Nevada Ifta Form 2012-2026

What is the Nevada IFTA Form

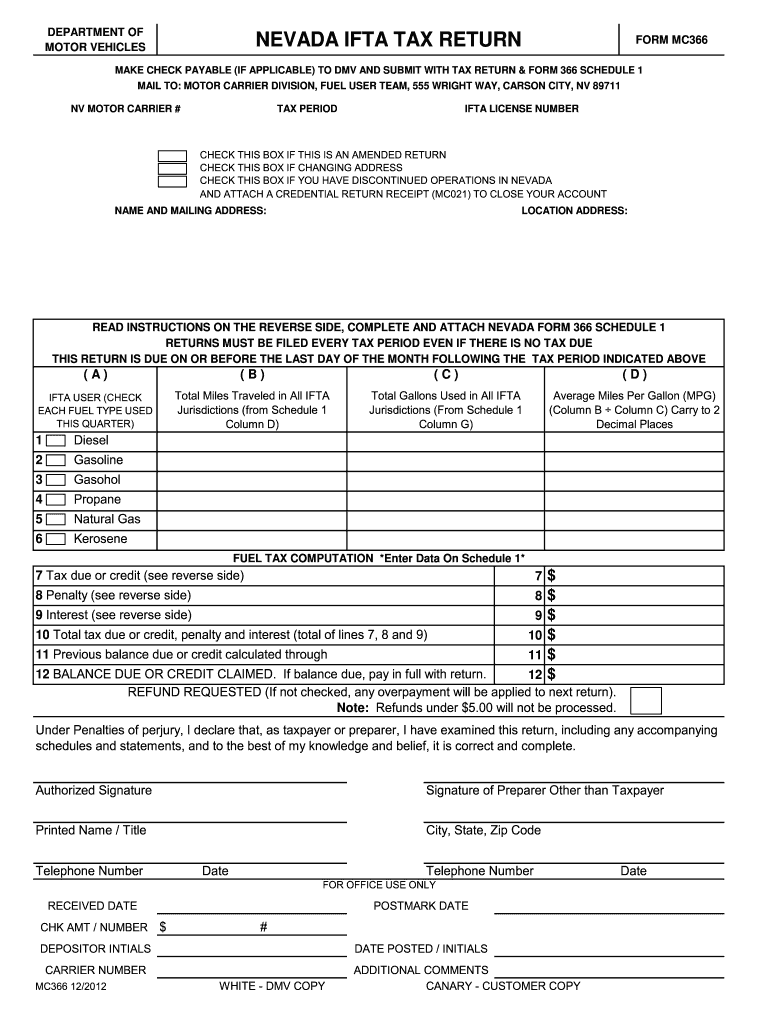

The Nevada IFTA form is a crucial document used for reporting fuel tax information for motor carriers operating in multiple jurisdictions. IFTA stands for the International Fuel Tax Agreement, which simplifies the reporting of fuel use taxes for interstate commercial vehicles. This form is essential for ensuring compliance with state and federal regulations regarding fuel taxes, making it a necessary component for businesses operating in the transportation sector.

How to use the Nevada IFTA Form

Using the Nevada IFTA form involves several steps to ensure accurate reporting of fuel consumption and taxes owed. First, gather all relevant information, including miles traveled in each state and the gallons of fuel purchased. Next, complete the form by entering the required data in the designated fields. It is important to double-check the entries for accuracy before submission. Finally, submit the completed form to the appropriate Nevada tax authority, ensuring that all deadlines are met to avoid penalties.

Steps to complete the Nevada IFTA Form

Completing the Nevada IFTA form requires careful attention to detail. Follow these steps for successful completion:

- Collect all necessary data, including mileage and fuel purchase records.

- Fill in the vehicle identification details, including the license plate number and vehicle type.

- Report the total miles traveled in each jurisdiction and the total gallons of fuel purchased.

- Calculate the fuel tax owed based on the rates applicable to each state.

- Review the form for any errors and ensure all required signatures are included.

Legal use of the Nevada IFTA Form

The legal use of the Nevada IFTA form hinges on compliance with state and federal regulations governing fuel taxes. To be considered valid, the form must be filled out accurately and submitted within the designated time frames. Additionally, eSignatures on the form are legally binding, provided they meet the requirements set forth by the ESIGN Act and UETA. Utilizing a reliable eSignature platform can enhance the legal standing of the document.

Filing Deadlines / Important Dates

Filing deadlines for the Nevada IFTA form are critical to avoid penalties. Typically, the form must be filed quarterly, with specific due dates for each quarter. For example, the first quarter's filing is due by April 30, the second quarter by July 31, the third quarter by October 31, and the fourth quarter by January 31 of the following year. Staying informed about these deadlines helps ensure compliance and avoids unnecessary fines.

Penalties for Non-Compliance

Failing to comply with the requirements of the Nevada IFTA form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by tax authorities. Additionally, repeated non-compliance can lead to more severe consequences, including the suspension of operating privileges. It is essential for businesses to adhere to filing deadlines and accurately report all necessary information to avoid these repercussions.

Quick guide on how to complete nevada ifta form

Complete Nevada Ifta Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly and efficiently. Handle Nevada Ifta Form on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Nevada Ifta Form easily

- Find Nevada Ifta Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or obscure sensitive data with tools specifically developed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form navigation, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Nevada Ifta Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nevada ifta form

Create this form in 5 minutes!

How to create an eSignature for the nevada ifta form

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is IFTA Nevada and how does it work?

IFTA Nevada, or the International Fuel Tax Agreement in Nevada, is designed to simplify the tax reporting process for fuel used by commercial vehicles operating across state lines. It allows businesses to report and pay fuel taxes for multiple jurisdictions with a single quarterly report. Understanding IFTA Nevada is essential for trucking companies to remain compliant and avoid penalties.

-

How can airSlate SignNow help with IFTA Nevada documentation?

airSlate SignNow offers a streamlined solution for signing and managing documents related to IFTA Nevada. Our platform allows businesses to securely send and eSign necessary paperwork, which can simplify the compliance process. This efficient handling of documents can save time and reduce errors in your IFTA reporting.

-

What are the costs associated with IFTA Nevada?

The costs for IFTA Nevada usually involve fuel tax rates that vary by state, as well as potential fees for filing late or incorrectly. Moreover, using electronic solutions like airSlate SignNow can provide a cost-effective option for managing your IFTA Nevada paperwork, ensuring compliance without incurring excessive costs. Consider the savings on time and resources as well.

-

What features does airSlate SignNow offer for managing IFTA Nevada?

airSlate SignNow includes features such as customizable templates, real-time tracking, and seamless integration with existing systems, catering specifically to the needs of those managing IFTA Nevada. Additionally, our platform ensures your documents are secure and easily accessible, making compliance hassle-free. These features are aimed at enhancing your operational efficiency.

-

Can I integrate airSlate SignNow with my existing accounting software for IFTA Nevada?

Yes, airSlate SignNow can be integrated with a variety of accounting and business management software to streamline your IFTA Nevada reporting. This integration allows for effortless updates and management of your documents, reducing manual entries. By integrating your tools, you can ensure smoother operations and maintain accurate records.

-

What are the benefits of using airSlate SignNow for IFTA Nevada compliance?

The benefits of using airSlate SignNow for IFTA Nevada compliance include reducing paperwork, minimizing errors in document submissions, and enhancing overall efficiency in tax reporting. Our platform also provides a user-friendly interface that simplifies the eSigning process, helping you stay organized. Businesses can also leverage tracking features to monitor document progress.

-

Is airSlate SignNow compliant with IFTA Nevada regulations?

Absolutely, airSlate SignNow ensures that all document management processes adhere to IFTA Nevada regulations. Our commitment to compliance means that users can confidently use our platform for managing essential tax documentation. This assurance protects your business from potential legal issues related to document management in IFTA Nevada.

Get more for Nevada Ifta Form

- Webmethods trading networks pdf form

- Brookstreetonline form

- Letter of explanation for u s mailing address form

- Backward area form h p pdf

- Mv4st form

- Health risk assessment questionnaire template form

- Author declaration form university of otago otago ac

- Operating circular no 10 frbservices org frbservices form

Find out other Nevada Ifta Form

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document