8879 Vt C Form

What is the 8879 Vt C

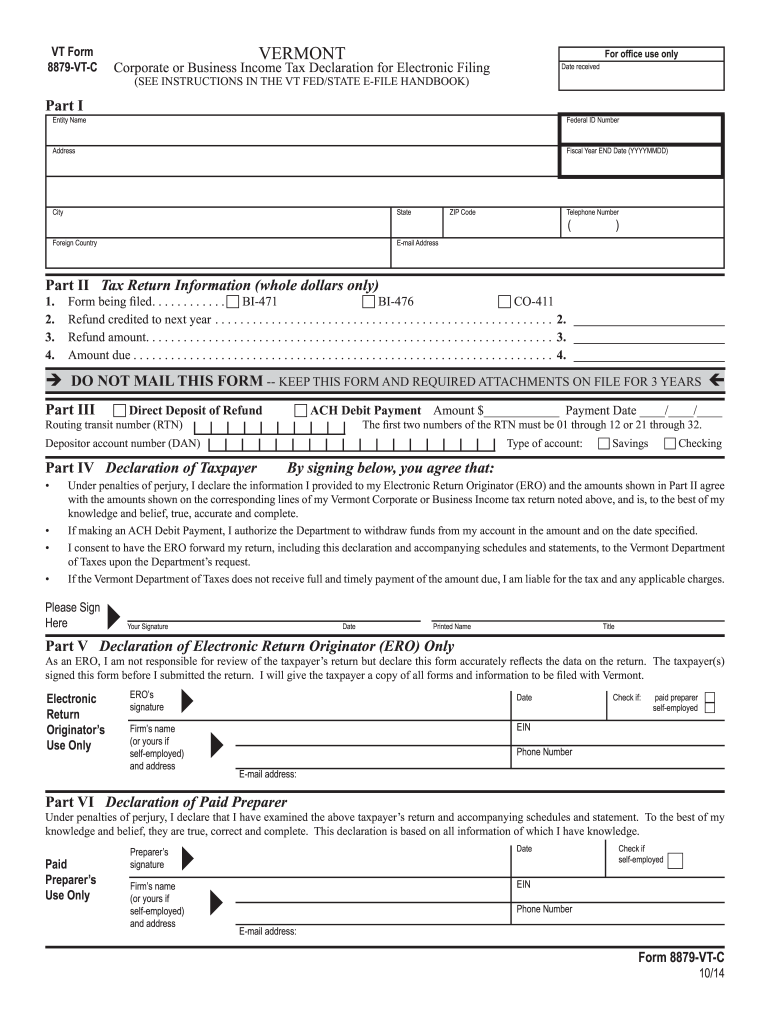

The 8879 Vt C form, also known as the Vermont 8879 Corporate, is a declaration used by corporations in Vermont to authorize the electronic filing of their tax returns. This form serves as a signature document, confirming that the information provided in the tax return is accurate and complete. It is essential for ensuring compliance with state tax regulations and for protecting the integrity of the filing process.

How to use the 8879 Vt C

Using the 8879 Vt C involves several straightforward steps. First, ensure that all necessary financial information is gathered and accurately reflected in your tax return. Next, complete the 8879 Vt C by providing the required details, including the corporate name, tax identification number, and the signature of an authorized representative. Once completed, this form must be submitted alongside the electronic tax return to the Vermont Department of Taxes.

Steps to complete the 8879 Vt C

Completing the 8879 Vt C form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents and information necessary for your corporate tax return.

- Fill out the corporate details on the form, including the name and tax identification number.

- Ensure that the authorized representative reviews and signs the form, confirming the accuracy of the information.

- Submit the completed form electronically along with the corporate tax return.

Legal use of the 8879 Vt C

The legal use of the 8879 Vt C is governed by Vermont state tax laws. This form must be signed by an authorized corporate officer to be considered valid. By signing the form, the officer certifies that the information provided is true and accurate, which is crucial for compliance with tax regulations. Failure to properly complete or submit the form can result in penalties or delays in processing the tax return.

Required Documents

To successfully complete the 8879 Vt C, certain documents are necessary. These include:

- Corporate financial statements for the tax year.

- Previous year’s tax return for reference.

- Any supporting documentation related to deductions or credits claimed.

Filing Deadlines / Important Dates

Filing deadlines for the 8879 Vt C align with the corporate tax return deadlines in Vermont. Typically, corporations must file their returns by the fifteenth day of the fourth month following the end of their fiscal year. It is important to keep track of these dates to avoid late filing penalties.

Quick guide on how to complete 8879 vt c

Accomplish 8879 Vt C seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can obtain the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to produce, modify, and electronically sign your documents swiftly without holdups. Manage 8879 Vt C on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and electronically sign 8879 Vt C effortlessly

- Obtain 8879 Vt C and click Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign 8879 Vt C and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8879 vt c

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is 8879 vt corporate, and how can it benefit my business?

8879 vt corporate refers to the corporate solutions offered by airSlate SignNow that enable businesses to streamline their digital signing processes. This feature allows teams to efficiently send and eSign documents online, enhancing productivity. With a focus on ease of use and cost-effectiveness, your business can signNowly reduce turnaround time on important contracts and agreements.

-

How much does the airSlate SignNow service cost for 8879 vt corporate users?

The pricing for the 8879 vt corporate service varies based on the features and number of users. airSlate SignNow offers flexible subscription plans that allow businesses to choose a package that best fits their needs and budget. Contact our sales team for a detailed quote tailored to your corporate requirements.

-

What features are included in the 8879 vt corporate plan?

The 8879 vt corporate plan includes a variety of features designed for business efficiency, such as document templates, team management tools, and advanced reporting capabilities. These functionalities assist organizations in effectively managing their signing processes. You can integrate these features seamlessly into your existing workflows for improved productivity.

-

Is airSlate SignNow compliant with e-signature laws for 8879 vt corporate?

Yes, airSlate SignNow is fully compliant with e-signature laws such as the ESIGN Act and UETA, ensuring that all electronically signed documents through the 8879 vt corporate service hold legal standing. This compliance provides peace of mind to businesses concerned about the legality of their signed documents. Utilize airSlate SignNow confidently knowing you meet industry standards.

-

Can the 8879 vt corporate service integrate with other software systems?

Absolutely! The 8879 vt corporate service from airSlate SignNow offers robust integrations with popular tools such as Salesforce, Google Workspace, and Microsoft Office. This flexibility allows your business to synchronize workflows easily and enhances overall operational efficiency. Check our integration options to connect your existing systems with airSlate SignNow.

-

How does airSlate SignNow ensure the security of documents for 8879 vt corporate clients?

airSlate SignNow prioritizes document security by utilizing advanced encryption and secure servers for all signed documents under the 8879 vt corporate package. Our platform follows best practices in data protection and offers features like secure access and audit trails. This commitment to security helps maintain confidentiality and integrity of your crucial business documents.

-

What support options are available for 8879 vt corporate users?

For 8879 vt corporate users, airSlate SignNow provides a range of support options, including dedicated account managers, 24/7 customer support, and comprehensive online resources. Our team is ready to assist with any questions or technical issues you may encounter. You can easily signNow out through chat, email, or phone for immediate assistance.

Get more for 8879 Vt C

Find out other 8879 Vt C

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile