Al 8453 C Form

What is the Al 8453 C

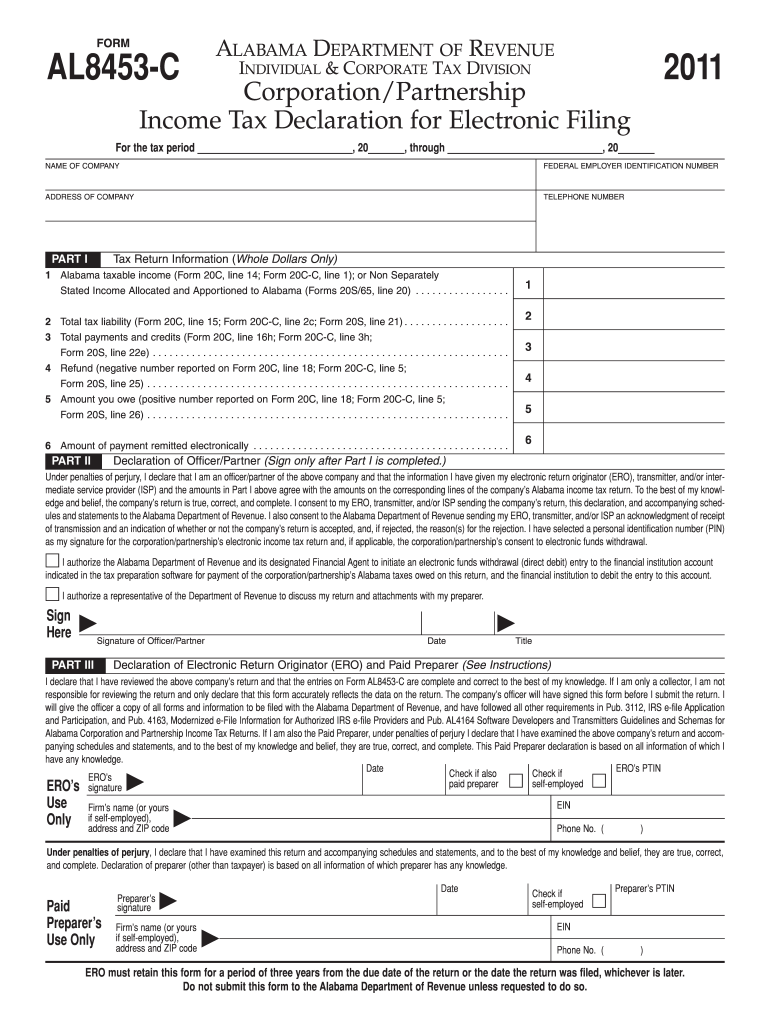

The Al 8453 C is a tax form used by partnerships in Alabama to report income, deductions, and credits to the IRS. This form is essential for ensuring compliance with federal tax regulations and is specifically designed for partnerships that need to file their tax returns electronically. By utilizing the Al 8453 C, partnerships can provide necessary information to the IRS while maintaining accurate records of their financial activities.

Steps to complete the Al 8453 C

Completing the Al 8453 C involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including income statements and expense records. Next, fill out the form by entering the required information, such as partnership details, income, and deductions. It is crucial to double-check all entries for accuracy. Once completed, the form can be submitted electronically through an authorized e-filing service or printed for manual submission.

Legal use of the Al 8453 C

The legal use of the Al 8453 C is governed by IRS regulations, which stipulate that partnerships must file this form to report their tax obligations accurately. Electronic signatures on the form are considered legally binding, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws. This ensures that the form holds legal weight in the eyes of the IRS and can be used in legal proceedings if necessary.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Al 8453 C. These guidelines include instructions on what information is required, how to report income and deductions, and deadlines for submission. Adhering to these guidelines is crucial for avoiding penalties and ensuring that the form is processed correctly. Partnerships should regularly review IRS updates to stay informed about any changes to the filing requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Al 8453 C are typically aligned with the tax return deadlines for partnerships. Generally, partnerships must file their tax returns by March 15 for the previous tax year. If additional time is needed, partnerships can apply for an extension, but it is essential to submit the Al 8453 C by the extended deadline to avoid penalties. Keeping track of these important dates helps ensure timely compliance with tax obligations.

Required Documents

To successfully complete the Al 8453 C, several documents are required. These include financial statements detailing income, expenses, and deductions, as well as any supporting documentation for credits claimed. Additionally, partnerships should have their Employer Identification Number (EIN) readily available, as this is necessary for accurate filing. Ensuring that all required documents are organized and accessible can streamline the completion process.

Form Submission Methods (Online / Mail / In-Person)

The Al 8453 C can be submitted through various methods, including online, by mail, or in person. Electronic submission is often preferred for its efficiency and speed, allowing for quicker processing by the IRS. When submitting by mail, partnerships should ensure that the form is sent to the correct IRS address and consider using a trackable mailing option. In-person submissions may be made at designated IRS offices, but this method is less common.

Quick guide on how to complete al 8453 c

Complete Al 8453 C effortlessly on any device

Online document administration has become popular among organizations and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documentation, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Al 8453 C on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Al 8453 C without stress

- Obtain Al 8453 C and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choosing. Alter and eSign Al 8453 C and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the al 8453 c

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is form 8453 c?

Form 8453 C is a crucial document used for the electronic filing of certain tax returns. It serves as a declaration that allows taxpayers to use a third-party service, like airSlate SignNow, for submitting their tax documents electronically.

-

How can airSlate SignNow help with form 8453 c?

airSlate SignNow simplifies the process of completing and submitting form 8453 c by providing a user-friendly interface for eSigning. With our software, users can easily fill out the form digitally, ensuring accuracy and compliance before submission.

-

What are the pricing options for using airSlate SignNow for form 8453 c?

airSlate SignNow offers flexible pricing plans designed to fit various business needs, starting from a basic plan to more comprehensive packages. Companies can choose the option that provides the best value for submitting documents like form 8453 c.

-

Are there any features specifically for form 8453 c in airSlate SignNow?

Yes, airSlate SignNow provides specialized features for managing form 8453 c, including customizable templates and automated workflows. These tools ensure that the form is filled correctly and eSigned efficiently, reducing the time and effort involved.

-

What are the benefits of using airSlate SignNow for form 8453 c?

Using airSlate SignNow for form 8453 c offers several benefits, such as enhanced security for sensitive tax information and greater efficiency in document processing. Additionally, the platform's ease of use ensures that users can submit their forms without unnecessary delays.

-

Can I integrate airSlate SignNow with other tools for handling form 8453 c?

Absolutely! airSlate SignNow offers multiple integrations with popular applications that can streamline your workflow for form 8453 c. By connecting with tools like cloud storage services and CRM software, users can manage their documents more effectively.

-

Is there customer support available for questions about form 8453 c on airSlate SignNow?

Yes, airSlate SignNow provides excellent customer support for all inquiries related to form 8453 c. Our dedicated support team is available to assist users with any questions or concerns they may have, ensuring a smooth experience.

Get more for Al 8453 C

- Oklahoma notary application online form

- Sample letter to beneficiaries distribution of funds 203965299 form

- Rg active half ironman training plan form

- Lees sandwiches rowland heights form

- Building notice examples 622474352 form

- Animal friends pet claim form

- How to create a contact form in wordpress step by step

- United kingdom england banknote form

Find out other Al 8453 C

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document