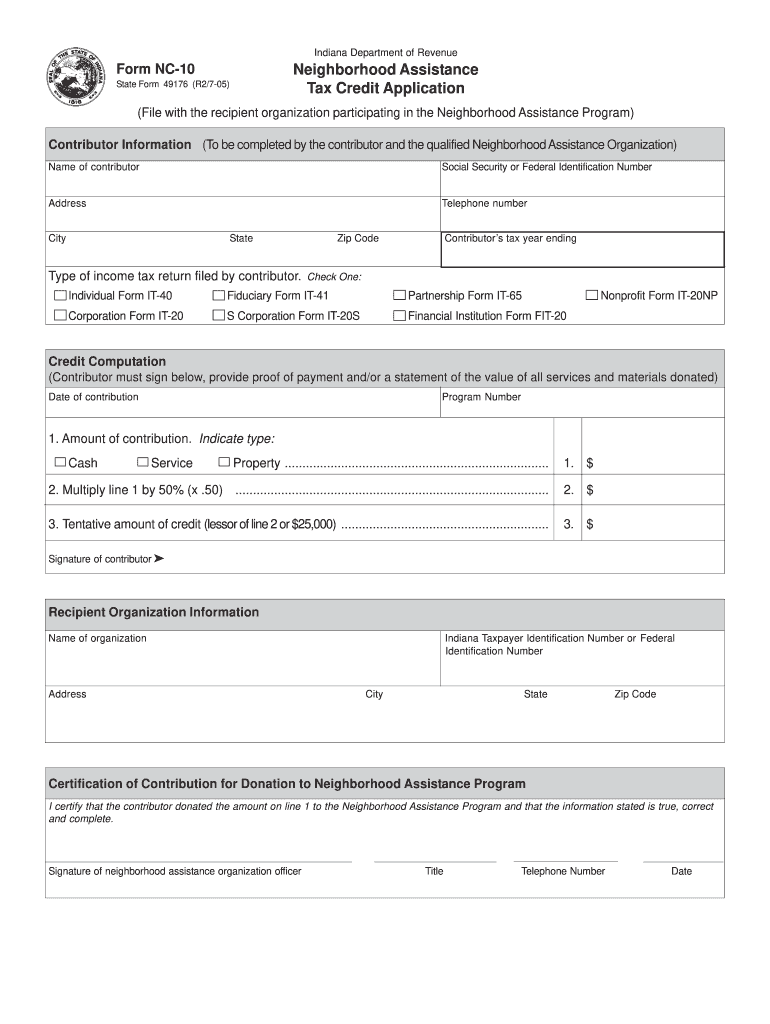

The State Form 49176 R27 05, also known as the Indiana Neighborhood Assistance Tax Credit application, is a document used by residents of Indiana to apply for tax credits associated with contributions made to eligible neighborhood assistance programs. This form is crucial for individuals and businesses seeking to benefit from tax incentives while supporting community-focused initiatives. By filling out this form, applicants can potentially reduce their tax liability based on their contributions to qualified organizations.

How to obtain the State Form 49176 R27 05

The Indiana 49176 form can be easily obtained through various channels. Individuals can download the form directly from the Indiana Department of Revenue's official website. Additionally, physical copies may be available at local tax offices or community organizations that participate in the neighborhood assistance programs. It is important to ensure that you are using the most current version of the form to avoid any issues during the application process.

Steps to complete the State Form 49176 R27 05

Completing the Indiana 49176 form involves several key steps:

- Gather necessary information, including personal identification details and information about the contributions made.

- Carefully fill out each section of the form, ensuring accuracy in reporting the amounts contributed.

- Attach any required documentation that supports your application, such as receipts or letters from the organizations you contributed to.

- Review the completed form for any errors or omissions before submission.

- Submit the form according to the instructions provided, either online or via mail.

Legal use of the State Form 49176 R27 05

The Indiana 49176 form is legally binding when completed and submitted according to the guidelines set forth by the Indiana Department of Revenue. To ensure that the form is recognized legally, it must be filled out accurately and submitted within the designated time frame. Additionally, all claims for tax credits must be substantiated with appropriate documentation, as failure to comply with legal requirements could result in penalties or disqualification from receiving the credits.

Key elements of the State Form 49176 R27 05

Several key elements are essential for the completion of the Indiana 49176 form:

- Applicant Information: This section requires personal details such as name, address, and Social Security number.

- Contribution Details: Applicants must provide information about the organizations supported and the amounts contributed.

- Certification: A declaration confirming the accuracy of the information provided must be signed by the applicant.

- Attachments: Any necessary supporting documents must be included to validate the contributions claimed.

Form Submission Methods

The Indiana 49176 form can be submitted through multiple methods, providing flexibility for applicants. The form can be completed and submitted online via the Indiana Department of Revenue's e-filing system, which offers a convenient option for those who prefer digital submissions. Alternatively, applicants may choose to print the completed form and mail it to the appropriate tax office. In-person submissions may also be accepted at designated locations, ensuring that all applicants can find a method that suits their needs.

Quick guide on how to complete state form 49176 r27 05

Effortlessly Prepare State Form 49176 R27 05 on Any Device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, alter, and eSign your documents quickly and without interruptions. Manage State Form 49176 R27 05 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related processes today.

The Simplest Way to Edit and eSign State Form 49176 R27 05 with Ease

- Locate State Form 49176 R27 05 and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and the need to print new copies due to errors. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign State Form 49176 R27 05 to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state form 49176 r27 05

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the relevance of indiana 49176 tax for businesses?

The indiana 49176 tax is signNow as it shapes the fiscal responsibilities of businesses operating in this region. Understanding this tax can help businesses effectively manage their finances and compliance. airSlate SignNow offers templates that can assist in preparing tax documents in alignment with these regulations.

-

How can airSlate SignNow help with preparing documents related to indiana 49176 tax?

airSlate SignNow simplifies the process of preparing documents needed for indiana 49176 tax compliance. Users can create, edit, and eSign essential documents efficiently, ensuring all necessary paperwork is accurate and submitted on time. This saves businesses valuable time and reduces errors in tax submissions.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing tiers to suit different business needs, starting from a cost-effective basic plan. This flexibility allows businesses focusing on indiana 49176 tax compliance to choose a plan that fits their budget while still gaining access to powerful document management tools. Comprehensive features are available even at entry-level pricing.

-

What features does airSlate SignNow provide for indiana 49176 tax management?

airSlate SignNow provides robust features including customizable templates, automated workflows, and secure eSigning, all of which can streamline the management of indiana 49176 tax documents. Users can track document progress and ensure all necessary signatures are collected efficiently. This enhances productivity and compliance.

-

Are there integrations available with airSlate SignNow for tax software?

Yes, airSlate SignNow seamlessly integrates with various tax software, allowing users to manage their indiana 49176 tax needs from a centralized platform. These integrations facilitate easy import and export of data, making tax preparation more streamlined. This connectivity enhances user experience while managing tax documentation.

-

What are the benefits of using airSlate SignNow for indiana 49176 tax filing?

Using airSlate SignNow for indiana 49176 tax filing signNowly enhances the ease and accuracy of document preparation. The platform's automation tools help ensure that all forms are completed correctly and submitted on time. Additionally, the secure eSigning feature ensures that all documents are legally binding, giving businesses peace of mind.

-

Can airSlate SignNow assist in tracking tax deadlines related to indiana 49176 tax?

Absolutely, airSlate SignNow helps users set reminders and track important deadlines related to indiana 49176 tax. By utilizing automated alerts, users can stay informed about pending filings and ensure timely submissions. This proactive approach helps businesses avoid penalties and maintain compliance.

Get more for State Form 49176 R27 05

- Ttd nadaneerajanam form

- Test your english vocabulary in use elementary with answers second edition pdf form

- Santander direct debit mandate form

- Writing decimals in words worksheet pdf form

- Cayman national bank application form

- Big air waiver form

- Piedmont doctors note form

- Fillable online michigan fis 2053 515 department of form

Find out other State Form 49176 R27 05

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document