720 Vi Form 2013

What is the 720 Vi Form

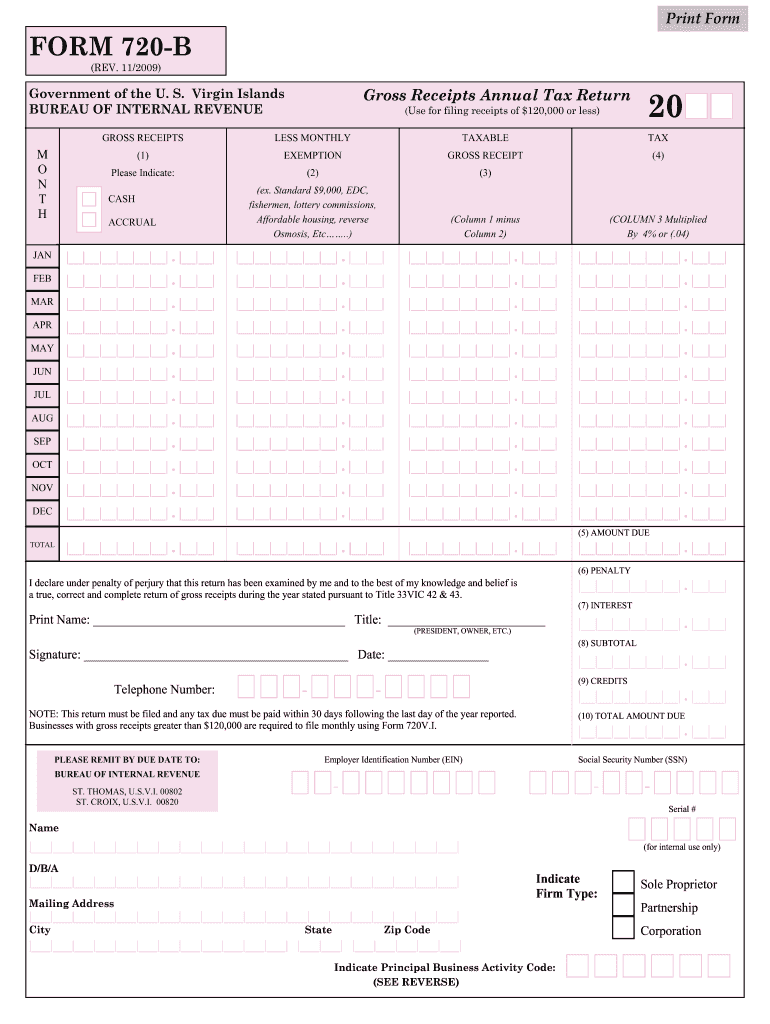

The 720 Vi Form is a tax document used in the U.S. Virgin Islands for reporting various types of income, deductions, and credits. It is essential for individuals and businesses operating within the territory to ensure compliance with local tax regulations. The form captures critical financial information that helps the Virgin Islands Bureau of Internal Revenue assess tax liabilities accurately. Understanding the purpose of the 720 Vi Form is crucial for anyone engaging in economic activities in the Virgin Islands.

Steps to complete the 720 Vi Form

Completing the 720 Vi Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax records. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay close attention to the calculations, as errors can lead to penalties or delays in processing. After completing the form, review it thoroughly before submission to ensure that all required signatures and dates are included.

How to obtain the 720 Vi Form

The 720 Vi Form can be obtained through the Virgin Islands Bureau of Internal Revenue's official website or by visiting their local offices. It is advisable to download the most current version of the form to ensure compliance with any recent updates or changes in tax law. Additionally, taxpayers may request a physical copy of the form by contacting the Bureau directly. Having the correct version of the form is essential for accurate reporting and compliance.

Legal use of the 720 Vi Form

The legal use of the 720 Vi Form is governed by the tax laws of the U.S. Virgin Islands. It is important for taxpayers to understand that submitting this form is not just a matter of compliance but also a legal obligation. Failure to file the form correctly or on time may result in penalties, interest on unpaid taxes, or even legal action. Therefore, ensuring that the form is filled out accurately and submitted within the designated deadlines is crucial for maintaining compliance with local tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 720 Vi Form are critical to avoid penalties. Typically, the form must be submitted by the same deadlines as federal tax returns, which is usually April 15 for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special provisions for businesses. It is essential to stay informed about any changes to these dates and to mark them on your calendar to ensure timely submission.

Required Documents

To complete the 720 Vi Form, several documents are required to substantiate the information reported. These typically include income statements such as W-2s or 1099s, receipts for deductible expenses, and any other financial records that support the claims made on the form. Having these documents organized and readily available can streamline the completion process and help prevent errors that could lead to complications with tax authorities.

Quick guide on how to complete 720 vi 2009 form

Complete 720 Vi Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle 720 Vi Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign 720 Vi Form with ease

- Obtain 720 Vi Form and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to store your changes.

- Select your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form retrieval, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign 720 Vi Form to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 720 vi 2009 form

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to the 2009 virgin islands?

airSlate SignNow is a versatile eSignature solution that enables businesses to send and sign documents seamlessly. The 2009 virgin islands refer to a signNow period for document management innovations, marking the growth of digital signatures. Our platform is designed to simplify these processes for companies in that region and beyond.

-

How much does airSlate SignNow cost for users in the 2009 virgin islands?

Pricing for airSlate SignNow varies based on the chosen plan, but we offer competitive rates tailored for businesses in the 2009 virgin islands. Plans range from basic to advanced features, ensuring you can select the right option that meets your budget and needs while empowering your digital workflow.

-

What features does airSlate SignNow offer to customers in the 2009 virgin islands?

airSlate SignNow provides a range of features, including customizable templates, team collaboration tools, and advanced reporting capabilities. For users in the 2009 virgin islands, these features enhance document management efficiency, ensuring smooth operations and compliance with regional regulations.

-

Can I integrate airSlate SignNow with other software commonly used in the 2009 virgin islands?

Yes, airSlate SignNow can be integrated with numerous third-party applications, making it highly compatible with popular software solutions in the 2009 virgin islands. Whether you're using CRM tools or project management software, our platform helps streamline your business processes.

-

What are the benefits of using airSlate SignNow for businesses in the 2009 virgin islands?

Using airSlate SignNow provides numerous benefits, such as cost savings, increased productivity, and enhanced security for document transactions. For businesses in the 2009 virgin islands, adopting eSignatures means quicker turnaround times and better customer experiences.

-

Is airSlate SignNow secure for users in the 2009 virgin islands?

Absolutely! airSlate SignNow employs advanced encryption and compliance features to ensure the security of your documents. For businesses in the 2009 virgin islands, this level of security offers peace of mind and helps meet regulatory obligations.

-

How can airSlate SignNow improve workflow efficiency for companies in the 2009 virgin islands?

airSlate SignNow enhances workflow efficiency by automating document signing processes and reducing manual tasks. Companies in the 2009 virgin islands can benefit from faster approvals, which ultimately leads to faster project completion and improved client satisfaction.

Get more for 720 Vi Form

Find out other 720 Vi Form

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT