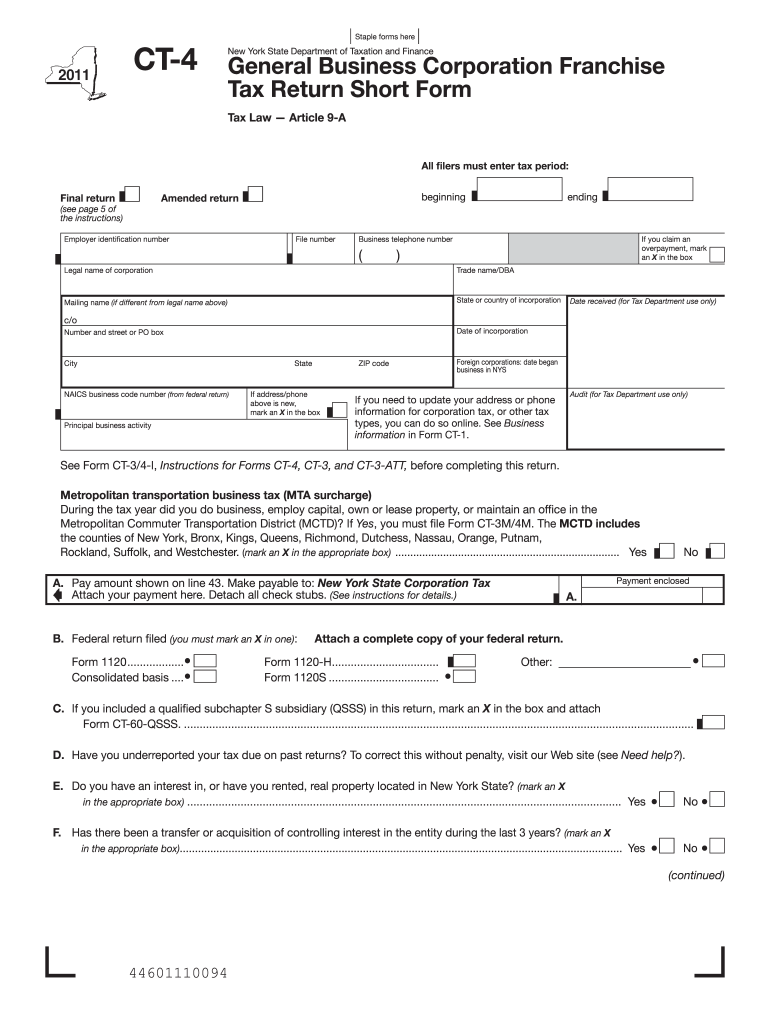

Form CT 4General Business Corporation Franchise Tax 2014

What is the Form CT 4General Business Corporation Franchise Tax

The Form CT 4General Business Corporation Franchise Tax is an important document required by the state for corporations operating in Connecticut. This form is used to report and pay the franchise tax that corporations owe based on their income and business activities within the state. The franchise tax is a fee for the privilege of doing business in Connecticut and is calculated using specific formulas established by state law.

Steps to complete the Form CT 4General Business Corporation Franchise Tax

Completing the Form CT 4General Business Corporation Franchise Tax involves several key steps:

- Gather necessary financial information, including revenue and expenses for the tax year.

- Access the form through the Connecticut Department of Revenue Services website or other official sources.

- Fill out the required sections, ensuring that all information is accurate and complete.

- Calculate the franchise tax based on the instructions provided on the form.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail.

How to obtain the Form CT 4General Business Corporation Franchise Tax

The Form CT 4General Business Corporation Franchise Tax can be obtained from the Connecticut Department of Revenue Services website. It is available for download in PDF format, allowing businesses to print and fill it out manually. Additionally, some tax preparation software may include this form, enabling users to complete it digitally.

Legal use of the Form CT 4General Business Corporation Franchise Tax

The legal use of the Form CT 4General Business Corporation Franchise Tax is essential for maintaining compliance with Connecticut state tax laws. Properly completing and submitting this form ensures that the corporation fulfills its tax obligations and avoids potential penalties. The form serves as a formal declaration of the corporation's financial activities and tax liability for the reporting period.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the Form CT 4General Business Corporation Franchise Tax to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. It is important for businesses to keep track of these dates to ensure timely submission and compliance with state regulations.

Penalties for Non-Compliance

Failure to file the Form CT 4General Business Corporation Franchise Tax by the deadline can result in significant penalties. These may include late fees and interest on the unpaid tax amount. Additionally, non-compliance may lead to further legal actions by the state, including the potential suspension of the corporation's business license. It is crucial for corporations to adhere to filing requirements to avoid these consequences.

Quick guide on how to complete form ct 42011general business corporation franchise tax

Complete Form CT 4General Business Corporation Franchise Tax effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form CT 4General Business Corporation Franchise Tax on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to update and eSign Form CT 4General Business Corporation Franchise Tax seamlessly

- Obtain Form CT 4General Business Corporation Franchise Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the woes of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Form CT 4General Business Corporation Franchise Tax while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 42011general business corporation franchise tax

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Form CT 4General Business Corporation Franchise Tax?

The Form CT 4General Business Corporation Franchise Tax is a tax form required for corporations operating in certain jurisdictions. It reports the franchise tax owed based on the corporation's income and business activities. Understanding this form is essential for compliance and avoiding penalties.

-

How does airSlate SignNow help with Form CT 4General Business Corporation Franchise Tax filings?

AirSlate SignNow streamlines the process of completing and submitting the Form CT 4General Business Corporation Franchise Tax. With its eSigning capabilities, you can easily fill out, sign, and send documents securely. This saves time and ensures your filings are accurate and timely.

-

What are the features of airSlate SignNow related to Form CT 4General Business Corporation Franchise Tax?

AirSlate SignNow offers a variety of features that facilitate the management of Form CT 4General Business Corporation Franchise Tax. These include customizable templates, automated workflows, and secure document storage. These features help businesses manage tax filings efficiently.

-

Is airSlate SignNow affordable for filing Form CT 4General Business Corporation Franchise Tax?

Yes, airSlate SignNow is a cost-effective solution for managing documents, including the Form CT 4General Business Corporation Franchise Tax. With various pricing plans, it caters to businesses of all sizes, ensuring you get value for your investment while maintaining compliance.

-

Can I integrate airSlate SignNow with my accounting software for Form CT 4General Business Corporation Franchise Tax?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting software, allowing for a smooth workflow in handling the Form CT 4General Business Corporation Franchise Tax. This integration helps in automating updates and tracking your tax documents easily.

-

What benefits do I gain from using airSlate SignNow for Form CT 4General Business Corporation Franchise Tax?

Using airSlate SignNow for the Form CT 4General Business Corporation Franchise Tax provides multiple benefits, such as increased efficiency and reduced paperwork. The platform enhances collaboration among team members and ensures all documents are securely stored and easily accessible.

-

How secure is airSlate SignNow for managing Form CT 4General Business Corporation Franchise Tax documents?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption and authentication methods to protect your Form CT 4General Business Corporation Franchise Tax documents against unauthorized access. You can trust that your sensitive data is safe and confidential.

Get more for Form CT 4General Business Corporation Franchise Tax

Find out other Form CT 4General Business Corporation Franchise Tax

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template