Ftb 4600k Form 2013

What is the Ftb 4600k Form

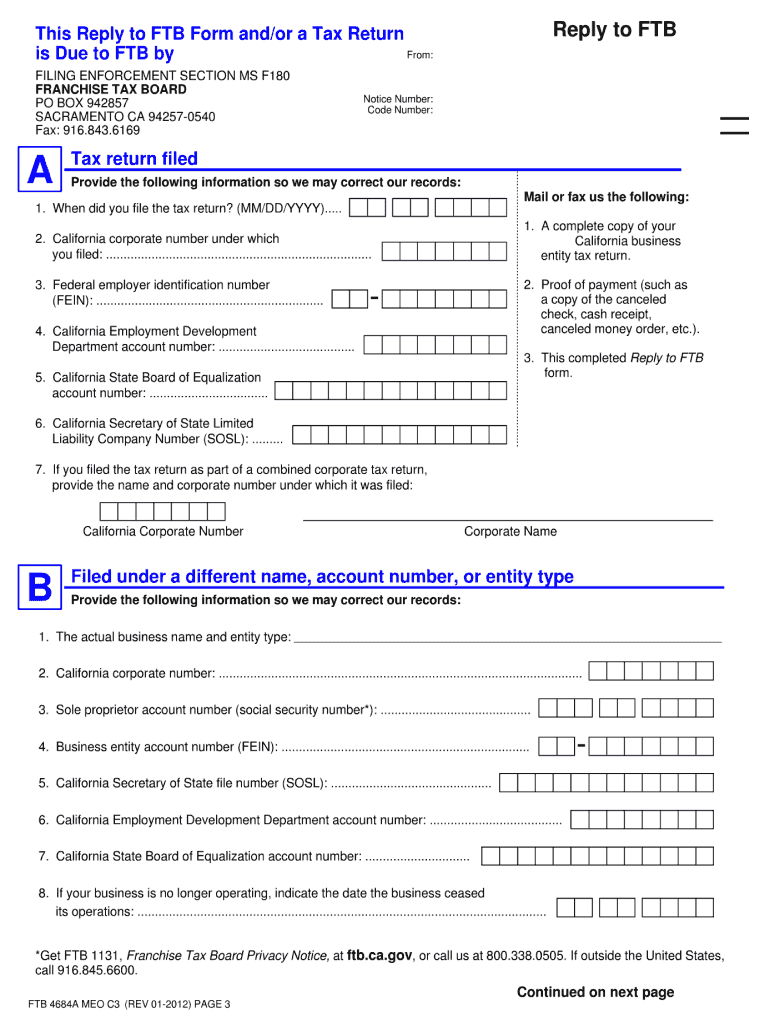

The Ftb 4600k Form is a tax-related document used by individuals and businesses in California for reporting specific financial information. This form is particularly relevant for those who need to report income, deductions, and credits to the California Franchise Tax Board. Understanding the purpose and requirements of the Ftb 4600k Form is essential for ensuring compliance with state tax laws.

How to use the Ftb 4600k Form

Using the Ftb 4600k Form involves several steps to ensure accurate reporting of your tax information. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out each section of the form, providing accurate information as required. It is important to review the completed form for any errors before submission. The form can be submitted either electronically or by mail, depending on your preference and the specific requirements set by the California Franchise Tax Board.

Steps to complete the Ftb 4600k Form

Completing the Ftb 4600k Form involves a systematic approach:

- Gather all relevant financial documents, such as W-2s, 1099s, and expense receipts.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your income accurately in the designated sections.

- List any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Review the entire form for accuracy and completeness.

- Submit the form electronically or print and mail it to the appropriate address.

Legal use of the Ftb 4600k Form

The Ftb 4600k Form must be used in accordance with California tax laws and regulations. This includes ensuring that all information provided is truthful and accurate. Failing to comply with legal requirements can result in penalties or audits by the California Franchise Tax Board. It is crucial to be aware of the legal implications of submitting this form, particularly regarding the accuracy of reported income and deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Ftb 4600k Form are typically aligned with the federal tax deadlines. Generally, individual taxpayers must file by April 15 of each year. However, it is advisable to check for any updates or changes to deadlines, as extensions may be available under certain circumstances. Keeping track of these important dates can help avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Ftb 4600k Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to file electronically through the California Franchise Tax Board's website, which offers a streamlined process.

- Mail: The completed form can be printed and mailed to the designated address provided by the Franchise Tax Board.

- In-Person: Some individuals may prefer to submit their forms in person at local Franchise Tax Board offices, where assistance may also be available.

Quick guide on how to complete ftb 4600k 2012 form

Complete Ftb 4600k Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Ftb 4600k Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Ftb 4600k Form effortlessly

- Find Ftb 4600k Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive information with tools available from airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of missing or lost files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from a device of your choice. Modify and eSign Ftb 4600k Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ftb 4600k 2012 form

Create this form in 5 minutes!

How to create an eSignature for the ftb 4600k 2012 form

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the Ftb 4600k Form?

The Ftb 4600k Form is a tax form used by California taxpayers to report income and calculate tax obligations. It's essential for ensuring compliance with state tax regulations. Utilizing airSlate SignNow can streamline the process of filling out and submitting your Ftb 4600k Form efficiently.

-

How can I eSign my Ftb 4600k Form with airSlate SignNow?

With airSlate SignNow, signing your Ftb 4600k Form is straightforward. Simply upload the form, invite your signers, and they can eSign electronically in a secure environment. This not only saves time but also ensures your documents are legally compliant.

-

Is there a cost associated with using airSlate SignNow for the Ftb 4600k Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can choose a plan that provides features suitable for managing your Ftb 4600k Form efficiently. The pricing remains cost-effective, ensuring you receive great value for your investment.

-

What features of airSlate SignNow benefit users handling the Ftb 4600k Form?

airSlate SignNow includes features like customizable templates, advanced editing tools, and cloud storage that are particularly beneficial for managing the Ftb 4600k Form. These tools enhance productivity and streamline the document management process, allowing for quick updates and easy access.

-

Can I integrate airSlate SignNow with other software while handling the Ftb 4600k Form?

Absolutely! airSlate SignNow offers seamless integrations with various software systems, enabling you to enhance functionality while managing the Ftb 4600k Form. This allows for smoother workflows and better data management across platforms you may already be using.

-

How does using airSlate SignNow improve the workflow for the Ftb 4600k Form?

Using airSlate SignNow improves workflow for the Ftb 4600k Form by automating repetitive tasks like eSigning and document routing. This minimizes human error and speeds up the overall process, ensuring that your forms are completed and submitted on time.

-

What security measures does airSlate SignNow implement for the Ftb 4600k Form?

airSlate SignNow employs robust security protocols, including encryption and secure cloud storage, to protect your Ftb 4600k Form. This ensures that your sensitive information remains confidential and safe from unauthorized access throughout the signing process.

Get more for Ftb 4600k Form

- Ihk koblenz ausbildungsnachweis form

- Client intake form pregnancy massage

- The marketing plan handbook alexander chernev pdf form

- Printable feedback form

- Customer details form

- Jwt handbook download form

- Superior court of california county of los angeles form

- Safe electric certificate of insurance r44 form fo

Find out other Ftb 4600k Form

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later