Boe 401 Ez Short Form

What is the BOE 401 EZ Short Form?

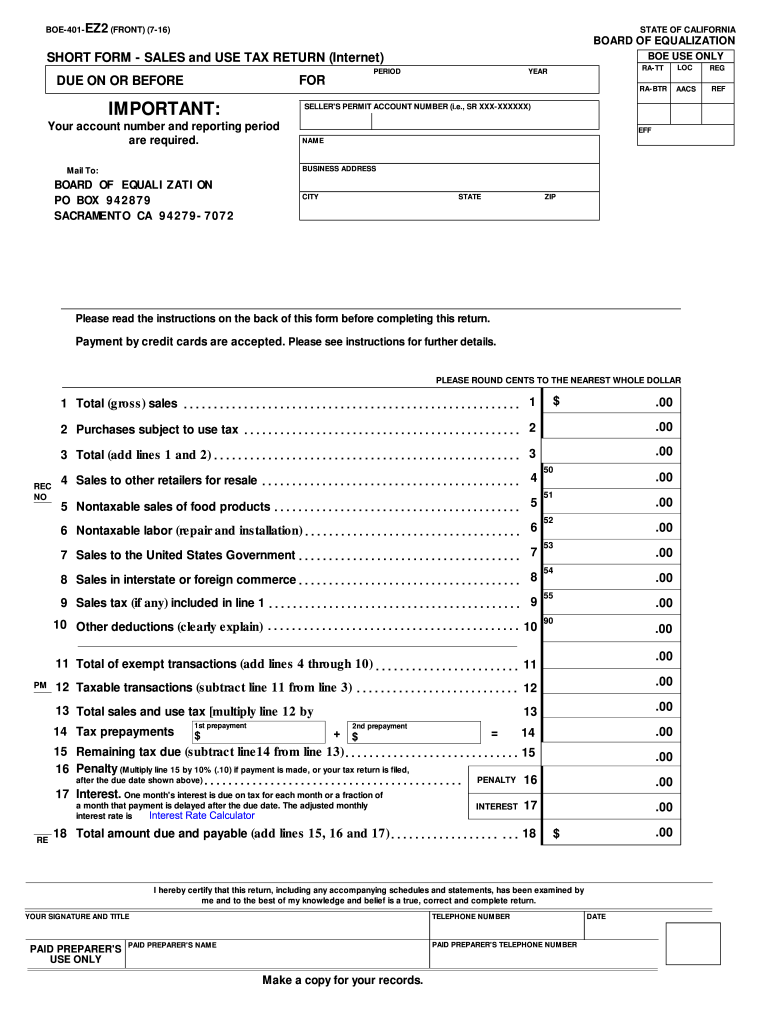

The BOE 401 EZ Short Form is a simplified version of the California sales tax return, specifically designed for businesses with straightforward tax situations. This form allows eligible taxpayers to report their sales and use tax liabilities in a more efficient manner. It is particularly beneficial for small businesses or those with limited sales tax transactions, as it streamlines the reporting process and reduces the complexity often associated with tax forms.

How to Use the BOE 401 EZ Short Form

Using the BOE 401 EZ Short Form involves several key steps. First, ensure that your business qualifies to use this form, which is typically for businesses with total taxable sales of less than a specified threshold. Next, gather all necessary sales records and documentation. Complete the form by accurately entering your sales figures, deductions, and the total amount of tax due. Finally, review the completed form for accuracy before submitting it to the California Department of Tax and Fee Administration (CDTFA).

Steps to Complete the BOE 401 EZ Short Form

Completing the BOE 401 EZ Short Form can be broken down into a few straightforward steps:

- Gather your sales records, including receipts and invoices.

- Determine your total sales for the reporting period.

- Calculate any applicable deductions, such as sales tax exemptions.

- Fill out the form by entering your total sales, deductions, and tax due.

- Review your entries for accuracy to avoid errors.

- Submit the completed form to the CDTFA either online or by mail.

Legal Use of the BOE 401 EZ Short Form

The BOE 401 EZ Short Form is legally recognized as a valid method for reporting sales and use tax in California. To ensure compliance, businesses must adhere to the guidelines set forth by the CDTFA. This includes using the form only if eligible, accurately reporting sales and tax amounts, and submitting it by the designated deadlines. Failure to comply with these regulations may result in penalties or interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the BOE 401 EZ Short Form vary based on the reporting period. Generally, businesses must submit their sales tax returns either monthly, quarterly, or annually, depending on their sales volume. It is crucial to be aware of these deadlines to avoid late fees. The CDTFA provides a calendar of important dates, including due dates for each reporting period, which businesses should consult regularly.

Form Submission Methods

The BOE 401 EZ Short Form can be submitted through multiple methods, providing flexibility for businesses. Taxpayers can file the form online through the CDTFA's website, which is often the quickest option. Alternatively, businesses may choose to mail a paper copy of the form or deliver it in person to their local CDTFA office. Each method has its own processing times and requirements, so it is advisable to select the one that best suits your needs.

Quick guide on how to complete boe 401 ez short form

Complete Boe 401 Ez Short Form effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly without any holdups. Manage Boe 401 Ez Short Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign Boe 401 Ez Short Form with ease

- Find Boe 401 Ez Short Form and click Get Form to begin.

- Utilize the tools available to submit your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Boe 401 Ez Short Form while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the boe 401 ez short form

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is a CA form sales tax return and why is it important?

A CA form sales tax return is a mandatory document that businesses in California must submit to report sales and use tax collected over a specific period. Filing this return ensures compliance with state tax laws, helping businesses avoid fines and penalties while accurately tracking sales tax obligations.

-

How can airSlate SignNow help with my CA form sales tax return?

With airSlate SignNow, you can easily eSign and manage your CA form sales tax return digitally, streamlining the submission process. Our platform provides templates and tools that simplify document management, ensuring your return is submitted correctly and on time.

-

Is airSlate SignNow cost-effective for small businesses filing CA form sales tax return?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses, making it an affordable option for managing your CA form sales tax return. The ability to streamline document handling and improve efficiency can save you both time and money in the long run.

-

What features does airSlate SignNow provide for handling CA form sales tax return?

airSlate SignNow includes a range of features designed for ease of use, including customizable templates for CA form sales tax return and secure eSigning capabilities. Additionally, our platform supports collaboration and audit trails, ensuring all parties can sign documents seamlessly and track their history.

-

Can I integrate airSlate SignNow with my accounting software for CA form sales tax return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software tools to assist in preparing your CA form sales tax return. This integration ensures that all your financial data is synchronized, making your tax filing experience smooth and efficient.

-

What are the benefits of using airSlate SignNow for CA form sales tax return?

Using airSlate SignNow for your CA form sales tax return provides numerous benefits, including enhanced efficiency, reduced paperwork, and increased accuracy in submissions. Our solution reduces the time spent on documentation, allowing you to focus on your business's core activities.

-

How secure is airSlate SignNow when filing CA form sales tax return?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your CA form sales tax return and sensitive information, ensuring compliance with data protection regulations and giving you peace of mind.

Get more for Boe 401 Ez Short Form

Find out other Boe 401 Ez Short Form

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement