593 E Form 2019

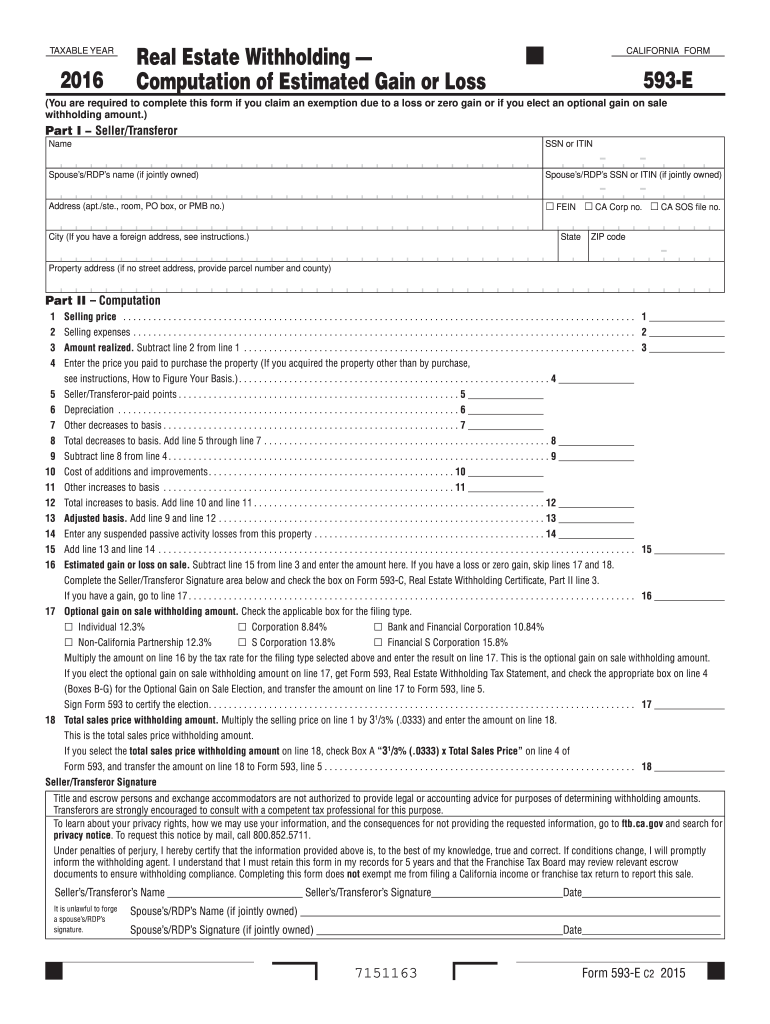

What is the 593 E Form

The 593 E Form is a tax form used in the United States to report certain types of income, specifically for individuals and entities that are not subject to U.S. tax withholding. This form is essential for non-resident aliens and foreign entities receiving income from U.S. sources, ensuring compliance with Internal Revenue Service (IRS) regulations. By accurately completing the 593 E Form, taxpayers can claim exemptions from withholding and avoid unnecessary tax deductions on their earnings.

How to use the 593 E Form

Using the 593 E Form involves several steps to ensure accurate reporting of income and compliance with IRS guidelines. Taxpayers must first gather all necessary information, including details about the income received and the payer's information. After filling out the form, individuals should review it for accuracy before submitting it to the appropriate tax authority. It is also advisable to keep a copy of the completed form for personal records, as it may be needed for future reference or audits.

Steps to complete the 593 E Form

Completing the 593 E Form requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the 593 E Form from the IRS website or other reliable sources.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details about the income received, specifying the type of income and the amount.

- Indicate any applicable exemptions or deductions you are claiming.

- Review the completed form for accuracy and completeness.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the 593 E Form

The 593 E Form is legally recognized by the IRS when completed correctly. It serves as a formal declaration of income and is crucial for non-resident aliens and foreign entities to avoid excessive withholding taxes. Compliance with IRS regulations is essential to ensure that the form is accepted and that taxpayers are not subject to penalties. Understanding the legal implications of the 593 E Form can help individuals navigate their tax obligations effectively.

Filing Deadlines / Important Dates

Filing deadlines for the 593 E Form are critical to avoid penalties. Generally, the form must be submitted by the tax filing deadline for the year in which the income was received. It is important for taxpayers to be aware of specific dates, as these may vary based on individual circumstances or changes in IRS regulations. Keeping track of these deadlines can help ensure timely submission and compliance with tax laws.

Who Issues the Form

The 593 E Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their responsibilities when reporting income. It is important for individuals to refer to the IRS for the most current version of the form and any updates regarding its use.

Quick guide on how to complete 593 e 2016 form

Complete 593 E Form smoothly on any device

Digital document management has become widely adopted by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents promptly without delays. Manage 593 E Form on any platform utilizing airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign 593 E Form effortlessly

- Find 593 E Form and click Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to the computer.

Forget about lost or mislaid files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign 593 E Form and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 593 e 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 593 e 2016 form

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is a 593 E Form?

The 593 E Form is a crucial document used for various tax-related processes. It is essential for reporting certain transactions and ensuring compliance with state tax regulations. Understanding how to use the 593 E Form can streamline your business operations and maintain legal compliance.

-

How does airSlate SignNow assist with the 593 E Form?

airSlate SignNow provides an intuitive platform for creating, sending, and eSigning the 593 E Form quickly and securely. Our solution simplifies the document management process, allowing you to focus on your business while ensuring your 593 E Form is handled efficiently. Enjoy the ease of electronic signatures with full compliance.

-

What are the features of using airSlate SignNow for the 593 E Form?

With airSlate SignNow, you gain access to features like templates, real-time tracking, and integrations with popular applications. These tools enhance how you manage the 593 E Form, making it easier to customize documents and collaborate with your team. The platform is designed to save you time and improve productivity.

-

Is there a mobile option for completing the 593 E Form?

Yes, airSlate SignNow offers a mobile-friendly interface that allows you to complete and sign the 593 E Form from any device. Whether you're in the office or on the go, our mobile app ensures you can manage important documents efficiently. This flexibility helps you stay productive and responsive to your business needs.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to cater to different business needs, including services for handling the 593 E Form. Our plans are designed to be cost-effective, ensuring you can choose one that fits your budget while providing the necessary features. You can find more details on our website or contact our sales team for personalized assistance.

-

How secure is the 593 E Form data when using airSlate SignNow?

Security is a top priority at airSlate SignNow, especially regarding sensitive documents like the 593 E Form. Our platform employs bank-level encryption and strict compliance with data protection regulations to safeguard your information. This ensures that your documents remain secure throughout the eSigning process.

-

Can I integrate airSlate SignNow with other software for processing the 593 E Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage the 593 E Form efficiently. Integration with tools like CRM systems, project management software, and cloud storage solutions can streamline workflows and improve overall productivity.

Get more for 593 E Form

Find out other 593 E Form

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now