Use Tax Transaction Return Form

What is the Use Tax Transaction Return

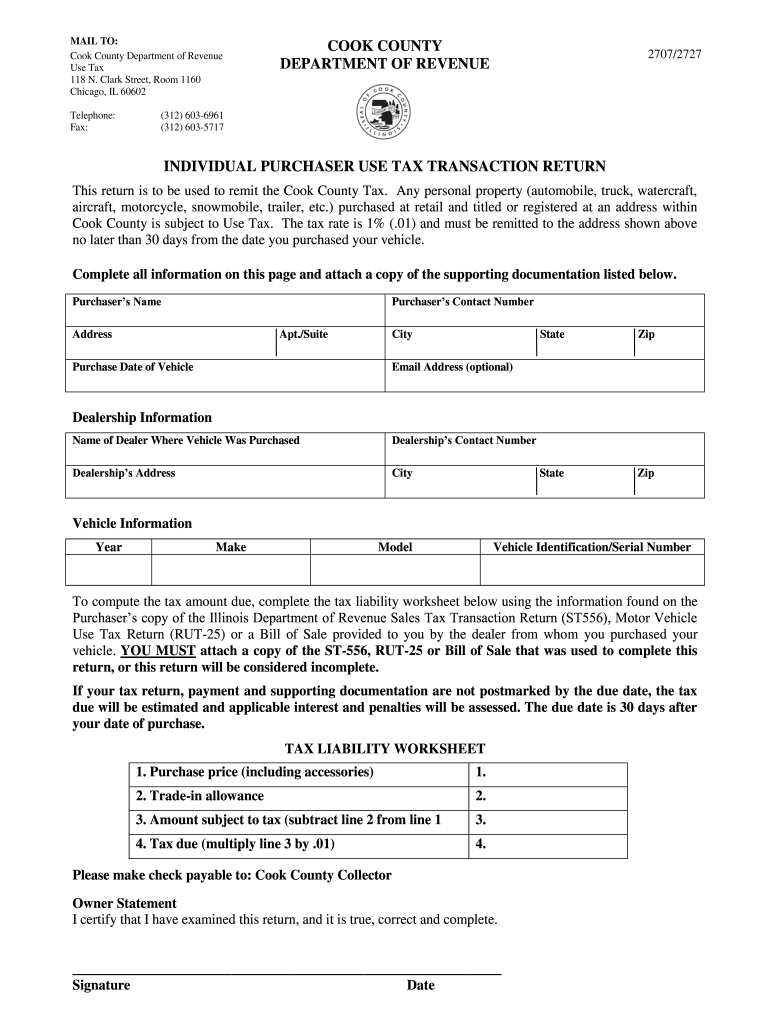

The Use Tax Transaction Return is a vital document used by individuals and businesses in the United States to report and pay use tax on items purchased for use in their state. This tax applies to goods and services acquired from out-of-state vendors when sales tax was not collected at the time of purchase. The return ensures compliance with state tax laws and helps maintain a level playing field between local and out-of-state retailers.

Steps to complete the Use Tax Transaction Return

Completing the Use Tax Transaction Return involves several key steps to ensure accuracy and compliance. First, gather all relevant purchase documentation, including receipts and invoices. Next, determine the total amount of taxable purchases made during the reporting period. This includes items that were not taxed at the point of sale. Then, accurately fill out the return form, ensuring all required fields are completed. Finally, review the form for any errors before submitting it to the appropriate state tax authority, either online or via mail.

Legal use of the Use Tax Transaction Return

The legal use of the Use Tax Transaction Return is governed by state tax regulations, which outline the requirements for reporting and paying use tax. For the return to be considered valid, it must be completed accurately and submitted by the designated deadline. Additionally, the use tax must be calculated based on the purchase price of the items, and any applicable exemptions must be clearly documented. Compliance with these legal stipulations helps avoid penalties and ensures that taxpayers fulfill their obligations under state law.

Filing Deadlines / Important Dates

Filing deadlines for the Use Tax Transaction Return vary by state, but they typically align with the overall tax filing calendar. Most states require the return to be filed annually, quarterly, or monthly, depending on the volume of taxable purchases. It is essential to be aware of specific due dates to avoid late fees and penalties. Taxpayers should consult their state’s tax authority for precise deadlines and any changes that may occur in the tax calendar.

Required Documents

When completing the Use Tax Transaction Return, several documents are necessary to support the information provided. These include receipts for all taxable purchases, invoices from vendors, and any previous tax returns that may provide context for the current filing. Keeping thorough records not only aids in the accurate completion of the return but also serves as documentation in case of an audit or inquiry from the tax authority.

Examples of using the Use Tax Transaction Return

Examples of situations requiring the Use Tax Transaction Return include individuals who purchase furniture from an online retailer that does not charge sales tax or businesses that acquire equipment from out-of-state suppliers. In both cases, the purchaser is responsible for reporting and paying the applicable use tax on those items. These examples illustrate the importance of understanding use tax obligations, particularly for those who frequently shop online or engage in cross-border transactions.

Who Issues the Form

The Use Tax Transaction Return is typically issued by the state tax authority where the items will be used. Each state has its own version of the form, which may vary in format and requirements. Taxpayers should ensure they are using the correct form for their state to guarantee compliance with local tax laws. It is advisable to check the state tax authority's website for the most current version of the form and any accompanying instructions.

Quick guide on how to complete use tax transaction return

Handle Use Tax Transaction Return with ease on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without any wait. Handle Use Tax Transaction Return on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Use Tax Transaction Return effortlessly

- Locate Use Tax Transaction Return and click on Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and possesses the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Use Tax Transaction Return to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the use tax transaction return

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is the process for filing an IL return in Cook County?

Filing an IL return in Cook County involves gathering all necessary tax documents and using a reliable eSignature solution like airSlate SignNow to streamline the process. You can easily fill out the necessary forms, electronically sign them, and securely submit your return online. This ensures that you stay compliant with state regulations while saving time.

-

How does airSlate SignNow assist with IL return submissions in Cook County?

airSlate SignNow provides a simple platform to create, send, and electronically sign your IL return in Cook County. With features designed for efficiency, you can complete the document without worrying about traditional printing or mailing delays. This not only speeds up your tax submission but also enhances security.

-

Are there any costs associated with using airSlate SignNow for IL returns in Cook County?

airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs, making it cost-effective for filing IL returns in Cook County. You can choose from various subscription options that fit your budget while still gaining access to advanced features for eSigning and document management.

-

What features does airSlate SignNow offer for managing IL return documents?

airSlate SignNow offers a range of features tailored for managing IL return documents in Cook County. You can utilize templates, automated workflows, and real-time tracking to ensure that every document is completed properly. These features enhance your overall document management experience.

-

Is airSlate SignNow compliant with Cook County tax regulations?

Yes, airSlate SignNow is designed to be compliant with Cook County tax regulations, including the requirements for submitting IL returns. The platform ensures that all electronic signatures meet legal standards, providing peace of mind while you complete your tax documents.

-

Can I integrate airSlate SignNow with other software for my IL return in Cook County?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to synchronize data for your IL return in Cook County. This integration capability enhances your productivity by connecting your existing systems with our eSigning solution.

-

What are the benefits of using airSlate SignNow for eSigning my IL return in Cook County?

Using airSlate SignNow for eSigning your IL return in Cook County offers numerous benefits, including quicker processing times and enhanced security. You can sign documents from anywhere, reduce the risk of errors, and avoid the hassle of physical paperwork. This makes tax season much less stressful.

Get more for Use Tax Transaction Return

Find out other Use Tax Transaction Return

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter