Tennessee County Business Tax Return Bus 415 Form 2015

What is the Tennessee County Business Tax Return Bus 415 Form

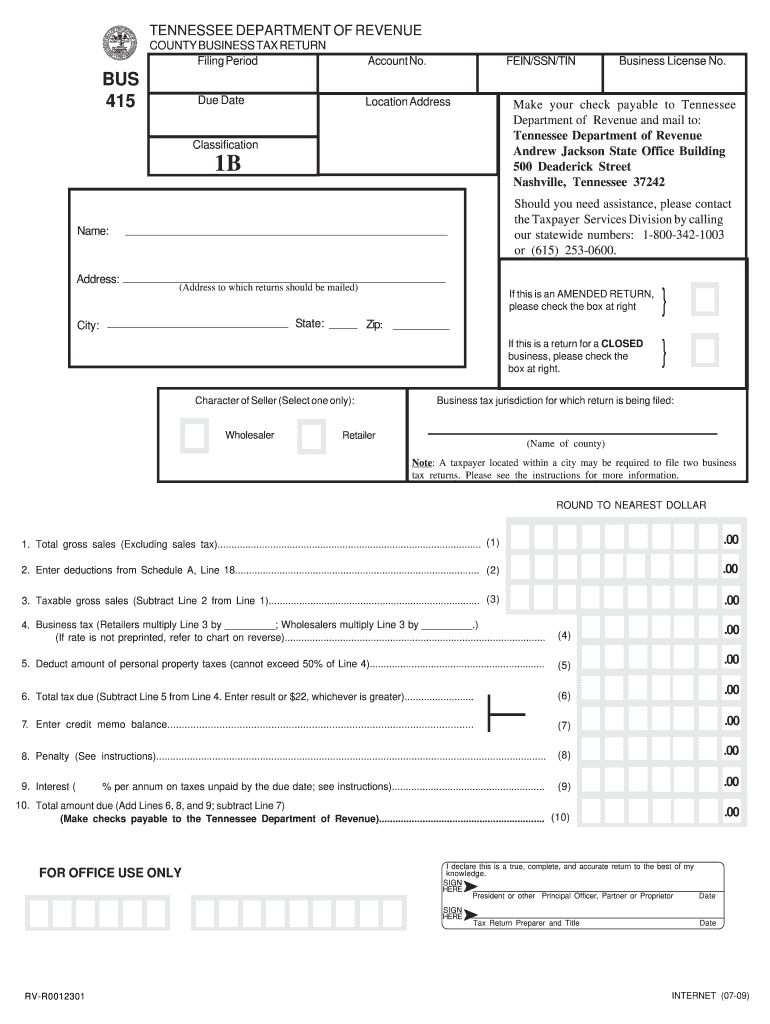

The Tennessee County Business Tax Return Bus 415 Form is a document required for businesses operating within various counties in Tennessee. This form serves as a declaration of the business's gross receipts and is essential for calculating the local business tax owed. It is crucial for compliance with local tax regulations and helps ensure that businesses contribute appropriately to their respective counties.

How to use the Tennessee County Business Tax Return Bus 415 Form

Using the Tennessee County Business Tax Return Bus 415 Form involves several steps. First, gather all necessary financial records, including gross receipts and any applicable deductions. Next, accurately fill out the form, ensuring that all information is complete and correct. After completing the form, it can be submitted either electronically or by mail, depending on the specific requirements of the county in which the business operates.

Steps to complete the Tennessee County Business Tax Return Bus 415 Form

Completing the Tennessee County Business Tax Return Bus 415 Form requires careful attention to detail. Follow these steps:

- Collect financial documents, including income statements and receipts.

- Fill in your business information, including name, address, and type of business entity.

- Report gross receipts accurately, including all sources of income.

- Calculate any applicable deductions as allowed by local tax laws.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Tennessee County Business Tax Return Bus 415 Form vary by county. Generally, businesses must submit their returns annually, with specific due dates typically falling on the last day of the month following the end of the fiscal year. It is essential for businesses to check with their local county tax office for the exact deadlines to avoid penalties.

Penalties for Non-Compliance

Failure to file the Tennessee County Business Tax Return Bus 415 Form on time can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action from local tax authorities. It is important for businesses to stay informed about their filing obligations to avoid these consequences.

Digital vs. Paper Version

Businesses have the option to complete the Tennessee County Business Tax Return Bus 415 Form either digitally or on paper. The digital version offers advantages such as ease of use and faster submission times. Electronic filing can also help reduce errors and streamline the process, making it a preferred choice for many business owners.

Quick guide on how to complete tennessee county business tax return bus 415 2009 form

Complete Tennessee County Business Tax Return Bus 415 Form smoothly on any device

Online document organization has become favored among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage Tennessee County Business Tax Return Bus 415 Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to alter and eSign Tennessee County Business Tax Return Bus 415 Form effortlessly

- Obtain Tennessee County Business Tax Return Bus 415 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing out new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device. Alter and eSign Tennessee County Business Tax Return Bus 415 Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tennessee county business tax return bus 415 2009 form

Create this form in 5 minutes!

How to create an eSignature for the tennessee county business tax return bus 415 2009 form

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Tennessee County Business Tax Return Bus 415 Form?

The Tennessee County Business Tax Return Bus 415 Form is a document required by county authorities in Tennessee for businesses to report their gross receipts and pay business taxes. This form ensures compliance with local tax regulations and helps maintain your business's good standing.

-

How does airSlate SignNow assist with the Tennessee County Business Tax Return Bus 415 Form?

airSlate SignNow provides an easy-to-use platform that allows businesses to fill out and eSign the Tennessee County Business Tax Return Bus 415 Form electronically. This eliminates the need for paper documents and speeds up the submission process, making tax compliance simpler.

-

Is there a cost associated with using airSlate SignNow for the Tennessee County Business Tax Return Bus 415 Form?

Yes, airSlate SignNow offers various pricing plans to cater to businesses of all sizes. Each plan provides access to features that streamline the completion and submission of documents like the Tennessee County Business Tax Return Bus 415 Form, ensuring you find the right fit for your budget.

-

What features does airSlate SignNow offer for managing the Tennessee County Business Tax Return Bus 415 Form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows for the Tennessee County Business Tax Return Bus 415 Form. These tools help enhance efficiency, reduce errors, and ensure timely filing of your business tax returns.

-

Can I integrate airSlate SignNow with other accounting software for filing the Tennessee County Business Tax Return Bus 415 Form?

Absolutely! airSlate SignNow supports integrations with various accounting and finance software, allowing seamless data transfer for filling out the Tennessee County Business Tax Return Bus 415 Form. This integration simplifies the process of gathering necessary financial information and ensures accuracy in your tax filings.

-

What are the benefits of using airSlate SignNow for the Tennessee County Business Tax Return Bus 415 Form?

By using airSlate SignNow for the Tennessee County Business Tax Return Bus 415 Form, you benefit from reduced paperwork, enhanced security, and faster processing times. The platform's user-friendly interface makes it accessible for businesses of all sizes, ultimately saving you time and reducing stress during tax season.

-

How secure is the data when submitting the Tennessee County Business Tax Return Bus 415 Form through airSlate SignNow?

Security is a top priority at airSlate SignNow. When you submit the Tennessee County Business Tax Return Bus 415 Form, your data is encrypted during transmission and storage, ensuring that sensitive business information is protected against unauthorized access.

Get more for Tennessee County Business Tax Return Bus 415 Form

Find out other Tennessee County Business Tax Return Bus 415 Form

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document