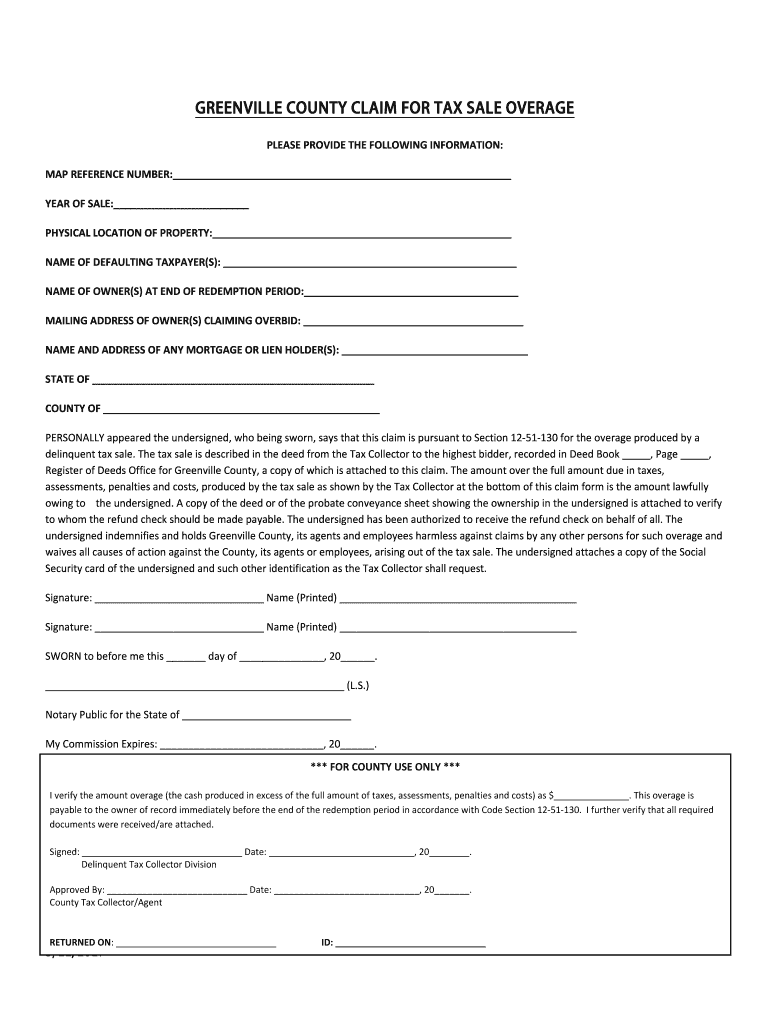

South Carolina Tax Overage Form

What is the South Carolina Tax Overage

The South Carolina tax overage refers to funds that remain after a property is sold at a tax sale, exceeding the amount owed in taxes. When a property is auctioned due to unpaid taxes, the winning bid may surpass the tax debt, resulting in an overage. This surplus is typically held by the county and can be claimed by the former property owner or other entitled parties. Understanding this concept is crucial for individuals involved in property ownership or tax sales in South Carolina.

How to obtain the South Carolina Tax Overage

To obtain the South Carolina tax overage, individuals must follow a structured process. First, they should confirm their eligibility by reviewing the county records where the tax sale occurred. Next, they need to gather necessary documentation, such as proof of ownership and identification. After compiling these documents, they can submit a claim to the appropriate county office, detailing the amount owed and providing evidence of their entitlement. It is essential to adhere to any specific guidelines set forth by the county to ensure a successful claim.

Steps to complete the South Carolina Tax Overage

Completing the South Carolina tax overage process involves several key steps:

- Verify the existence of an overage by checking county tax sale records.

- Gather required documents, including identification and proof of property ownership.

- Prepare a formal claim that outlines the overage amount and supporting evidence.

- Submit the claim to the designated county office, ensuring compliance with local regulations.

- Follow up with the county to check the status of the claim and address any additional requirements.

Legal use of the South Carolina Tax Overage

The legal use of the South Carolina tax overage is governed by state laws and regulations. Claimants must ensure they have the rightful claim to the funds, which typically means being the former owner or an heir. It is important to understand the legal framework surrounding tax overages, as improper claims can lead to legal disputes or denial of funds. Consulting with a legal professional experienced in property law may be beneficial for navigating this process.

State-specific rules for the South Carolina Tax Overage

South Carolina has specific rules governing tax overages that claimants must follow. These rules include time limits for filing claims, required documentation, and procedures for contesting denials. Each county may have its own variations, so it is crucial for individuals to familiarize themselves with local regulations. Understanding these state-specific rules can significantly impact the success of a claim for tax overages.

Required Documents

When filing a claim for the South Carolina tax overage, several documents are typically required to support the claim:

- Proof of identity, such as a government-issued ID.

- Documentation proving ownership of the property, such as a deed.

- Any correspondence related to the tax sale.

- Completed claim forms as specified by the county.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding South Carolina tax overages can result in various penalties. Claimants may face denial of their claims, loss of eligibility for future claims, or even legal action if fraudulent information is provided. It is essential to adhere strictly to the guidelines and ensure that all submitted information is accurate and truthful to avoid these consequences.

Quick guide on how to complete south carolina tax overage

Complete South Carolina Tax Overage effortlessly on any device

Digital document handling has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the required form and securely archive it online. airSlate SignNow provides all the features you require to design, modify, and electronically sign your documents quickly without holdups. Manage South Carolina Tax Overage on any device using airSlate SignNow’s Android or iOS applications and simplify your document-related processes today.

The easiest method to revise and eSign South Carolina Tax Overage with minimal effort

- Locate South Carolina Tax Overage and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact confidential information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes just moments and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Edit and eSign South Carolina Tax Overage to ensure excellent communication at any stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the south carolina tax overage

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the 50 state overages guide?

The 50 state overages guide is a comprehensive resource that provides businesses with essential legal information and procedures for handling overages in all 50 states. It ensures that you are informed about state-specific regulations and helps streamline your document management process while using airSlate SignNow.

-

How can the 50 state overages guide benefit my business?

Utilizing the 50 state overages guide can signNowly enhance your operational efficiency by providing clear directives on state compliance. This prevents costly mistakes and ensures that your team is always equipped with the latest legal updates, ultimately saving time and resources.

-

Is the 50 state overages guide included in the airSlate SignNow subscription?

Yes, the 50 state overages guide is included in certain airSlate SignNow subscription plans. This allows businesses to access vital information without additional costs, enhancing the overall value of your investment in our eSignature and document management solutions.

-

How does airSlate SignNow integrate with the 50 state overages guide?

AirSlate SignNow seamlessly integrates the 50 state overages guide into its platform, making it easily accessible within the workflow. Users can refer to the guide while preparing documents, ensuring compliance with state regulations throughout the signing process.

-

What features does airSlate SignNow offer alongside the 50 state overages guide?

In addition to the 50 state overages guide, airSlate SignNow offers features such as customizable templates, real-time collaboration, and secure cloud storage. These tools work together to maximize document efficiency and support your business needs.

-

Can I customize the 50 state overages guide for my industry?

Yes, businesses can tailor aspects of the 50 state overages guide to better fit their specific industry requirements. This level of customization ensures that the information is relevant and actionable, aligning with your unique operational processes.

-

What are the costs associated with accessing the 50 state overages guide?

The costs for the 50 state overages guide vary depending on the airSlate SignNow subscription plan you choose. We offer several pricing tiers, ensuring that you can find a plan that fits your budget while still providing access to this indispensable resource.

Get more for South Carolina Tax Overage

Find out other South Carolina Tax Overage

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney