Vermont Sales Tax Form S 3 2013

What is the Vermont Sales Tax Form S-3

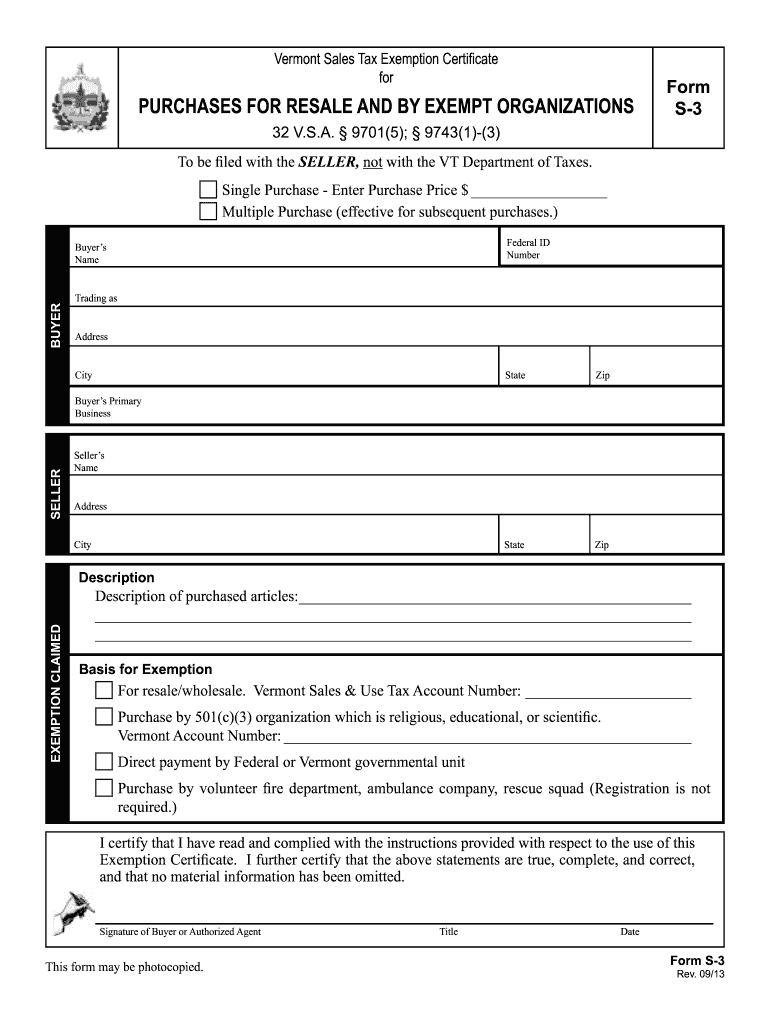

The Vermont Sales Tax Form S-3 is a tax document used by businesses and individuals in Vermont to report and remit sales tax collected on taxable sales. This form is essential for ensuring compliance with Vermont's sales tax regulations. It provides a structured way to calculate the total sales tax due based on the sales made during a specific reporting period. The form must be completed accurately to avoid penalties and ensure proper tax reporting.

How to use the Vermont Sales Tax Form S-3

Using the Vermont Sales Tax Form S-3 involves several key steps. First, gather all necessary sales records for the reporting period. This includes invoices, receipts, and any other documentation that shows the sales made. Next, complete the form by entering the total sales amount, the applicable sales tax rate, and calculating the total sales tax due. After filling out the form, review it for accuracy before submitting it to the Vermont Department of Taxes.

Steps to complete the Vermont Sales Tax Form S-3

Completing the Vermont Sales Tax Form S-3 involves a systematic approach:

- Collect all sales data for the reporting period.

- Determine the total sales amount and applicable sales tax rate.

- Fill in the required fields on the form, including your business information and sales figures.

- Calculate the total sales tax due based on your sales amount.

- Review the completed form for any errors or omissions.

- Submit the form to the Vermont Department of Taxes by the due date.

Key elements of the Vermont Sales Tax Form S-3

The Vermont Sales Tax Form S-3 includes several key elements that are crucial for proper completion:

- Business Information: Name, address, and tax identification number of the business.

- Sales Details: Total sales amount, including taxable and non-taxable sales.

- Sales Tax Calculation: The applicable sales tax rate and total sales tax due.

- Signature: Required signature of the taxpayer or authorized representative.

Form Submission Methods

The Vermont Sales Tax Form S-3 can be submitted through various methods. Taxpayers have the option to file the form online through the Vermont Department of Taxes website, which provides a convenient way to ensure timely submission. Alternatively, the form can be mailed directly to the department or submitted in person at a local tax office. It is important to choose the method that best suits your needs while ensuring compliance with submission deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Vermont Sales Tax Form S-3 are critical for compliance. Typically, the form is due on the 25th of the month following the end of the reporting period. For example, sales made in January would need to be reported by February 25. It is essential to stay informed about any changes to these deadlines to avoid late fees or penalties.

Quick guide on how to complete vermont sales tax form s 3 2003

Complete Vermont Sales Tax Form S 3 effortlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without complications. Manage Vermont Sales Tax Form S 3 on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to modify and electronically sign Vermont Sales Tax Form S 3 with ease

- Locate Vermont Sales Tax Form S 3 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, lengthy form navigation, or errors that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Vermont Sales Tax Form S 3 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vermont sales tax form s 3 2003

Create this form in 5 minutes!

How to create an eSignature for the vermont sales tax form s 3 2003

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Vermont Sales Tax Form S 3?

The Vermont Sales Tax Form S 3 is a document used by businesses to report and pay their sales tax obligations in Vermont. It ensures compliance with state tax regulations and helps streamline the filing process.

-

How can airSlate SignNow help me with the Vermont Sales Tax Form S 3?

AirSlate SignNow offers a user-friendly platform that allows you to easily create, send, and eSign your Vermont Sales Tax Form S 3. This solution helps save time and reduces errors, ensuring accurate submissions.

-

What features does airSlate SignNow offer for managing the Vermont Sales Tax Form S 3?

At airSlate SignNow, you'll find features like customizable templates, real-time tracking, and secure eSigning, all designed to facilitate the efficient processing of the Vermont Sales Tax Form S 3. These tools enhance collaboration and simplify tax filing.

-

Is there a cost associated with using airSlate SignNow for the Vermont Sales Tax Form S 3?

Yes, airSlate SignNow provides various pricing plans tailored to meet different business needs. Each plan offers access to important features for processing the Vermont Sales Tax Form S 3, all at a cost-effective rate.

-

Can I integrate airSlate SignNow with other software for managing the Vermont Sales Tax Form S 3?

AirSlate SignNow seamlessly integrates with various software tools such as accounting systems and CRMs. This integration allows for efficient data transfer when managing the Vermont Sales Tax Form S 3, reducing duplication of effort.

-

What are the benefits of using airSlate SignNow for the Vermont Sales Tax Form S 3?

Using airSlate SignNow for the Vermont Sales Tax Form S 3 provides numerous benefits, including improved accuracy, increased efficiency, and enhanced security for your tax documents. This solution empowers businesses to focus more on growth rather than paperwork.

-

Is airSlate SignNow compliant with Vermont tax regulations for the Sales Tax Form S 3?

Absolutely! AirSlate SignNow is designed to comply with Vermont's tax regulations, ensuring that your Vermont Sales Tax Form S 3 is processed accurately and in accordance with state requirements.

Get more for Vermont Sales Tax Form S 3

Find out other Vermont Sales Tax Form S 3

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online