Tax Transfer Form Au330 2018

What is the Tax Transfer Form Au330

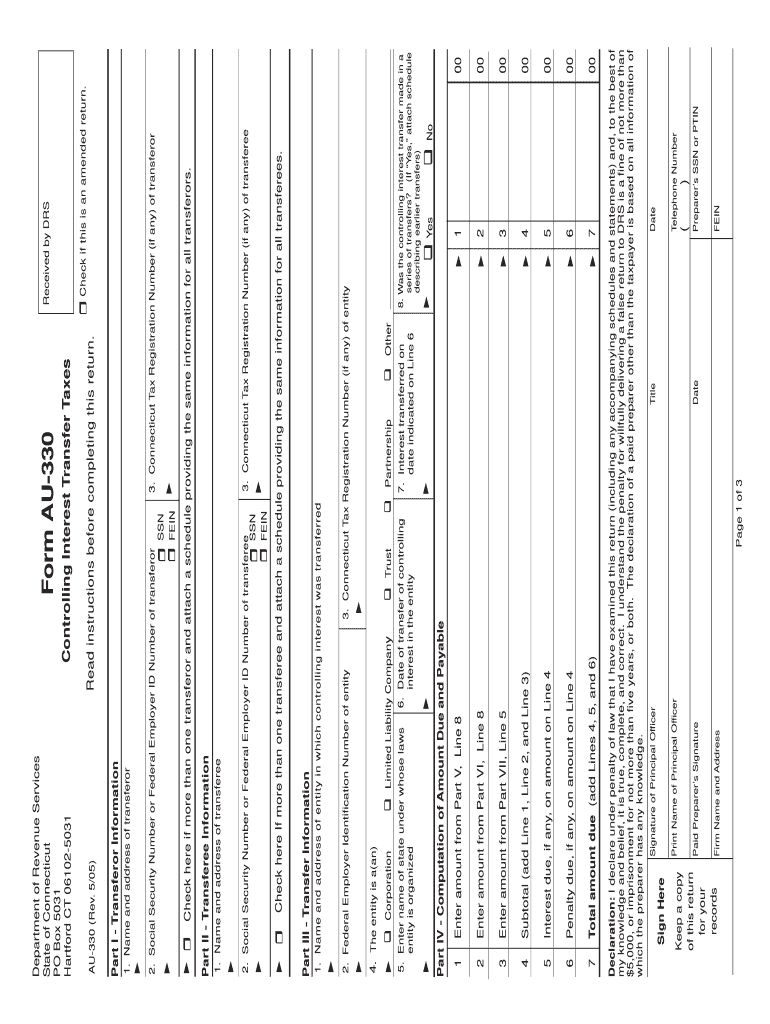

The Tax Transfer Form Au330 is a specific document used in the United States to facilitate the transfer of tax-related information between entities or individuals. This form is essential for ensuring that tax obligations are accurately reported and that any necessary adjustments to tax records are made. It typically includes fields for personal information, tax identification numbers, and details related to the transfer of tax liabilities or credits. Understanding the purpose and function of this form is crucial for compliance with tax regulations.

How to use the Tax Transfer Form Au330

Using the Tax Transfer Form Au330 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including tax identification numbers and relevant financial details. Next, fill out the form carefully, ensuring that all fields are completed accurately. It is advisable to review the form for any errors before submitting it. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements of the tax authority involved.

Steps to complete the Tax Transfer Form Au330

To complete the Tax Transfer Form Au330 effectively, follow these steps:

- Gather required documentation, including previous tax returns and identification numbers.

- Carefully fill in personal information, ensuring accuracy in names and addresses.

- Provide details regarding the tax transfer, including amounts and relevant dates.

- Review the completed form for any mistakes or missing information.

- Sign and date the form as required, ensuring compliance with eSignature laws if submitting electronically.

Legal use of the Tax Transfer Form Au330

The legal use of the Tax Transfer Form Au330 is governed by federal and state tax laws. To be considered valid, the form must be completed accurately and submitted within the designated timeframes. Additionally, it is important to ensure that any electronic signatures used comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Adhering to these legal standards helps to ensure that the form is recognized as a legitimate document by tax authorities.

Key elements of the Tax Transfer Form Au330

Key elements of the Tax Transfer Form Au330 include:

- Personal Information: This section requires the names, addresses, and tax identification numbers of the parties involved.

- Transfer Details: Information regarding the nature of the tax transfer, including amounts and relevant tax periods.

- Signature Section: A designated area for signatures, which may include electronic signature options for digital submissions.

- Instructions: Guidance on how to complete and submit the form, including any specific state requirements.

Form Submission Methods (Online / Mail / In-Person)

The Tax Transfer Form Au330 can be submitted through various methods, depending on the requirements of the tax authority. Common submission methods include:

- Online Submission: Many tax authorities allow for electronic submission through their official websites, which may require creating an account.

- Mail: The completed form can be printed and mailed to the appropriate tax office, ensuring that it is sent to the correct address.

- In-Person: Some individuals may choose to submit the form in person at local tax offices, which can provide immediate confirmation of receipt.

Quick guide on how to complete tax transfer form au330 2005

Complete Tax Transfer Form Au330 effortlessly on any device

Digital document management has gained immense popularity among organizations and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Tax Transfer Form Au330 on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Tax Transfer Form Au330 effortlessly

- Find Tax Transfer Form Au330 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Tax Transfer Form Au330 to ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax transfer form au330 2005

Create this form in 5 minutes!

How to create an eSignature for the tax transfer form au330 2005

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the Tax Transfer Form Au330?

The Tax Transfer Form Au330 is a document used for transferring tax responsibilities or ownership between entities in Australia. It simplifies and streamlines the process of managing tax liabilities ensuring all parties comply with local regulations. Utilizing airSlate SignNow can help you complete and eSign the Tax Transfer Form Au330 quickly.

-

How does airSlate SignNow facilitate the completion of the Tax Transfer Form Au330?

AirSlate SignNow offers a user-friendly interface to help you easily fill out and electronically sign the Tax Transfer Form Au330. The platform provides templates and digital tools to enhance accuracy and expedite the document completion process. With airSlate SignNow, you can efficiently manage your tax transfer paperwork online.

-

Can I customize the Tax Transfer Form Au330 in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the Tax Transfer Form Au330 according to your specific needs. You can add or remove fields, include company logos, and adjust other parameters to match your business requirements. This customization feature ensures that your forms are tailored to suit your exact purpose.

-

Is airSlate SignNow secure for handling the Tax Transfer Form Au330?

Absolutely! AirSlate SignNow prioritizes security and compliance when handling documents like the Tax Transfer Form Au330. The platform uses advanced encryption protocols and secure cloud storage to protect sensitive information, ensuring that your data remains confidential and secure throughout the signing process.

-

What are the pricing options for using airSlate SignNow for the Tax Transfer Form Au330?

AirSlate SignNow offers various pricing plans tailored to fit different business needs, including monthly and annual subscriptions. For users completing the Tax Transfer Form Au330, it's best to check the official website for the latest pricing details and current promotions. The pricing is designed to be cost-effective while providing premium features for document processing.

-

What features does airSlate SignNow offer for the Tax Transfer Form Au330?

AirSlate SignNow includes several features to enhance your experience with the Tax Transfer Form Au330, such as template creation, multi-party signing, and real-time notifications. These features streamline the signing process and improve document management efficiency. As a result, you can handle tax transfers more effectively.

-

Does airSlate SignNow integrate with other platforms for the Tax Transfer Form Au330?

Yes, airSlate SignNow easily integrates with various platforms to allow seamless handling of the Tax Transfer Form Au330. Whether using CRM systems, cloud storage options, or accounting software, the integrations enhance your document workflow. This capability makes it easier to manage your tax documents across different applications.

Get more for Tax Transfer Form Au330

Find out other Tax Transfer Form Au330

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template