Vehicle Rental Tax Annual Reconciliation DAS 28R Vehicle Rental Tax Annual Reconciliation DAS 28R Form

Understanding the Vehicle Rental Tax Annual Reconciliation DAS 28R

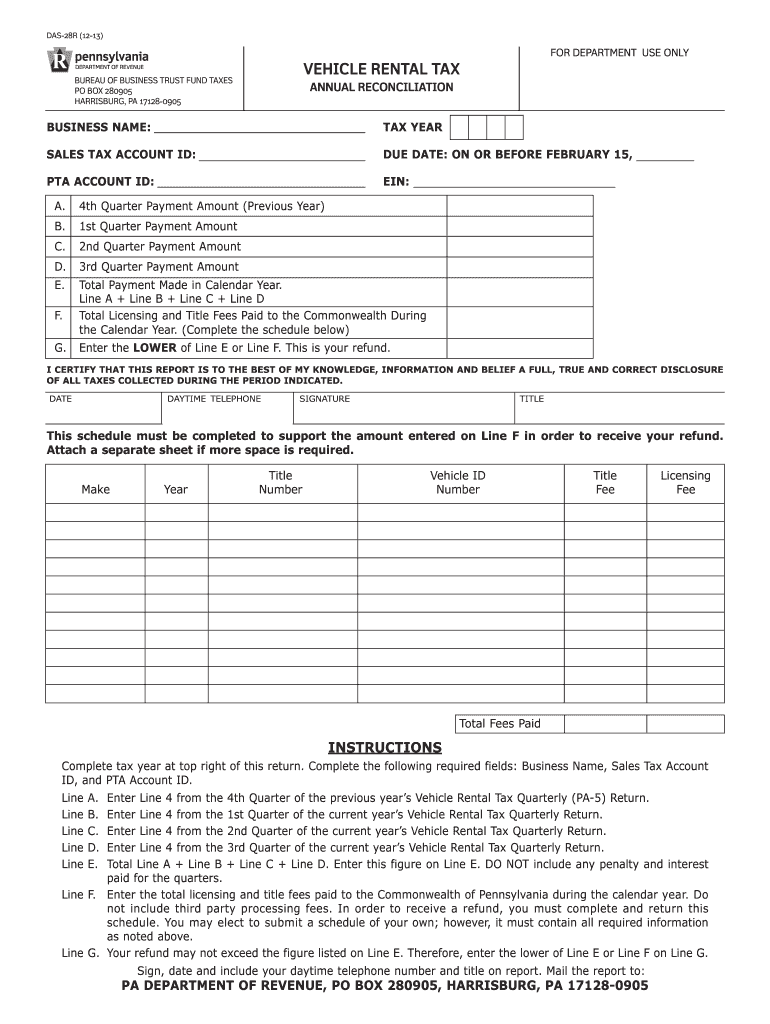

The Vehicle Rental Tax Annual Reconciliation DAS 28R is a crucial document for businesses involved in vehicle rentals in the United States. This form is used to reconcile the vehicle rental tax collected throughout the year with the actual tax liability. It ensures that businesses accurately report their earnings and comply with state tax regulations. The DAS 28R serves as a summary of the vehicle rental tax collected, allowing for adjustments and corrections as necessary. Understanding its purpose is essential for maintaining compliance and avoiding penalties.

Steps to Complete the Vehicle Rental Tax Annual Reconciliation DAS 28R

Completing the Vehicle Rental Tax Annual Reconciliation DAS 28R involves several important steps:

- Gather necessary documentation: Collect all records of vehicle rental transactions, including invoices and receipts.

- Calculate total rental income: Sum up all rental income received during the year.

- Determine tax collected: Calculate the total vehicle rental tax collected based on the rental income.

- Fill out the DAS 28R form: Input the calculated figures into the appropriate sections of the form.

- Review for accuracy: Double-check all entries to ensure they are correct and complete.

- Submit the form: File the completed DAS 28R with the appropriate state tax authority by the deadline.

Legal Use of the Vehicle Rental Tax Annual Reconciliation DAS 28R

The legal use of the Vehicle Rental Tax Annual Reconciliation DAS 28R is essential for businesses to demonstrate compliance with state tax laws. This form is recognized as a legal document that outlines the tax obligations of vehicle rental companies. Proper completion and submission of the DAS 28R can protect businesses from audits and penalties. It is important to retain copies of the submitted forms and related documentation for future reference and potential audits.

Filing Deadlines for the Vehicle Rental Tax Annual Reconciliation DAS 28R

Filing deadlines for the Vehicle Rental Tax Annual Reconciliation DAS 28R can vary by state. Generally, businesses are required to submit the form by a specific date following the end of the tax year. It is crucial to check with the local tax authority for exact deadlines to avoid late fees and penalties. Staying informed about these deadlines ensures timely compliance and helps maintain good standing with tax regulations.

Required Documents for the Vehicle Rental Tax Annual Reconciliation DAS 28R

To complete the Vehicle Rental Tax Annual Reconciliation DAS 28R, several documents are typically required:

- Records of all vehicle rental transactions

- Invoices and receipts related to rental income

- Previous tax returns, if applicable

- Any correspondence with state tax authorities

Having these documents organized and accessible will facilitate a smoother reconciliation process and ensure accurate reporting.

Penalties for Non-Compliance with the Vehicle Rental Tax Annual Reconciliation DAS 28R

Failure to comply with the requirements of the Vehicle Rental Tax Annual Reconciliation DAS 28R can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from tax authorities. Additionally, non-compliance can lead to increased scrutiny during audits, which may further complicate a business's tax situation. It is vital for vehicle rental companies to prioritize timely and accurate completion of this form to avoid such consequences.

Quick guide on how to complete vehicle rental tax annual reconciliation das 28r vehicle rental tax annual reconciliation das 28r

Complete Vehicle Rental Tax Annual Reconciliation DAS 28R Vehicle Rental Tax Annual Reconciliation DAS 28R effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can find the right form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle Vehicle Rental Tax Annual Reconciliation DAS 28R Vehicle Rental Tax Annual Reconciliation DAS 28R on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

The easiest method to alter and eSign Vehicle Rental Tax Annual Reconciliation DAS 28R Vehicle Rental Tax Annual Reconciliation DAS 28R with ease

- Find Vehicle Rental Tax Annual Reconciliation DAS 28R Vehicle Rental Tax Annual Reconciliation DAS 28R and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of the documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, either by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from a device of your choice. Modify and eSign Vehicle Rental Tax Annual Reconciliation DAS 28R Vehicle Rental Tax Annual Reconciliation DAS 28R and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vehicle rental tax annual reconciliation das 28r vehicle rental tax annual reconciliation das 28r

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is Pennsylvania Form 28R?

Pennsylvania Form 28R is a document required for certain legal and administrative purposes in Pennsylvania. It is essential for businesses and individuals to ensure compliance when submitting this form. Understanding its requirements can streamline your workflow.

-

How can airSlate SignNow help with Pennsylvania Form 28R?

AirSlate SignNow simplifies the process of sending and eSigning Pennsylvania Form 28R. Our platform allows you to prepare and manage the form digitally, reducing errors and saving time. With a user-friendly interface, you can complete your documentation efficiently.

-

What are the pricing plans for using airSlate SignNow?

AirSlate SignNow offers several pricing plans that accommodate various needs and budgets. You can choose a plan that provides the features necessary for managing Pennsylvania Form 28R and other documents. All plans include secure eSigning and document management tools.

-

Are there any additional features for Pennsylvania Form 28R users?

Yes, airSlate SignNow provides additional features for users handling Pennsylvania Form 28R, such as customizable templates and detailed audit trails. These features enhance the document management process and ensure compliance with state requirements. Signing and tracking are seamless and efficient.

-

What are the benefits of using airSlate SignNow for Pennsylvania Form 28R?

Using airSlate SignNow for Pennsylvania Form 28R offers numerous benefits, including time savings and enhanced accuracy. The platform eliminates the need for paper forms and manual signatures, minimizing the chances of errors. You also gain access to a secure storage system for your documents.

-

Can I integrate airSlate SignNow with other software for Pennsylvania Form 28R?

Absolutely! AirSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage Pennsylvania Form 28R. Whether you use CRM systems or project management tools, our integrations improve workflow and boost overall productivity.

-

Is airSlate SignNow secure for handling sensitive documents like Pennsylvania Form 28R?

Yes, airSlate SignNow is built with security in mind. We use industry-leading security measures, including encryption and GDPR compliance, to protect sensitive documents like Pennsylvania Form 28R. Your data is safe with us, ensuring peace of mind during the signing process.

Get more for Vehicle Rental Tax Annual Reconciliation DAS 28R Vehicle Rental Tax Annual Reconciliation DAS 28R

- Trigonometric ratios questions and answers pdf form

- Pr contract template form

- Participant guide template form

- L2 form california medical board

- Calgary cambridge model pdf form

- Dc 224 3 19 driversubjects name power of attorney granted to form

- Shelley coston record bell county texas form

- Mecostaosceola county standard parenting time schedule form

Find out other Vehicle Rental Tax Annual Reconciliation DAS 28R Vehicle Rental Tax Annual Reconciliation DAS 28R

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement