Exemption CertificatesDepartment of Taxes VermontPrintable Vermont Sales Tax Exemption CertificatesExemptionsDepartment of Motor 2021-2026

Understanding Vermont Form S-3

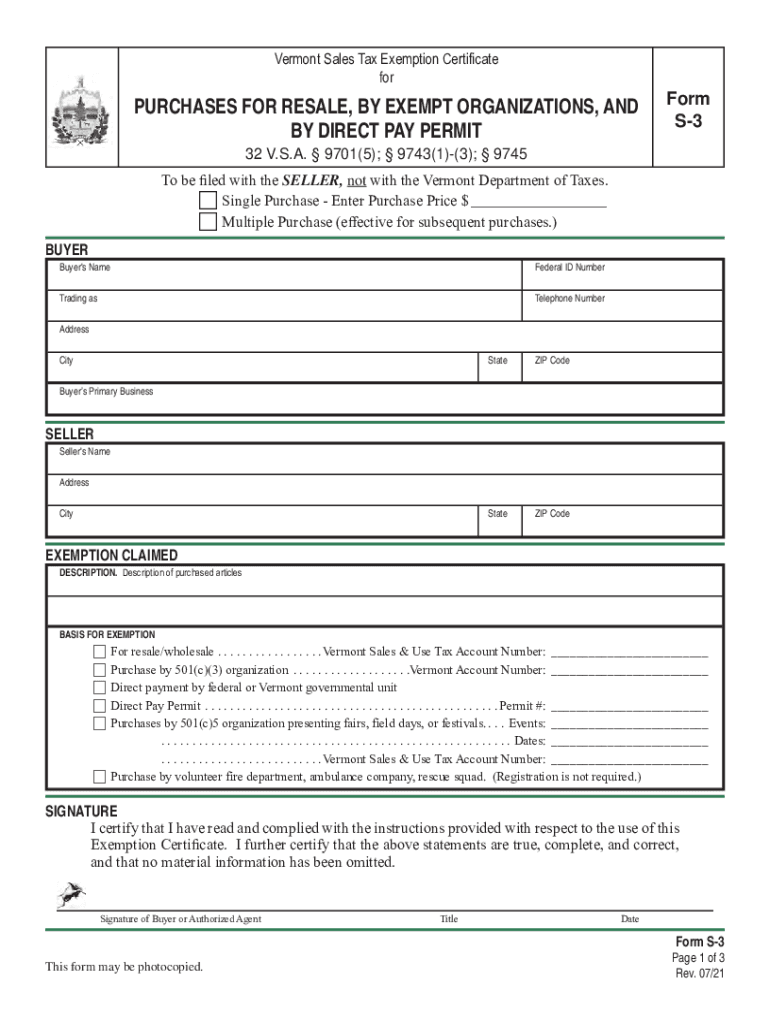

The Vermont Form S-3 is a crucial document for individuals and businesses seeking a sales tax exemption in the state of Vermont. This form is primarily used to certify that certain purchases are exempt from sales tax, allowing eligible entities to save on costs associated with taxable goods and services. Understanding the specific use cases and requirements of the S-3 form is essential for compliance with Vermont tax regulations.

Steps to Complete Vermont Form S-3

Completing the Vermont Form S-3 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the purchaser's details and the seller's information. Next, accurately fill out the form by providing the appropriate exemption reason, which may include categories such as resale or nonprofit status. Ensure that all signatures are obtained where required, as this validates the exemption claim. It is advisable to review the form for completeness before submission.

Eligibility Criteria for Using Form S-3

To utilize the Vermont Form S-3, certain eligibility criteria must be met. Generally, businesses that are registered for sales tax and have a valid resale certificate can apply. Nonprofit organizations and governmental entities may also qualify for exemptions under specific conditions. It is important to verify that the purchases being claimed for exemption align with the reasons specified in the form to avoid potential compliance issues.

Legal Use of Vermont Form S-3

The legal use of Vermont Form S-3 is governed by state tax laws. The form must be used appropriately to avoid penalties associated with improper claims. This includes ensuring that the form is filled out correctly and submitted in accordance with Vermont Department of Taxes guidelines. Misuse of the form can lead to audits and potential fines, making it essential for users to understand their responsibilities when claiming sales tax exemptions.

Key Elements of Vermont Form S-3

Key elements of the Vermont Form S-3 include the purchaser's name, address, and tax identification number, as well as the seller's information. The form also requires a clear indication of the exemption type being claimed, along with the signature of the purchaser or an authorized representative. Providing accurate and complete information is vital to ensure that the exemption is honored by the seller and recognized by the state.

Examples of Using Vermont Form S-3

Examples of using Vermont Form S-3 can help clarify its application. For instance, a retail business purchasing inventory for resale would complete the form to exempt those purchases from sales tax. Similarly, a nonprofit organization buying supplies for charitable events may also use the S-3 form to claim tax exemption. Understanding these scenarios can assist users in determining when and how to apply for exemptions effectively.

Quick guide on how to complete exemption certificatesdepartment of taxes vermontprintable vermont sales tax exemption certificatesexemptionsdepartment of

Fill out Exemption CertificatesDepartment Of Taxes VermontPrintable Vermont Sales Tax Exemption CertificatesExemptionsDepartment Of Motor seamlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed papers, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Exemption CertificatesDepartment Of Taxes VermontPrintable Vermont Sales Tax Exemption CertificatesExemptionsDepartment Of Motor on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and electronically sign Exemption CertificatesDepartment Of Taxes VermontPrintable Vermont Sales Tax Exemption CertificatesExemptionsDepartment Of Motor with ease

- Obtain Exemption CertificatesDepartment Of Taxes VermontPrintable Vermont Sales Tax Exemption CertificatesExemptionsDepartment Of Motor and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important areas of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Exemption CertificatesDepartment Of Taxes VermontPrintable Vermont Sales Tax Exemption CertificatesExemptionsDepartment Of Motor and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct exemption certificatesdepartment of taxes vermontprintable vermont sales tax exemption certificatesexemptionsdepartment of

Create this form in 5 minutes!

People also ask

-

What is Vermont Form S 3 and why do I need it?

Vermont Form S 3 is a state-specific document used for various tax purposes in Vermont. It is essential for businesses and individuals who need to report income, deductions, and other tax-related information accurately. Utilizing airSlate SignNow to manage Vermont Form S 3 can streamline the filing process.

-

How can airSlate SignNow help with Vermont Form S 3?

AirSlate SignNow provides a user-friendly platform to eSign and manage Vermont Form S 3 efficiently. By using our service, you can quickly create, send, and track your documents, ensuring that your filings are timely and compliant. This helps reduce the administrative burden associated with tax documentation.

-

What pricing plans are available for using airSlate SignNow for Vermont Form S 3?

AirSlate SignNow offers flexible pricing plans tailored to meet different business needs, starting from a basic tier to more comprehensive packages. Each plan includes tools to manage Vermont Form S 3 and other important documents. By choosing the right plan, you can ensure that you only pay for what you need.

-

Is airSlate SignNow secure for handling Vermont Form S 3?

Yes, airSlate SignNow prioritizes security with bank-level encryption and secure user access controls. When managing sensitive documents like Vermont Form S 3, you can rest assured that your information is protected. Our platform complies with industry standards to keep your data safe.

-

Can I integrate airSlate SignNow with other applications for Vermont Form S 3?

Absolutely, airSlate SignNow supports integrations with various applications such as CRM systems, cloud storage, and productivity tools. This makes it easier to manage Vermont Form S 3 alongside other business processes. Integrating our service simplifies document workflows across your organization.

-

What are the benefits of using airSlate SignNow for Vermont Form S 3 over traditional methods?

Using airSlate SignNow for Vermont Form S 3 offers numerous advantages over traditional paper methods, including faster processing times and reduced administrative effort. You can eSign documents from anywhere, track changes in real-time, and eliminate the risk of lost paperwork. This enhances overall efficiency and accuracy.

-

How do I get started with airSlate SignNow for Vermont Form S 3?

Getting started with airSlate SignNow for Vermont Form S 3 is easy! Simply visit our website, sign up for an account, and explore the user-friendly interface. You can begin creating and managing your Vermont Form S 3 documents within minutes, with access to helpful resources and support.

Get more for Exemption CertificatesDepartment Of Taxes VermontPrintable Vermont Sales Tax Exemption CertificatesExemptionsDepartment Of Motor

- Assignment to living trust oklahoma form

- Notice of assignment to living trust oklahoma form

- Revocation of living trust oklahoma form

- Letter to lienholder to notify of trust oklahoma form

- Timber sale contract oklahoma form

- Forest products sale contract timber oklahoma form

- Easement 497323256 form

- Oklahoma easement form

Find out other Exemption CertificatesDepartment Of Taxes VermontPrintable Vermont Sales Tax Exemption CertificatesExemptionsDepartment Of Motor

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement