3561 Booklet Form 2014

What is the 3561 Booklet Form

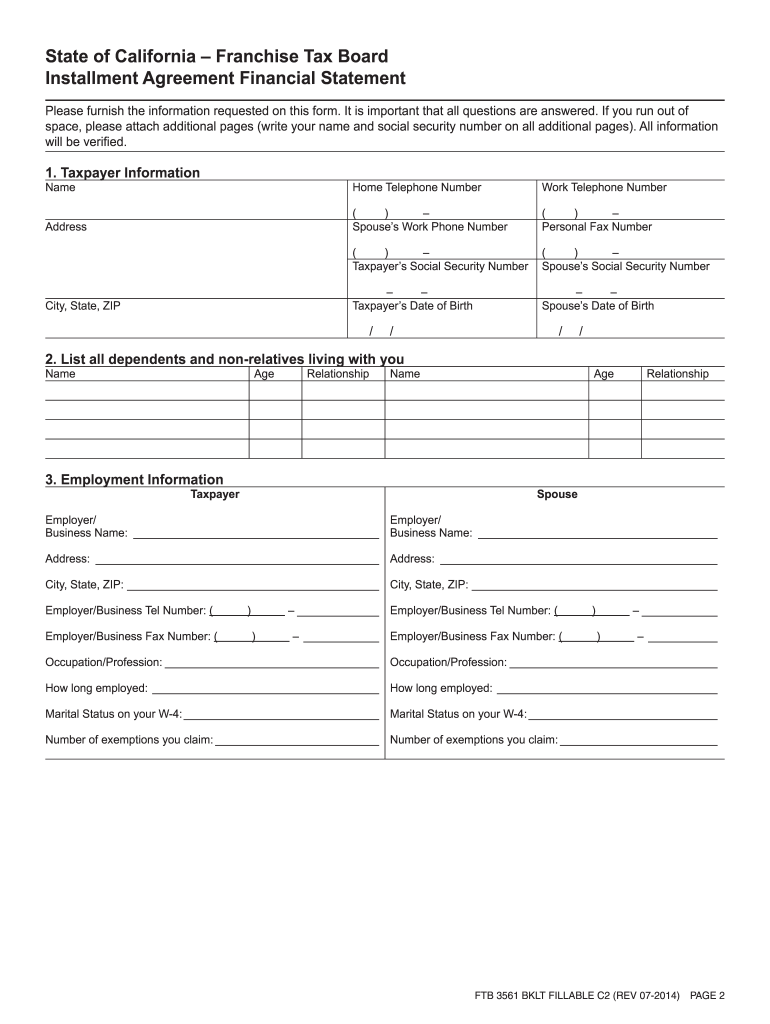

The 3561 Booklet Form is a specific document used primarily for tax purposes in the United States. This form is essential for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). It serves as a comprehensive guide to ensure that all necessary details are accurately captured, aiding in the proper assessment of tax obligations. Understanding the purpose and requirements of the 3561 Booklet Form is crucial for compliance and to avoid potential penalties.

How to use the 3561 Booklet Form

Using the 3561 Booklet Form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and expense records. Next, carefully read the instructions provided with the form to understand each section's requirements. Fill out the form completely, ensuring that all figures are accurate and reflect your financial situation. After completing the form, review it for any errors before submission. This attention to detail helps prevent delays or issues with the IRS.

Steps to complete the 3561 Booklet Form

Completing the 3561 Booklet Form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all relevant financial documents, such as income statements and receipts.

- Review the instructions accompanying the form to understand each section.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any deductions, ensuring all figures are accurate.

- Double-check your entries for errors or omissions.

- Sign and date the form before submitting it to the IRS.

Legal use of the 3561 Booklet Form

The legal use of the 3561 Booklet Form hinges on its compliance with IRS regulations. This form must be completed accurately and submitted within the designated deadlines to be considered valid. Electronic signatures are permissible, provided they meet the legal standards set forth by the ESIGN Act and UETA. Ensuring that the form is filled out correctly protects against potential legal issues and penalties associated with non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 3561 Booklet Form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the tax year following the reporting period. However, specific circumstances, such as extensions or special provisions for certain taxpayers, may alter these dates. It is essential to stay informed about any changes to filing deadlines to ensure timely submission.

Who Issues the Form

The 3561 Booklet Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax administration in the United States. The IRS provides the form along with detailed instructions to assist taxpayers in accurately reporting their financial information. Accessing the form directly from the IRS ensures that you are using the most current version, which is crucial for compliance.

Quick guide on how to complete 3561 booklet 2005 form

Complete 3561 Booklet Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed materials, as you can access the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage 3561 Booklet Form on any system with airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

The easiest way to modify and eSign 3561 Booklet Form without any hassle

- Locate 3561 Booklet Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your updates.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Modify and eSign 3561 Booklet Form and ensure effective communication at any point of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 3561 booklet 2005 form

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is the 3561 Booklet Form?

The 3561 Booklet Form is a document used for specific customs declarations and is essential for businesses involved in import/export activities. When utilizing airSlate SignNow, you can easily create, send, and eSign the 3561 Booklet Form, ensuring compliance and efficiency in your operations.

-

How can airSlate SignNow help with the 3561 Booklet Form?

airSlate SignNow streamlines the process of completing and signing the 3561 Booklet Form, providing an intuitive platform that reduces administrative burdens. With our eSignature feature, you can quickly get approvals from relevant parties, making your paperwork workflow seamless.

-

Is there a cost associated with using airSlate SignNow for the 3561 Booklet Form?

Yes, there is a pricing structure for using airSlate SignNow, which provides a cost-effective solution for managing documents like the 3561 Booklet Form. Our pricing tiers are designed to fit various business sizes and needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the 3561 Booklet Form?

airSlate SignNow includes several features for the 3561 Booklet Form, such as templates, eSigning capabilities, and secure document storage. These features enhance the document management process, allowing for quick updates and streamlined workflows.

-

Can I integrate airSlate SignNow with other tools for the 3561 Booklet Form?

Absolutely! airSlate SignNow offers integrations with various software tools that can assist in processing the 3561 Booklet Form. This flexibility allows you to incorporate the platform into your existing workflows, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for the 3561 Booklet Form?

Using airSlate SignNow for the 3561 Booklet Form offers numerous benefits, including time savings, increased accuracy, and enhanced compliance. The ability to eSign documents from anywhere accelerates the process, helping businesses operate efficiently.

-

Is it easy to get started with airSlate SignNow for the 3561 Booklet Form?

Yes, getting started with airSlate SignNow for the 3561 Booklet Form is simple. Our user-friendly interface and helpful resources guide you through the setup process, making it easy for anyone to manage their documents effectively.

Get more for 3561 Booklet Form

Find out other 3561 Booklet Form

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe