Alabama Pte V Form

What is the Alabama Pte V Form

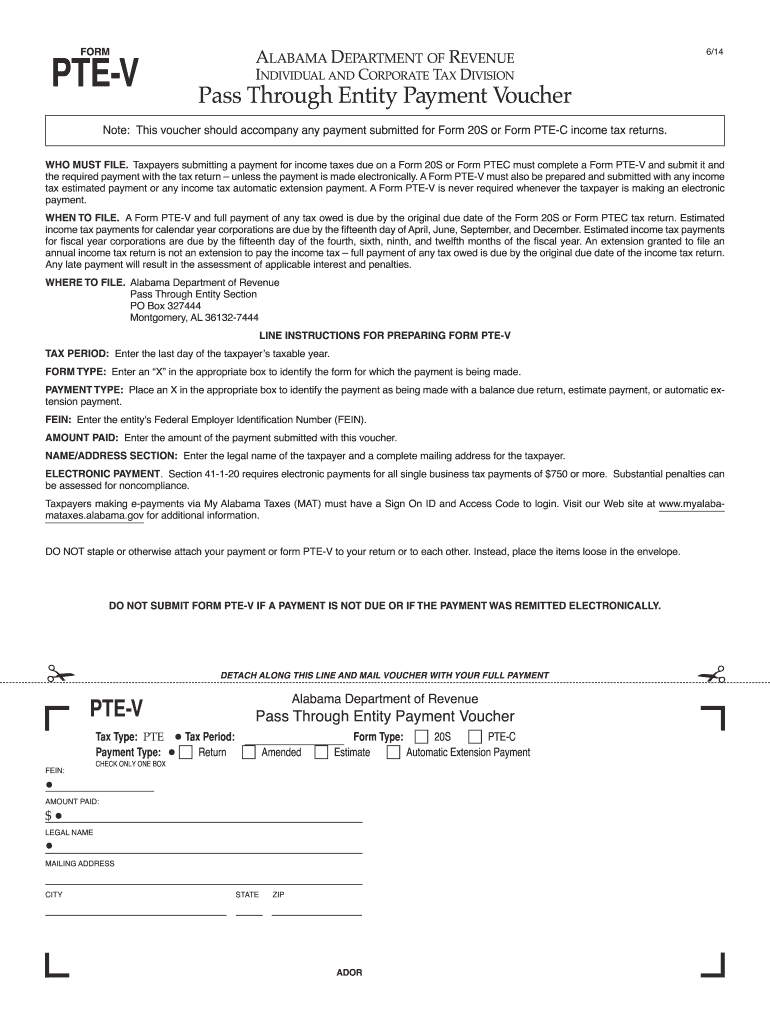

The Alabama Pte V form is a critical document used for reporting the income and expenses of pass-through entities in the state of Alabama. This form is specifically designed for entities such as partnerships, S corporations, and limited liability companies (LLCs) that pass their income directly to their owners or shareholders. By using the Alabama Pte V form, these entities can ensure compliance with state tax regulations while accurately reporting their financial activities.

How to use the Alabama Pte V Form

Utilizing the Alabama Pte V form involves several key steps. First, the entity must gather all necessary financial information, including income, deductions, and credits. Next, the form should be filled out with accurate data reflecting the entity's financial situation for the tax year. Once completed, it must be submitted to the Alabama Department of Revenue, either electronically or via mail, depending on the entity's preference. It is essential to ensure that all information is accurate to avoid potential penalties.

Steps to complete the Alabama Pte V Form

Completing the Alabama Pte V form requires careful attention to detail. Follow these steps:

- Gather financial records, including income statements and expense reports.

- Fill in the entity's identifying information, such as name and tax identification number.

- Report total income and allowable deductions accurately.

- Calculate the net income or loss for the entity.

- Sign and date the form to certify its accuracy.

Legal use of the Alabama Pte V Form

The Alabama Pte V form is legally recognized for reporting purposes under Alabama tax law. To ensure its legal validity, the form must be completed accurately and submitted by the designated deadline. Compliance with state regulations is crucial, as failure to submit the form or inaccuracies may result in penalties or additional scrutiny from the Alabama Department of Revenue.

Required Documents

When preparing to complete the Alabama Pte V form, it is important to have the following documents ready:

- Financial statements, including profit and loss statements.

- Previous year’s tax returns for reference.

- Documentation of any deductions or credits being claimed.

- Partnership agreements or operating agreements for LLCs.

Filing Deadlines / Important Dates

Filing deadlines for the Alabama Pte V form are critical to avoid penalties. Typically, the form is due on the fifteenth day of the third month following the end of the entity's tax year. For entities operating on a calendar year, this means the form is usually due by March 15. It is advisable to mark this date on your calendar and prepare the necessary documentation well in advance to ensure timely submission.

Quick guide on how to complete alabama pte v form

Complete Alabama Pte V Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents swiftly without delays. Handle Alabama Pte V Form on any device using airSlate SignNow apps for Android or iOS and enhance any document-centered process today.

The easiest method to modify and electronically sign Alabama Pte V Form without hassle

- Locate Alabama Pte V Form and then click Get Form to commence.

- Employ the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Alabama Pte V Form and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama pte v form

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the Alabama Form PTE V?

The Alabama Form PTE V is a state-specific form designed for partnerships and entities in Alabama to report income and certain tax credits. Understanding how to accurately complete the Alabama Form PTE V is essential for compliance and ensures that your business meets state regulations.

-

How does airSlate SignNow simplify the process of completing the Alabama Form PTE V?

airSlate SignNow simplifies the process of completing the Alabama Form PTE V by providing an intuitive electronic signature platform. Users can easily fill out forms, sign documents, and send them securely, eliminating the hassle of printing and mailing paperwork.

-

Is pricing for airSlate SignNow competitive for businesses needing to file the Alabama Form PTE V?

Yes, airSlate SignNow offers competitive pricing packages tailored for businesses that frequently handle forms like the Alabama Form PTE V. With flexible plans, companies can choose the best option that fits their document management needs and budget.

-

Are there any specific features in airSlate SignNow that assist with the Alabama Form PTE V?

airSlate SignNow provides features such as customizable templates and automated workflows that help streamline the completion of the Alabama Form PTE V. These features allow users to save time and reduce errors when preparing their tax forms.

-

Can airSlate SignNow integrate with accounting software for filing the Alabama Form PTE V?

Yes, airSlate SignNow offers integrations with popular accounting software, making it easier to file the Alabama Form PTE V in conjunction with your financial records. This integration helps ensure that all necessary data is accurately transferred and reduces the risk of discrepancies.

-

What benefits does airSlate SignNow provide for businesses filling out the Alabama Form PTE V?

By using airSlate SignNow, businesses benefit from a streamlined document management process, enhanced security features, and reduced turnaround time for signing the Alabama Form PTE V. This leads to increased efficiency and ensures that tax documents are submitted on time.

-

Is it easy to share the Alabama Form PTE V using airSlate SignNow?

Absolutely! airSlate SignNow makes it easy to share the Alabama Form PTE V with team members and stakeholders. Users can send documents via email or generate shareable links, ensuring everyone involved has access to the necessary information.

Get more for Alabama Pte V Form

Find out other Alabama Pte V Form

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document