Common Reporting Standard CRS Self CIMB Bank Form

Understanding the Common Reporting Standard (CRS)

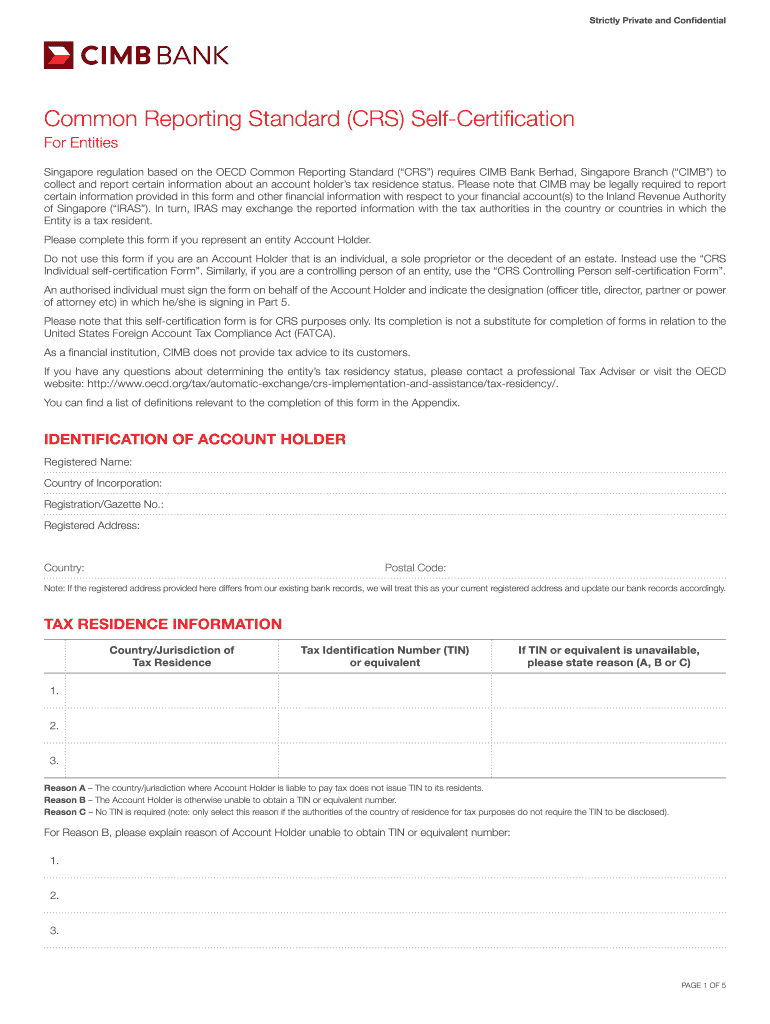

The Common Reporting Standard (CRS) is an international standard for the automatic exchange of financial account information between governments. It was developed by the Organisation for Economic Co-operation and Development (OECD) to combat tax evasion. Financial institutions, like CIMB Bank, are required to collect and report information on accounts held by foreign tax residents. This ensures that tax authorities have access to the necessary data to enforce compliance with tax laws.

Steps to Complete the CRS Self-Certification Form

Completing the CRS self-certification form is essential for individuals and entities to declare their tax residency status. Here are the steps to follow:

- Gather necessary personal information, including your name, address, and tax identification number.

- Determine your tax residency status based on your physical presence and legal obligations.

- Fill out the CRS self-certification form accurately, ensuring all details are correct.

- Submit the completed form to your financial institution, such as CIMB Bank, as per their submission guidelines.

Legal Use of the CRS Self-Certification Form

The CRS self-certification form serves as a legal document that confirms an individual's or entity's tax residency status. It is crucial for compliance with international tax regulations. By submitting this form, account holders affirm that the information provided is true and accurate, which protects both the individual and the financial institution from potential legal repercussions related to tax evasion.

Required Documents for CRS Self-Certification

When completing the CRS self-certification form, certain documents may be required to verify your identity and tax residency status. These documents typically include:

- Government-issued identification (e.g., passport, driver's license).

- Proof of address (e.g., utility bill, bank statement).

- Tax identification number from your country of residence.

Penalties for Non-Compliance with CRS Regulations

Failure to comply with CRS regulations can result in significant penalties for both individuals and financial institutions. Potential consequences include:

- Fines imposed by tax authorities for inaccurate or incomplete information.

- Increased scrutiny from tax agencies leading to audits.

- Possible legal action for tax evasion or fraud.

Eligibility Criteria for CRS Self-Certification

Eligibility for completing the CRS self-certification form generally includes individuals and entities that hold financial accounts in jurisdictions that participate in the CRS. Key criteria include:

- Being a tax resident of a participating jurisdiction.

- Having financial accounts with a reporting financial institution.

- Providing accurate and complete information as required by the CRS guidelines.

Quick guide on how to complete common reporting standard crs self cimb bank

Complete Common Reporting Standard CRS Self CIMB Bank effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without any hold-ups. Handle Common Reporting Standard CRS Self CIMB Bank on any gadget using the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

The simplest method to modify and eSign Common Reporting Standard CRS Self CIMB Bank without stress

- Find Common Reporting Standard CRS Self CIMB Bank and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive details using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Put aside concerns of lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Common Reporting Standard CRS Self CIMB Bank and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the common reporting standard crs self cimb bank

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What are cimb 13491 funds and how can they benefit my business?

CIMB 13491 funds are financial resources designated for a specific purpose within your business operations. By utilizing these funds effectively, you can enhance your company's growth through investments, operational expansion, or securing necessary resources. Properly managing cimb 13491 funds allows for better financial stability and encourages strategic planning.

-

How does airSlate SignNow integrate with cimb 13491 funds management?

AirSlate SignNow allows seamless documentation and eSigning capabilities that can be integrated into your cimb 13491 funds management process. With our platform, you can easily send, sign, and store vital documents related to these funds, ensuring compliance and efficient operations. This integration helps you manage your financial resources more effectively.

-

What features does airSlate SignNow offer for handling cimb 13491 funds?

AirSlate SignNow offers robust features, including customizable templates, automated workflows, and secure eSignature solutions tailored for cimb 13491 funds documentation. These features streamline the document approval process, allowing you to focus on strategic financial management. Our user-friendly platform makes it easier to oversee fund-related transactions.

-

Is airSlate SignNow a cost-effective solution for managing cimb 13491 funds?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing cimb 13491 funds. By reducing the time and resources spent on manual documentation processes, you can allocate financial resources more efficiently. This leads to potential savings and optimizes your overall fund management.

-

How can I ensure the security of my documents related to cimb 13491 funds with airSlate SignNow?

AirSlate SignNow prioritizes document security, especially when handling sensitive information like cimb 13491 funds. We implement robust encryption, secure cloud storage, and comprehensive compliance features to protect your documents. This ensures that your fund-related transactions remain confidential and secure.

-

Can I customize templates for cimb 13491 funds documentation in airSlate SignNow?

Yes, airSlate SignNow allows you to customize templates specifically for cimb 13491 funds documentation. This flexibility enables you to create tailored documents that meet the unique needs of your financial operations. Having personalized templates streamlines your processes and enhances the accuracy of your transactions.

-

What support options does airSlate SignNow offer for cimb 13491 funds users?

AirSlate SignNow provides comprehensive support for users managing cimb 13491 funds, including 24/7 customer service, online resources, and detailed documentation. Our knowledgeable support team is here to assist you with any inquiries regarding fund management. This ensures you have the assistance needed to maximize the benefits of our platform.

Get more for Common Reporting Standard CRS Self CIMB Bank

Find out other Common Reporting Standard CRS Self CIMB Bank

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself