Arizona Inheritance Tax Waiver Form

What is the Arizona Inheritance Tax Waiver Form

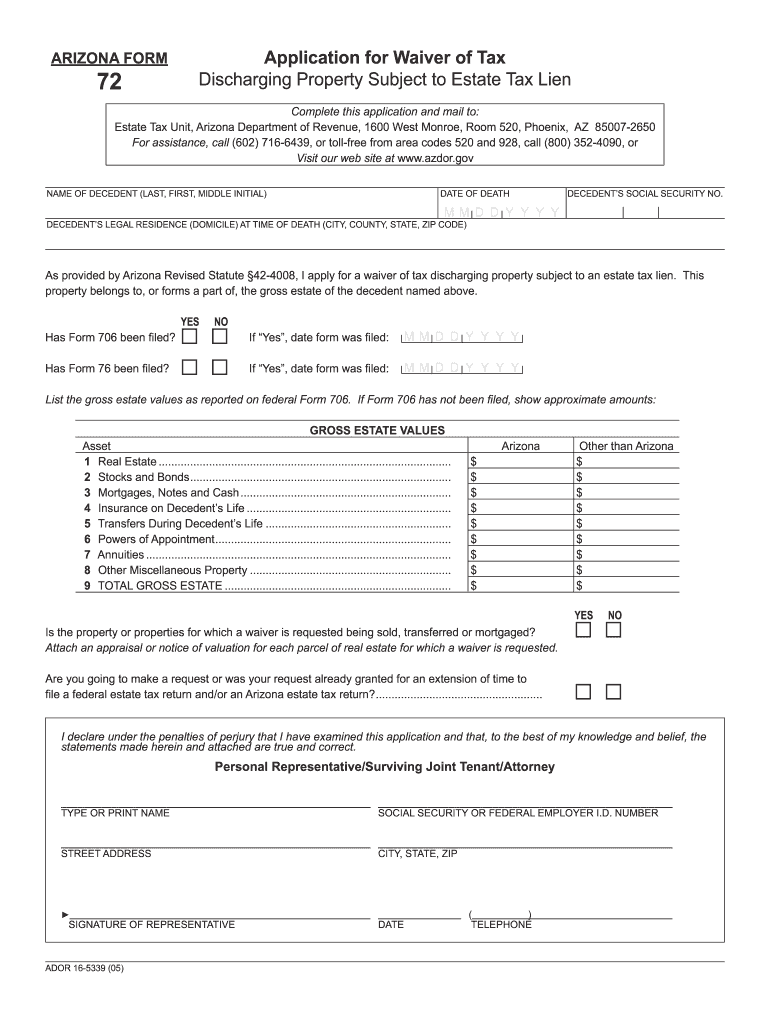

The Arizona inheritance tax waiver form is a legal document that allows heirs or beneficiaries to waive their rights to inherit property or assets subject to state inheritance tax. This form is particularly relevant in situations where the estate may not have sufficient funds to cover the tax obligations. By completing this waiver, individuals can clarify their intentions and potentially expedite the distribution of the estate. It is essential to understand that Arizona does not impose an inheritance tax; however, this form may still be relevant in specific scenarios involving estate tax considerations.

How to use the Arizona Inheritance Tax Waiver Form

Using the Arizona inheritance tax waiver form involves several straightforward steps. First, the individual must obtain the form, which can typically be found through state resources or legal assistance. Next, the form must be filled out accurately, including details such as the names of the parties involved, the relationship to the deceased, and any relevant estate details. Once completed, the form should be signed by all necessary parties, ensuring that it is executed correctly to be legally binding. Finally, the signed form should be submitted to the appropriate estate administrator or court, depending on the specific requirements of the estate.

Steps to complete the Arizona Inheritance Tax Waiver Form

Completing the Arizona inheritance tax waiver form involves a series of clear steps:

- Obtain the correct version of the form from a reliable source.

- Fill in personal information, including names, addresses, and relationships to the deceased.

- Provide details about the estate, including any property or assets involved.

- Review the form for accuracy and completeness.

- Sign and date the form, ensuring all required signatures are present.

- Submit the completed form to the estate administrator or relevant court.

Legal use of the Arizona Inheritance Tax Waiver Form

The legal use of the Arizona inheritance tax waiver form is crucial for ensuring that the document is recognized by courts and estate administrators. To be legally binding, the form must be filled out correctly and signed by all relevant parties. It is advisable to consult with a legal professional to ensure compliance with any specific state laws or regulations. Additionally, keeping a copy of the signed form for personal records is recommended, as it may be required for future reference or in case of disputes.

Required Documents

When preparing to complete the Arizona inheritance tax waiver form, certain documents may be required to support the application. These typically include:

- The death certificate of the deceased individual.

- Proof of identity for all parties involved, such as driver's licenses or passports.

- Any existing estate documents, including wills or trust agreements.

- Documentation of the assets or property that are subject to the waiver.

Form Submission Methods

The Arizona inheritance tax waiver form can be submitted through various methods, depending on the preferences of the parties involved. Common submission methods include:

- Online submission through designated state portals or estate management software.

- Mailing the completed form to the appropriate estate administrator or court.

- In-person delivery to the relevant office, allowing for immediate confirmation of receipt.

Quick guide on how to complete arizona inheritance tax waiver form

Finish Arizona Inheritance Tax Waiver Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute to conventional printed and signed documents, enabling you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents promptly without delays. Handle Arizona Inheritance Tax Waiver Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to alter and eSign Arizona Inheritance Tax Waiver Form with minimal effort

- Locate Arizona Inheritance Tax Waiver Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Arizona Inheritance Tax Waiver Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona inheritance tax waiver form

How to create an eSignature for your PDF file in the online mode

How to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is the Arizona inheritance tax waiver form?

The Arizona inheritance tax waiver form is a legal document used to waive any potential inheritance tax liabilities in Arizona. It ensures that heirs can receive their inheritance without having to worry about tax implications. Understanding the requirements for this form is crucial for smooth estate settlement.

-

How can I obtain the Arizona inheritance tax waiver form?

You can easily obtain the Arizona inheritance tax waiver form through your local county offices or online legal resources. airSlate SignNow offers templates that can streamline the process of filling out this form effectively. It's a quick and cost-effective solution for your estate planning needs.

-

Are there any fees associated with the Arizona inheritance tax waiver form?

While there may be no direct fees to file the Arizona inheritance tax waiver form itself, there could be associated legal fees or costs for professional services. Utilizing airSlate SignNow can save you money by providing an efficient way to manage and eSign the necessary documents. This can help you avoid additional costs in the estate settlement process.

-

What features does airSlate SignNow offer for the Arizona inheritance tax waiver form?

airSlate SignNow provides a user-friendly platform for creating, editing, and eSigning the Arizona inheritance tax waiver form. Key features include document templates, real-time collaboration, and secure cloud storage. These features ensure that your documents are handled safely and efficiently.

-

How does eSigning the Arizona inheritance tax waiver form work?

eSigning the Arizona inheritance tax waiver form through airSlate SignNow is straightforward. You simply upload the document, add the required eSignature fields, and send it to the relevant parties for their signatures. This process not only speeds up documentation but also enhances security and compliance.

-

Can I integrate airSlate SignNow with other tools for managing the Arizona inheritance tax waiver form?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms, allowing you to manage the Arizona inheritance tax waiver form alongside your other business applications. This integration facilitates document management workflows and enhances productivity. It's a versatile tool for both individuals and businesses.

-

What are the benefits of using airSlate SignNow for the Arizona inheritance tax waiver form?

Using airSlate SignNow for the Arizona inheritance tax waiver form offers numerous benefits, including expedited processing, cost savings, and reduced paper usage. The platform ensures that your documents are securely stored and easily accessible whenever needed. This convenience allows you to focus on more important aspects of estate planning.

Get more for Arizona Inheritance Tax Waiver Form

Find out other Arizona Inheritance Tax Waiver Form

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy