Tennessee Business Tax Return 2015-2026

What is the Tennessee Business Tax Return

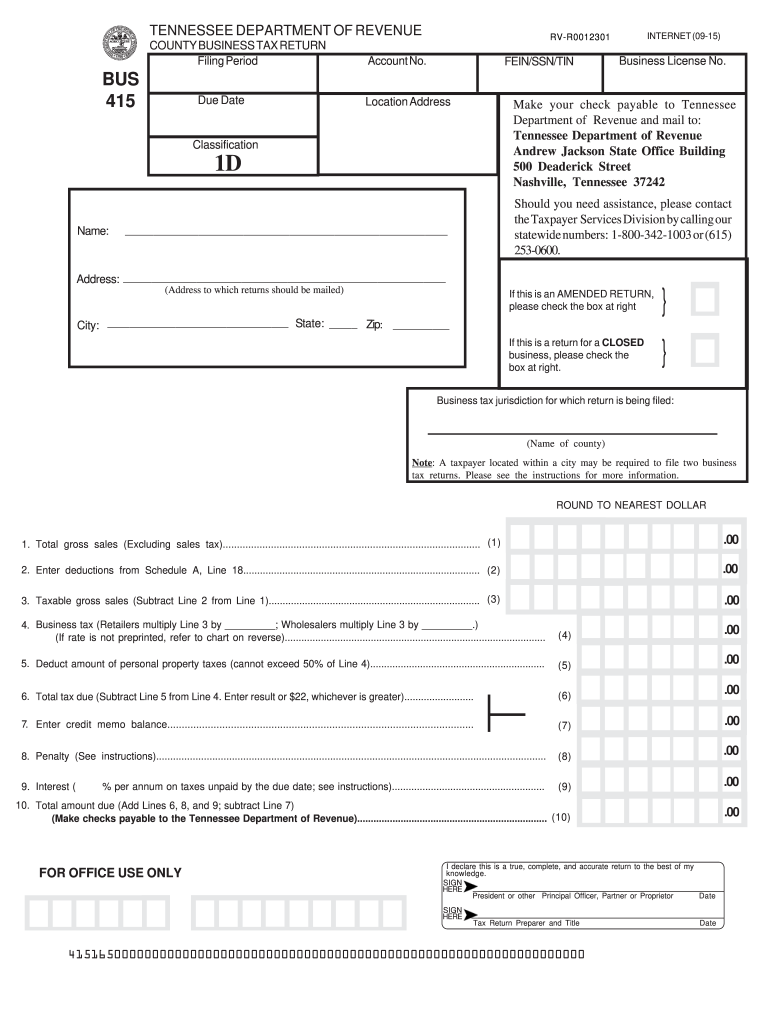

The Tennessee business tax return is a crucial document that businesses must file to report their income and calculate their tax obligations within the state. This return applies to various business entities, including corporations, limited liability companies (LLCs), and partnerships. The tax is based on gross receipts, which means that businesses must report their total sales before any deductions. Understanding the specifics of this return is essential for compliance with state tax laws and regulations.

Steps to Complete the Tennessee Business Tax Return

Completing the Tennessee business tax return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, determine your business's gross receipts and any applicable deductions. Once you have this information, fill out the appropriate forms, such as the TN Bus 415 or TN Bus 428, depending on your business structure. After completing the forms, review them carefully for any errors before submission.

Legal Use of the Tennessee Business Tax Return

The Tennessee business tax return serves as a legally binding document that reflects a business's financial activity within the state. To be considered valid, the return must be completed accurately and submitted by the designated deadline. Businesses must ensure compliance with state laws regarding tax reporting to avoid penalties. Electronic signatures can be used for submitting these forms, provided they meet the legal requirements set forth by the state.

Filing Deadlines / Important Dates

Filing deadlines for the Tennessee business tax return are crucial for maintaining compliance and avoiding penalties. Typically, the return is due on the 15th day of the fourth month following the end of the business's fiscal year. For businesses operating on a calendar year, this means the return is due by April 15. It is essential to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or legislative updates.

Required Documents

To successfully file the Tennessee business tax return, certain documents are required. These typically include:

- Financial statements, including income statements and balance sheets

- Records of gross receipts and any applicable deductions

- Previous year’s tax return for reference

- Any additional documentation required for specific deductions or credits

Having these documents organized and readily available will streamline the filing process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

Businesses in Tennessee have multiple options for submitting their tax returns. The forms can be filed online through the Tennessee Department of Revenue's website, which offers a convenient and efficient method. Alternatively, businesses may choose to mail their completed forms to the appropriate tax office or submit them in person. Each method has its own advantages, and businesses should select the one that best fits their needs while ensuring compliance with submission deadlines.

Quick guide on how to complete tennessee business tax return

Easily Prepare Tennessee Business Tax Return on Any Device

Managing documents online has become increasingly popular among both businesses and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, as you can locate the right form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruptions. Handle Tennessee Business Tax Return on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

How to Modify and Electronically Sign Tennessee Business Tax Return Effortlessly

- Locate Tennessee Business Tax Return and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Select relevant sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for that function.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to submit your form, either via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you prefer. Modify and electronically sign Tennessee Business Tax Return to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tennessee business tax return

Create this form in 5 minutes!

How to create an eSignature for the tennessee business tax return

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is a TN business tax return?

A TN business tax return is a specific tax document filed by businesses operating in Tennessee to report their income, expenses, and tax liabilities. It is essential for businesses to accurately complete this return to comply with state regulations and ensure they fulfill their tax obligations. Understanding how to file your TN business tax return is crucial for financial health and avoiding penalties.

-

How can airSlate SignNow help with filing a TN business tax return?

AirSlate SignNow simplifies the process of signing and sending essential documents, including those needed for your TN business tax return. With our user-friendly interface, you can easily prepare and share documents with your accountants or tax professionals. This streamlines the filing process and helps ensure timely submission.

-

What are the pricing options for using airSlate SignNow for TN business tax returns?

AirSlate SignNow offers various pricing tiers to suit businesses of different sizes and needs. Our plans start at an affordable rate, making it accessible for small businesses that require an effective solution for managing their TN business tax return documents. Each plan includes features geared towards enhancing productivity and making document management easier.

-

Does airSlate SignNow offer integrations with accounting software for TN business tax returns?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, providing an efficient way to manage your TN business tax return documentation. These integrations allow for direct syncing of financial data, making it easier to prepare your tax return and reducing the likelihood of errors. This feature enhances your overall workflow and accuracy.

-

What features of airSlate SignNow are beneficial for preparing a TN business tax return?

AirSlate SignNow includes features such as e-signatures, document templates, and secure cloud storage, which are incredibly useful for preparing your TN business tax return. E-signatures allow for quick approvals from stakeholders, while templates streamline repetitive tasks. With secure storage, you can easily access past returns for reference when filing.

-

Is airSlate SignNow secure for sensitive TN business tax return documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, employing advanced encryption methods to protect sensitive TN business tax return information. Our platform complies with industry standards, ensuring your data remains confidential and secure during the signing and sharing process. You can trust us to keep your critical business documents safe.

-

Can I track the status of my TN business tax return documents sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your documents, including those related to your TN business tax return. You will receive notifications when documents are viewed, signed, or completed, providing transparency throughout the process. This ensures you stay updated and can manage deadlines effectively.

Get more for Tennessee Business Tax Return

Find out other Tennessee Business Tax Return

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure