Montana Deduction Form

What is the Montana Deduction

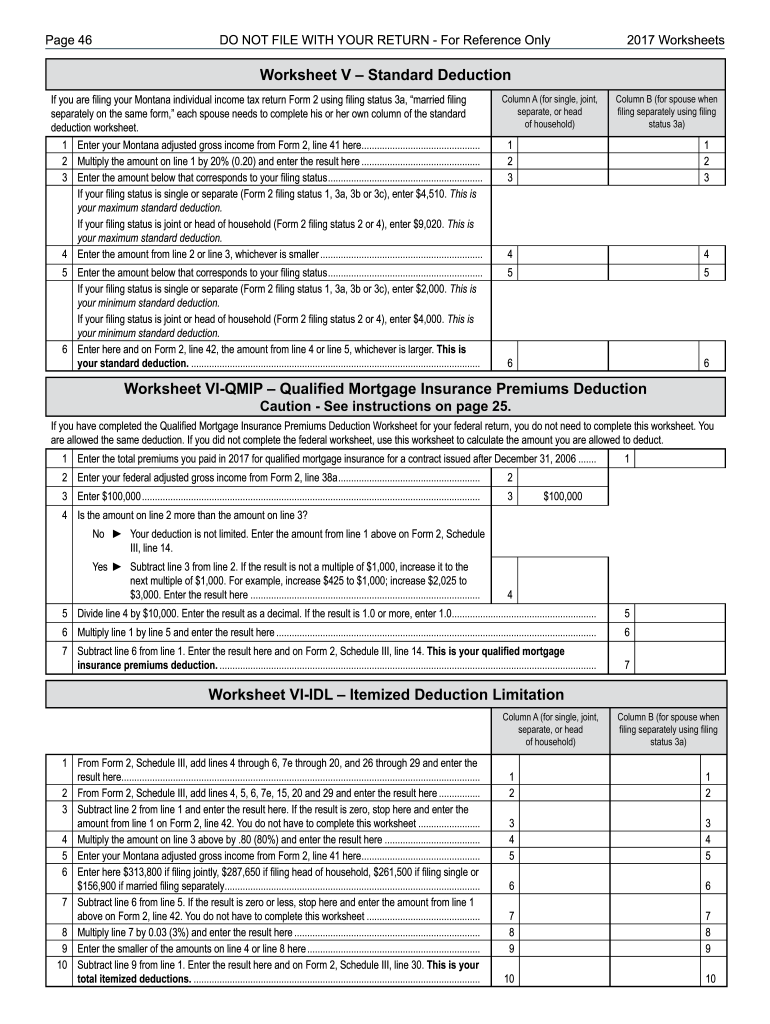

The Montana standard deduction is a tax benefit that reduces the amount of income subject to taxation for residents of Montana. This deduction allows eligible taxpayers to deduct a specified amount from their taxable income, thereby lowering their overall tax liability. The amount of the deduction can vary based on filing status, such as single, married filing jointly, or head of household. Understanding this deduction is crucial for effective tax planning and compliance.

How to use the Montana Deduction

To utilize the Montana standard deduction, taxpayers must first determine their eligibility based on their filing status and income level. Once eligibility is established, the deduction can be claimed on the Montana state income tax return. Taxpayers should ensure they accurately calculate their total income and apply the standard deduction appropriately to reduce their taxable income. This process can be facilitated through tax preparation software or by consulting a tax professional.

Steps to complete the Montana Deduction

Completing the Montana standard deduction involves several key steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Determine your filing status to identify the applicable standard deduction amount.

- Calculate your total income for the tax year.

- Subtract the standard deduction from your total income to determine your taxable income.

- Complete the Montana state tax return, ensuring the deduction is accurately reflected.

Eligibility Criteria

Eligibility for the Montana standard deduction depends on various factors, including filing status and income thresholds. Generally, all residents of Montana who file a state income tax return are eligible to claim this deduction. However, specific income limits may apply, and taxpayers should review the latest guidelines from the Montana Department of Revenue to ensure compliance and maximize their benefits.

Required Documents

When claiming the Montana standard deduction, taxpayers should prepare several documents to support their claim. These documents typically include:

- W-2 forms from employers, showing total income.

- 1099 forms for any additional income sources.

- Previous tax returns for reference.

- Any documentation related to deductions or credits that may affect the overall tax situation.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Montana can submit their state income tax return, including the standard deduction, through various methods. These methods include:

- Online submission via the Montana Department of Revenue's e-filing system, which is often the fastest and most efficient option.

- Mailing a paper return to the appropriate state tax office address.

- In-person submission at designated tax offices, although this option may be limited based on location and availability.

IRS Guidelines

While the Montana standard deduction is a state-specific benefit, it is essential to be aware of how it interacts with federal guidelines. Taxpayers should ensure that their claimed deductions comply with IRS regulations to avoid potential issues. The IRS provides comprehensive resources and guidelines regarding standard deductions, which can help taxpayers navigate their federal and state tax obligations effectively.

Quick guide on how to complete montana deduction

Complete Montana Deduction effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Handle Montana Deduction on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Montana Deduction without hassle

- Obtain Montana Deduction and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your changes.

- Decide how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Montana Deduction and ensure outstanding communication throughout any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the montana deduction

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Montana standard deduction for the current tax year?

The Montana standard deduction is a specific amount that taxpayers can subtract from their taxable income when filing their state taxes. For the current tax year, the Montana standard deduction varies based on filing status, so it’s essential to consult the latest tax guidelines to determine the exact figure pertinent to your situation.

-

How does the Montana standard deduction impact my tax filing process?

Understanding the Montana standard deduction is crucial as it can signNowly lower your taxable income, potentially resulting in a lower tax bill. When using eSigning solutions like airSlate SignNow, you can streamline the tax preparation and filing process, ensuring accurate documentation of your deductions.

-

Are there any eligibility requirements for the Montana standard deduction?

Yes, eligibility for the Montana standard deduction depends on your filing status and income level. To ensure you're taking full advantage of this deduction, consult with a tax professional, and consider utilizing airSlate SignNow to securely sign any necessary tax documents.

-

How does airSlate SignNow integrate with tax preparation software?

airSlate SignNow seamlessly integrates with popular tax preparation software, making it easy to manage your forms and documents related to the Montana standard deduction. This integration allows you to efficiently eSign and store your tax-related documents in one secure location.

-

What features does airSlate SignNow offer for tax professionals dealing with deductions?

airSlate SignNow offers features like customizable templates and secure storage, essential for tax professionals managing clients’ documents related to the Montana standard deduction. These tools save time and ensure that all forms are signed and filed accurately.

-

Can I use airSlate SignNow for filing amendments related to the Montana standard deduction?

Absolutely! airSlate SignNow can be utilized to eSign and submit any amendments related to your tax returns that may involve the Montana standard deduction. The platform ensures your amendments are processed quickly and securely.

-

What are the benefits of using airSlate SignNow for managing tax documents?

Using airSlate SignNow to manage tax documents provides efficiency, security, and ease of access. By digitizing the process, you can easily manage deductions such as the Montana standard deduction and ensure that all signatures are captured promptly.

Get more for Montana Deduction

Find out other Montana Deduction

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA