593 E Form 2019

What is the 593 E Form

The 593 E Form is a tax document used in the United States, primarily for reporting certain types of income that are exempt from withholding. This form is particularly relevant for individuals and businesses that receive payments that may not be subject to federal income tax withholding. Understanding the purpose and requirements of the 593 E Form is essential for ensuring compliance with IRS regulations.

How to use the 593 E Form

Using the 593 E Form involves several key steps. First, gather all necessary information related to the income you are reporting. This includes details about the payer and the amount received. Next, accurately fill out the form, ensuring that all sections are completed as required. Once the form is filled out, it should be submitted to the appropriate tax authority, typically the IRS, along with any other necessary documentation. It is important to retain a copy for your records.

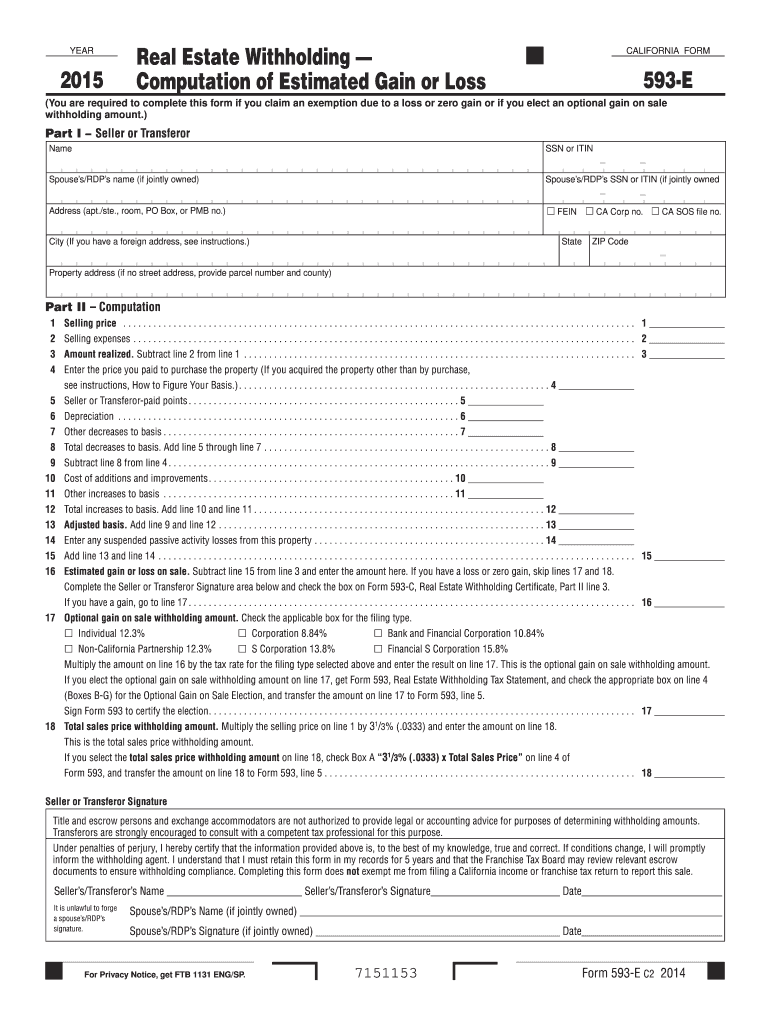

Steps to complete the 593 E Form

Completing the 593 E Form requires careful attention to detail. Start by entering your personal information, including your name and taxpayer identification number. Then, provide information about the income being reported, specifying the nature of the payment and the amount. Make sure to check for accuracy and completeness before submitting the form. Finally, review the submission guidelines to determine if you need to file electronically or by mail.

Legal use of the 593 E Form

The legal use of the 593 E Form is governed by IRS regulations. It is essential to ensure that the form is used correctly to avoid potential penalties. The form serves as a declaration of income that may be exempt from withholding, and accurate reporting is critical. Compliance with IRS guidelines helps protect taxpayers from audits and ensures that all income is reported appropriately.

Filing Deadlines / Important Dates

Filing deadlines for the 593 E Form are crucial to avoid penalties. Generally, the form must be submitted by the tax filing deadline for the year in which the income was received. It is advisable to check the IRS website for specific dates, as they may vary from year to year. Being aware of these deadlines helps ensure timely compliance and reduces the risk of incurring late fees.

Required Documents

When completing the 593 E Form, certain documents may be required to support the information reported. This includes documentation of the income received, such as payment statements or invoices. Additionally, having your taxpayer identification number and any relevant correspondence from the IRS can facilitate the completion process. Ensuring that all necessary documents are available can streamline the filing process.

Who Issues the Form

The 593 E Form is issued by the Internal Revenue Service (IRS). This federal agency is responsible for overseeing tax compliance and ensuring that all tax-related forms are properly issued and maintained. Understanding that the IRS is the authority behind this form reinforces its importance in the tax reporting process.

Quick guide on how to complete 593 e 2015 form

Complete 593 E Form seamlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle 593 E Form on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and eSign 593 E Form effortlessly

- Obtain 593 E Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal standing as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Adjust and eSign 593 E Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 593 e 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 593 e 2015 form

The best way to generate an eSignature for a PDF file in the online mode

The best way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is the 593 E Form and how is it used?

The 593 E Form is a document used for withholding tax on California sources of income. It is essential for non-residents earning income in California to report these taxes accurately. Understanding the 593 E Form is crucial for compliance with local tax laws.

-

How can airSlate SignNow help me with the 593 E Form?

airSlate SignNow offers a seamless eSignature solution that enables you to complete and send the 593 E Form electronically. With our user-friendly interface, you can easily gather signatures and ensure that all necessary parties complete their sections promptly. This streamlines the filing process, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the 593 E Form?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. Whether you are a solo entrepreneur or a large enterprise, there is an affordable option that includes all the features required for handling the 593 E Form effectively. Sign up for a free trial to explore our cost-effective solutions.

-

What features does airSlate SignNow offer for managing the 593 E Form?

airSlate SignNow offers several features perfect for managing the 593 E Form, including customizable templates, document tracking, and automated workflows. These tools enhance your efficiency and compliance by ensuring that important deadlines and steps are not missed. Experience these features to simplify your tax documentation.

-

Can I integrate airSlate SignNow with other software for the 593 E Form?

Absolutely! airSlate SignNow provides integrations with popular platforms like Google Drive, Salesforce, and Dropbox. These integrations allow you to easily import and export the 593 E Form and other documents, streamlining your workflow even further while maintaining a centralized document management system.

-

How secure is the eSigning process for the 593 E Form with airSlate SignNow?

The security of your documents is a top priority at airSlate SignNow. We use advanced encryption protocols to protect all transactions and ensure that your 593 E Form and other documents are secure. Additionally, you can track who opened, signed, and viewed your documents, ensuring complete transparency and accountability.

-

What are the benefits of using airSlate SignNow for my 593 E Form needs?

Using airSlate SignNow for your 593 E Form needs greatly enhances your efficiency by reducing paperwork and manual processes. Our platform allows for quick turnaround times and provides easy access whenever you need to manage tax forms. Enjoy a hassle-free experience during tax season with our reliable eSigning solution.

Get more for 593 E Form

- Complete these sixteen sentences to score your knowledge of present simple grammar form

- Dpd schadensmeldung pdf form

- Printable pain diagram form

- Letter to parents about student hygiene form

- Carrier packet here atlantic logistics form

- Centennial college re admit form

- Tu case id contact information telephone 18006639

- Homeopathy acute consultation intake form

Find out other 593 E Form

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure