Treasury and IRS Release FAQs to Help Small and Midsize Form

IRS Guidelines

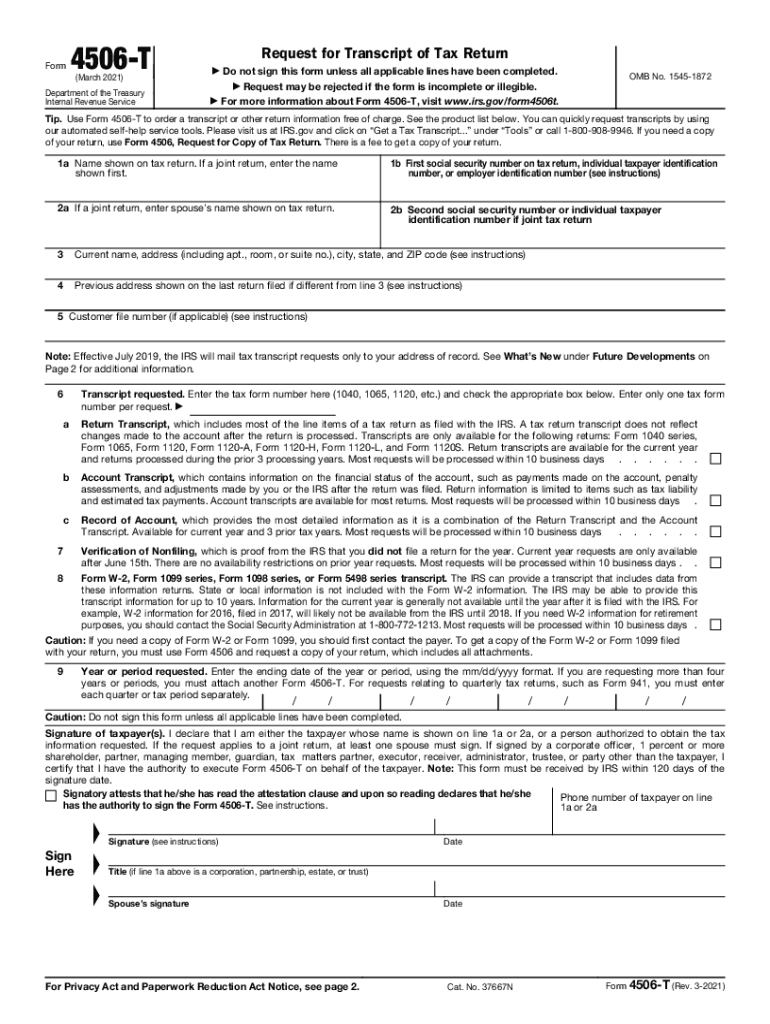

The IRS provides clear guidelines for obtaining and using the 2021 tax transcript. This document is essential for various purposes, including verifying income for loans, applying for financial aid, or resolving tax issues. The IRS typically issues transcripts for the current tax year and the previous three years. To ensure you receive the correct information, it is important to confirm that you are requesting the appropriate form, such as the 2021 IRS transcript or the tax return transcript for 2021.

Filing Deadlines / Important Dates

Understanding key filing deadlines is crucial for taxpayers. For the 2021 tax year, the deadline for filing individual tax returns was April 18, 2022. If you filed for an extension, the deadline would have been October 17, 2022. For those needing a transcript for tax purposes, it is advisable to request it soon after filing to ensure timely access to necessary documentation.

Required Documents

To request a 2021 tax transcript, you need specific information to verify your identity. This includes your Social Security number, date of birth, and the address used on your tax return. If you are requesting the transcript for someone else, you must provide their information along with your authorization. Having your 2021 Form 4506-T ready can streamline the process.

Form Submission Methods (Online / Mail / In-Person)

There are several methods to obtain your 2021 tax transcript. You can request it online through the IRS website, which is the fastest option. Alternatively, you can fill out Form 4506-T and submit it by mail. If you prefer in-person assistance, you can visit your local IRS office, but it is advisable to schedule an appointment in advance to avoid long wait times.

Penalties for Non-Compliance

Failing to provide accurate tax information can lead to significant penalties. If you do not file your tax return or request the necessary transcripts, you may face fines or interest on unpaid taxes. It is important to stay compliant with IRS regulations to avoid these consequences. Keeping your records organized and ensuring timely submissions can help mitigate these risks.

Digital vs. Paper Version

When it comes to tax transcripts, you have the option of receiving a digital or paper version. The digital version is typically faster to obtain and can be accessed immediately through the IRS online portal. The paper version may take longer to arrive but can be useful for those who prefer physical documentation. Both versions are considered valid for official purposes, provided they meet IRS standards.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios may require the use of the 2021 tax transcript for various reasons. For example, self-employed individuals often need to provide proof of income for loan applications. Retired individuals may use the transcript to verify income for Social Security benefits. Students may require it when applying for financial aid. Understanding your specific situation can help you determine how to best utilize the transcript.

Quick guide on how to complete treasury and irs release faqs to help small and midsize

Effortlessly Prepare Treasury And IRS Release FAQs To Help Small And Midsize on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed forms, enabling you to obtain the necessary document and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Treasury And IRS Release FAQs To Help Small And Midsize on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest method to edit and electronically sign Treasury And IRS Release FAQs To Help Small And Midsize with ease

- Find Treasury And IRS Release FAQs To Help Small And Midsize and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your document, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Treasury And IRS Release FAQs To Help Small And Midsize to ensure outstanding communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the treasury and irs release faqs to help small and midsize

How to make an eSignature for a PDF file in the online mode

How to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is a 2021 tax transcript?

A 2021 tax transcript is a summary of your tax return information for the tax year 2021. It includes data such as adjusted gross income, filing status, and other pertinent details. This document is essential for verifying income when applying for loans or scholarships.

-

How can I obtain my 2021 tax transcript using airSlate SignNow?

With airSlate SignNow, you can easily request your 2021 tax transcript online. Simply upload your form with the necessary information, and our platform will guide you through the submission process. The electronic signature feature ensures a quick and secure method to finalize your request.

-

Is there a fee to access a 2021 tax transcript through airSlate SignNow?

Accessing your 2021 tax transcript through airSlate SignNow may involve nominal fees based on the document processing features you choose. However, our platform offers a cost-effective solution that streamlines the signing process and saves time. For accurate pricing details, please check our pricing page.

-

What are the key features of airSlate SignNow for handling 2021 tax transcripts?

airSlate SignNow features a user-friendly interface, customizable templates, and robust security measures. You can easily upload, sign, and send your 2021 tax transcript with integrated workflows that save time and reduce errors. Every document is encrypted, ensuring your personal information remains secure.

-

How does airSlate SignNow benefit users dealing with 2021 tax transcripts?

Using airSlate SignNow for your 2021 tax transcript needs enhances efficiency and accuracy. Our platform allows multiple signers and real-time tracking, ensuring everyone stays informed during the signing process. Additionally, the ability to store documents securely helps you maintain organization for future reference.

-

Can I integrate airSlate SignNow with other applications for my 2021 tax transcript needs?

Yes, airSlate SignNow offers seamless integrations with various applications like Google Drive, Dropbox, and CRM tools. This allows you to streamline the workflow when obtaining your 2021 tax transcript and other document management tasks. Integrations enhance productivity and collaboration across your team.

-

What types of businesses can benefit from using airSlate SignNow for 2021 tax transcripts?

Any business needing to manage tax documents can benefit from airSlate SignNow, especially during tax season. Whether you're a small business, freelancer, or large corporation, our platform provides tailor-made solutions for sending and signing 2021 tax transcripts. It's a versatile tool that meets diverse industry needs.

Get more for Treasury And IRS Release FAQs To Help Small And Midsize

- Neat veterinary clinic payment agreement form

- Standard form 85 revised december

- Classroom maintenance checklist form

- Crc application form

- Automotive complaint form office of the attorney general ag ky

- Ust monthly walkthrough inspection form

- Application for special registration plates form vr 164

- Tc 95 608 form

Find out other Treasury And IRS Release FAQs To Help Small And Midsize

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free