Connecticut Form Au 330 2018-2026

What is the Connecticut Form Au 330

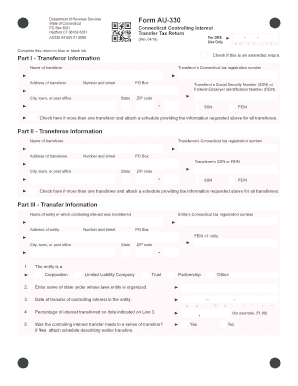

The Connecticut Form Au 330 is a tax document used for reporting the transfer of real estate in the state of Connecticut. This form is specifically designed for the Connecticut controlling interest transfer tax, which applies when a transferor sells or transfers a controlling interest in a business entity that owns real property. The form captures essential details about the transaction, including the parties involved, the property being transferred, and the applicable tax calculations. Understanding this form is crucial for ensuring compliance with state tax laws and accurately reporting any transfer taxes owed.

Steps to Complete the Connecticut Form Au 330

Completing the Connecticut Form Au 330 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the property and the parties involved in the transfer. Next, fill out the form by providing details such as the names of the transferor and transferee, property description, and the consideration amount. It is important to calculate the transfer tax based on the value of the controlling interest being transferred. After filling out the form, review it for completeness and accuracy before signing. Finally, submit the form to the appropriate state department along with any required payment for the transfer tax.

How to Obtain the Connecticut Form Au 330

The Connecticut Form Au 330 can be obtained from the official website of the Connecticut Department of Revenue Services. The form is typically available as a downloadable PDF, which can be printed and completed by hand or filled out electronically. Additionally, physical copies may be available at local government offices or tax assistance centers. It is essential to ensure that you are using the most current version of the form to avoid any compliance issues.

Required Documents for the Connecticut Form Au 330

When completing the Connecticut Form Au 330, certain documents may be required to support the information provided. These documents typically include:

- A copy of the purchase and sale agreement.

- Documentation proving the value of the controlling interest being transferred.

- Identification information for both the transferor and transferee.

- Any additional forms or declarations required by the Connecticut Department of Revenue Services.

Having these documents ready can facilitate a smoother filing process and help ensure that all necessary information is accurately reported.

Penalties for Non-Compliance

Failure to comply with the requirements of the Connecticut Form Au 330 can result in significant penalties. These may include fines for late filing, interest on unpaid transfer taxes, and potential legal repercussions. It is important to adhere to all filing deadlines and accurately report any transfer taxes to avoid these penalties. Understanding the specific compliance requirements can help mitigate risks associated with non-compliance.

Filing Deadlines for the Connecticut Form Au 330

Filing deadlines for the Connecticut Form Au 330 are critical to ensure timely compliance with state tax laws. Generally, the form must be filed within a specific timeframe following the transfer of the controlling interest. It is advisable to check the Connecticut Department of Revenue Services for the most current deadlines, as these can vary based on the nature of the transaction and any updates to state regulations. Meeting these deadlines is essential to avoid penalties and ensure proper processing of the transfer tax.

Quick guide on how to complete form au 330 2018 2019

Your assistance manual on how to prepare your Connecticut Form Au 330

If you’re curious about how to generate and send your Connecticut Form Au 330, below are a few brief guidelines on how to simplify tax submission.

To start, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures while returning to modify responses as needed. Optimize your tax handling with enhanced PDF editing, eSigning, and straightforward sharing.

Adhere to the following steps to finish your Connecticut Form Au 330 in just a few minutes:

- Create your account and begin working on PDFs within moments.

- Utilize our library to find any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Connecticut Form Au 330 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Use the Signature Tool to insert your legally-binding eSignature (if applicable).

- Review your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting via paper can result in increased errors on returns and delays in reimbursements. Naturally, before electronically filing your taxes, visit the IRS website for declaration regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form au 330 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the form au 330 2018 2019

How to make an eSignature for the Form Au 330 2018 2019 in the online mode

How to make an eSignature for the Form Au 330 2018 2019 in Google Chrome

How to make an eSignature for putting it on the Form Au 330 2018 2019 in Gmail

How to create an electronic signature for the Form Au 330 2018 2019 straight from your smartphone

How to make an eSignature for the Form Au 330 2018 2019 on iOS

How to create an eSignature for the Form Au 330 2018 2019 on Android devices

People also ask

-

What are Connecticut transfer taxes?

Connecticut transfer taxes are fees imposed on the transfer of property ownership in Connecticut. These taxes are typically calculated based on the sale price of the property. Understanding these taxes is crucial for both buyers and sellers to anticipate their total closing costs.

-

How do Connecticut transfer taxes affect property transactions?

Connecticut transfer taxes directly affect the financial aspects of property transactions. Buyers and sellers should be aware of these taxes to effectively budget for the total cost of the sale. Proper knowledge of Connecticut transfer taxes can prevent unexpected expenses during closing.

-

What is the rate of Connecticut transfer taxes?

The rate of Connecticut transfer taxes varies depending on the property's selling price and certain exemptions. Typically, the tax ranges from 0.75% to 2.5% of the property's value. It's important to consult with a real estate professional to get a precise understanding of applicable rates.

-

How does airSlate SignNow simplify the process of managing Connecticut transfer taxes?

airSlate SignNow streamlines the document signing process involved in property transactions, including those that pertain to Connecticut transfer taxes. Our easy-to-use platform allows users to prepare and e-sign necessary documents quickly, ensuring compliance with local regulations while saving time and frustration.

-

Are there any discounts available for eSigning documents related to Connecticut transfer taxes?

While airSlate SignNow focuses on providing a cost-effective service for document management, we also offer various pricing packages. While there is no specific discount for Connecticut transfer taxes documents, using our platform can overall reduce transaction costs by speeding up the signing process.

-

Can airSlate SignNow integrate with real estate software for Connecticut transfer taxes?

Yes, airSlate SignNow offers integrations with various real estate software to facilitate the management of Connecticut transfer taxes. By connecting our platform with existing software tools, users can automate workflows and enhance their document handling processes for property transactions.

-

What benefits does airSlate SignNow provide for handling Connecticut transfer taxes paperwork?

Using airSlate SignNow simplifies handling paperwork related to Connecticut transfer taxes by providing an efficient e-signature solution. This not only speeds up the signing process but also enhances security and compliance, making it easier for businesses to manage their transaction documents.

Get more for Connecticut Form Au 330

- Death claim form rflip fund rflipfund co

- Mohawk college diploma request form

- Aetna dental claim form iu

- Wedding information sheet

- Kent jeffirs form

- Cr 105 defendants financial statement on eligibility for appointment of counsel and reimbursement and record on appeal at form

- Land purchase contract template form

- Land payoff contract template form

Find out other Connecticut Form Au 330

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document