Rpd 41359 Form 2014

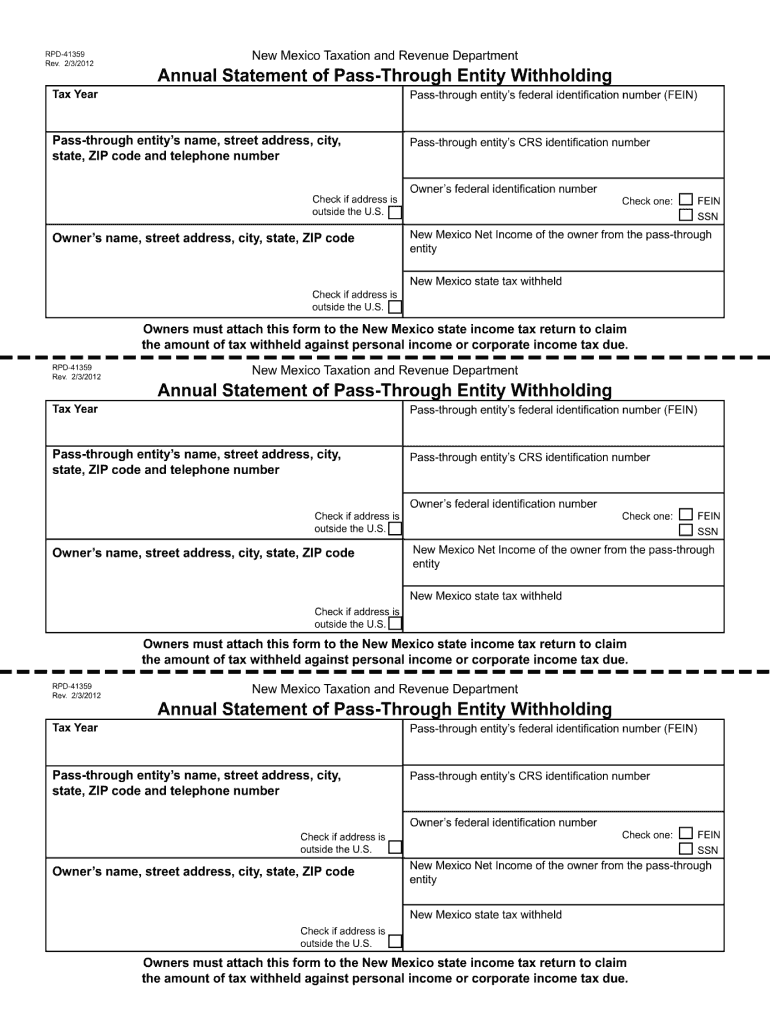

What is the Rpd 41359 Form

The Rpd 41359 Form is a specific document used primarily for tax-related purposes in the United States. It serves as a formal request or declaration that individuals or businesses must complete to comply with certain tax regulations. Understanding the purpose of this form is crucial for ensuring compliance and avoiding potential penalties.

How to use the Rpd 41359 Form

Using the Rpd 41359 Form involves several key steps. First, gather all necessary information required to complete the form accurately. This may include personal identification details, financial data, and any relevant tax information. Once you have the information, fill out the form carefully, ensuring that all sections are completed as required. After completing the form, review it for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Rpd 41359 Form

Completing the Rpd 41359 Form involves a systematic approach. Follow these steps:

- Obtain the latest version of the Rpd 41359 Form from a reliable source.

- Read the instructions carefully to understand what information is needed.

- Fill in your personal details, including name, address, and Social Security number.

- Provide any financial information required, such as income and deductions.

- Review the completed form for any errors or omissions.

- Sign and date the form as required.

- Submit the form to the designated agency or authority.

Legal use of the Rpd 41359 Form

The Rpd 41359 Form is legally binding when completed and submitted according to the relevant regulations. To ensure its legal validity, it is essential to follow all instructions accurately and provide truthful information. Misrepresentation or errors may lead to legal consequences, including fines or audits. Utilizing a trusted eSignature solution can also enhance the legal standing of the form by providing an electronic certificate and ensuring compliance with eSignature laws.

Required Documents

When completing the Rpd 41359 Form, certain documents may be required to support the information provided. These documents can include:

- Proof of identity, such as a driver’s license or passport.

- Financial statements or tax returns from previous years.

- Any relevant receipts or documentation that support deductions or claims.

Having these documents ready will facilitate the completion of the form and ensure that all necessary information is accurately reported.

Form Submission Methods

The Rpd 41359 Form can typically be submitted through various methods, including:

- Online submission via the official tax authority website.

- Mailing a physical copy of the form to the designated address.

- In-person submission at local tax offices or designated locations.

Choosing the appropriate submission method may depend on personal preference or specific guidelines set by the tax authority.

Quick guide on how to complete rpd 41359 2012 form

Easily Prepare Rpd 41359 Form on Any Device

Digital document management has become increasingly favored by enterprises and individuals alike. It presents an ideal eco-conscious replacement for conventional printed and signed documents, allowing for the correct format to be accessed and securely stored online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without interruptions. Manage Rpd 41359 Form on any device using airSlate SignNow apps for Android or iOS and streamline any document-related tasks today.

The simplest method to alter and eSign Rpd 41359 Form effortlessly

- Locate Rpd 41359 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching through forms, or errors that require rerunning new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign Rpd 41359 Form to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rpd 41359 2012 form

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the Rpd 41359 Form and why is it important?

The Rpd 41359 Form is a crucial document for tax reporting in certain jurisdictions. It ensures compliance with local tax regulations and helps businesses and individuals avoid penalties. Understanding the Rpd 41359 Form is essential for accurate financial management.

-

How can airSlate SignNow assist with managing the Rpd 41359 Form?

airSlate SignNow simplifies the process of managing the Rpd 41359 Form by providing an intuitive eSigning platform. Users can easily upload, sign, and send the form electronically. This streamlines document workflow, making it faster and more efficient.

-

Are there any costs associated with using airSlate SignNow for the Rpd 41359 Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Users can choose a plan that includes features for managing the Rpd 41359 Form. Each plan is designed to provide cost-effective solutions for businesses looking to enhance their document management.

-

What features does airSlate SignNow offer for the Rpd 41359 Form?

airSlate SignNow provides several key features for the Rpd 41359 Form, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your documents are handled efficiently and securely throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for the Rpd 41359 Form?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, making it easy to manage the Rpd 41359 Form within your existing workflow. Whether you're using CRMs, cloud storage services, or accounting software, integrations enhance the overall functionality.

-

What are the benefits of using airSlate SignNow for the Rpd 41359 Form?

Using airSlate SignNow for the Rpd 41359 Form offers signNow benefits such as enhanced security, reduced turnaround times, and improved user experience. This platform empowers teams to work more collaboratively and efficiently while ensuring compliance with legal standards.

-

Is it easy to use airSlate SignNow for the Rpd 41359 Form?

Yes, airSlate SignNow is designed to be user-friendly, allowing anyone to manage the Rpd 41359 Form with ease. The platform's straightforward interface and helpful resources make it accessible for both tech-savvy users and beginners alike.

Get more for Rpd 41359 Form

- Anything form 138563

- Philplans affidavit of loss forms

- Cocolife form

- Cutting edge pre intermediate tests pdf form

- Circle the adverbs and underline the verbs that they describe with answers form

- Public swimming pool monthly operation report form

- Release of liability form mortgage

- Alberta indianindian band declaration declaration form for alberta indianindian band

Find out other Rpd 41359 Form

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT