Texas Property Tax Form 50 246 2017

What is the Texas Property Tax Form 50 246

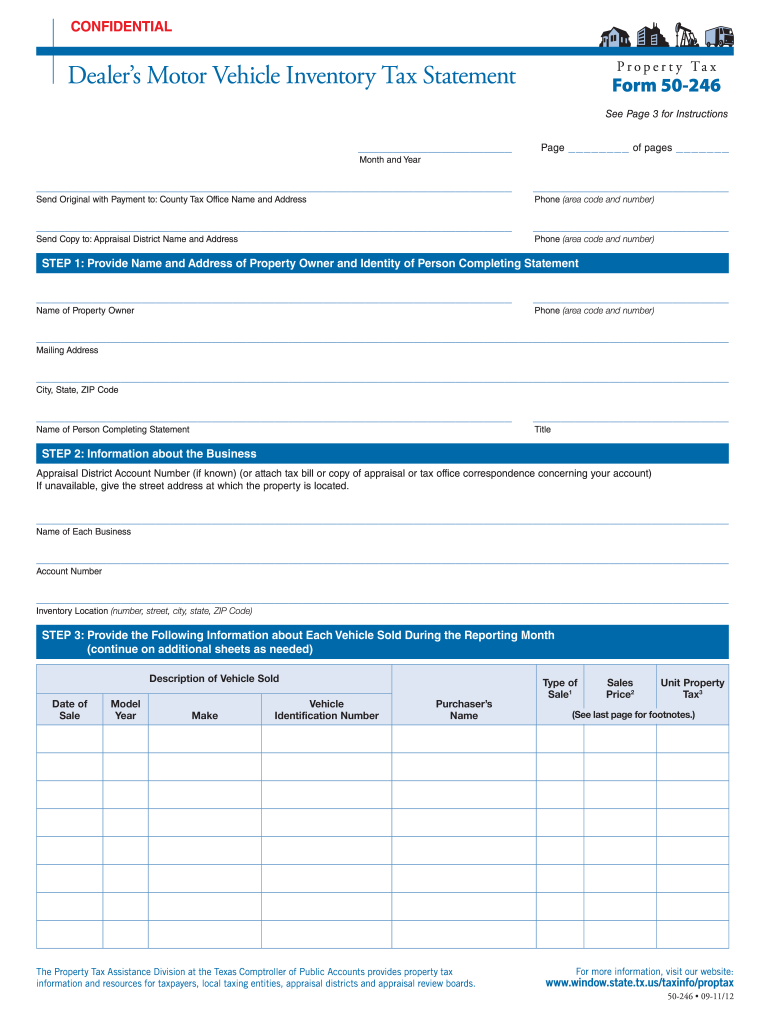

The Texas Property Tax Form 50 246 is an official document used by property owners in Texas to apply for a property tax exemption. This form is essential for individuals seeking to reduce their property tax burden by claiming exemptions based on specific criteria, such as age, disability, or veteran status. The form helps ensure that eligible property owners receive the tax relief they qualify for, thereby supporting financial stability and community welfare.

How to use the Texas Property Tax Form 50 246

To use the Texas Property Tax Form 50 246, property owners must first determine their eligibility for the exemption they wish to claim. After confirming eligibility, the form should be filled out accurately, providing all required information, such as the property owner's details, property description, and the specific exemption being requested. Once completed, the form can be submitted to the local appraisal district for processing.

Steps to complete the Texas Property Tax Form 50 246

Completing the Texas Property Tax Form 50 246 involves several key steps:

- Gather necessary information: Collect details about the property, including the address, legal description, and ownership information.

- Check eligibility: Review the criteria for the exemption being claimed to ensure compliance.

- Fill out the form: Provide accurate and complete information in all required sections of the form.

- Attach supporting documents: Include any necessary documentation that verifies eligibility, such as proof of age or disability.

- Submit the form: Send the completed form and attached documents to the appropriate local appraisal district.

Legal use of the Texas Property Tax Form 50 246

The Texas Property Tax Form 50 246 is legally binding when completed and submitted according to state regulations. It is crucial that the information provided is truthful and accurate, as any discrepancies may lead to penalties or denial of the exemption. The form must be filed within the specified deadlines to ensure consideration for the current tax year.

Key elements of the Texas Property Tax Form 50 246

Key elements of the Texas Property Tax Form 50 246 include:

- Property Owner Information: Name, address, and contact details of the property owner.

- Property Description: Specific details about the property, including its location and legal description.

- Exemption Type: The specific exemption being claimed, such as homestead, disability, or veteran.

- Signature: The property owner must sign the form to certify the accuracy of the information provided.

Form Submission Methods

The Texas Property Tax Form 50 246 can be submitted through various methods, including:

- Online: Many local appraisal districts offer electronic submission options through their websites.

- Mail: The completed form can be printed and mailed to the appropriate appraisal district office.

- In-Person: Property owners may also choose to deliver the form directly to their local appraisal district office.

Quick guide on how to complete texas property tax form 50 246 2012

Complete Texas Property Tax Form 50 246 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Texas Property Tax Form 50 246 on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-centric workflow today.

How to modify and eSign Texas Property Tax Form 50 246 with ease

- Find Texas Property Tax Form 50 246 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional signature in ink.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Texas Property Tax Form 50 246 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct texas property tax form 50 246 2012

Create this form in 5 minutes!

How to create an eSignature for the texas property tax form 50 246 2012

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Texas Property Tax Form 50 246?

Texas Property Tax Form 50 246 is a crucial document for property owners in Texas, utilized to apply for a property tax exemption. This form is specifically designed to help reduce the taxable value of residential properties, making it essential for homeowners seeking financial relief on their property taxes.

-

How do I complete the Texas Property Tax Form 50 246?

To complete the Texas Property Tax Form 50 246, you will need specific information regarding your property, including its location, ownership details, and any qualifications for exemptions. With airSlate SignNow, you can easily fill out, sign, and submit this form online, ensuring a seamless and efficient process.

-

Are there any fees associated with filing Texas Property Tax Form 50 246?

Filing the Texas Property Tax Form 50 246 typically does not incur a fee; however, it’s essential to check with your local appraisal district for any potential costs. Using airSlate SignNow, you can streamline your e-filing process without additional charges, providing a cost-effective solution for your property tax needs.

-

Can I track the status of my Texas Property Tax Form 50 246 submission?

Yes, with airSlate SignNow, you can track the status of your Texas Property Tax Form 50 246 submission in real time. This feature allows you to stay updated on your application's progress and ensures you have all necessary documentation submitted correctly.

-

What features does airSlate SignNow provide for handling Texas Property Tax Form 50 246?

airSlate SignNow offers features such as electronic signatures, document templates, and secure cloud storage, making it an ideal platform for managing your Texas Property Tax Form 50 246. These tools help simplify the documentation process, ensuring that your form is completed accurately and efficiently.

-

How does using airSlate SignNow benefit my Texas Property Tax Form 50 246 submissions?

Using airSlate SignNow for your Texas Property Tax Form 50 246 submissions benefits you by facilitating quick, easy, and secure document handling. This platform eliminates the hassle of paper forms and allows you to manage your submissions from anywhere, enabling greater convenience and efficiency.

-

Is it easy to integrate airSlate SignNow with other applications for Texas Property Tax Form 50 246?

Absolutely! airSlate SignNow offers seamless integration with various applications and services, allowing you to streamline your workflow with the Texas Property Tax Form 50 246. This capability enhances your efficiency in handling documents and ensures that your forms are processed without interruptions.

Get more for Texas Property Tax Form 50 246

Find out other Texas Property Tax Form 50 246

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template