Form 109

What is the Form 109?

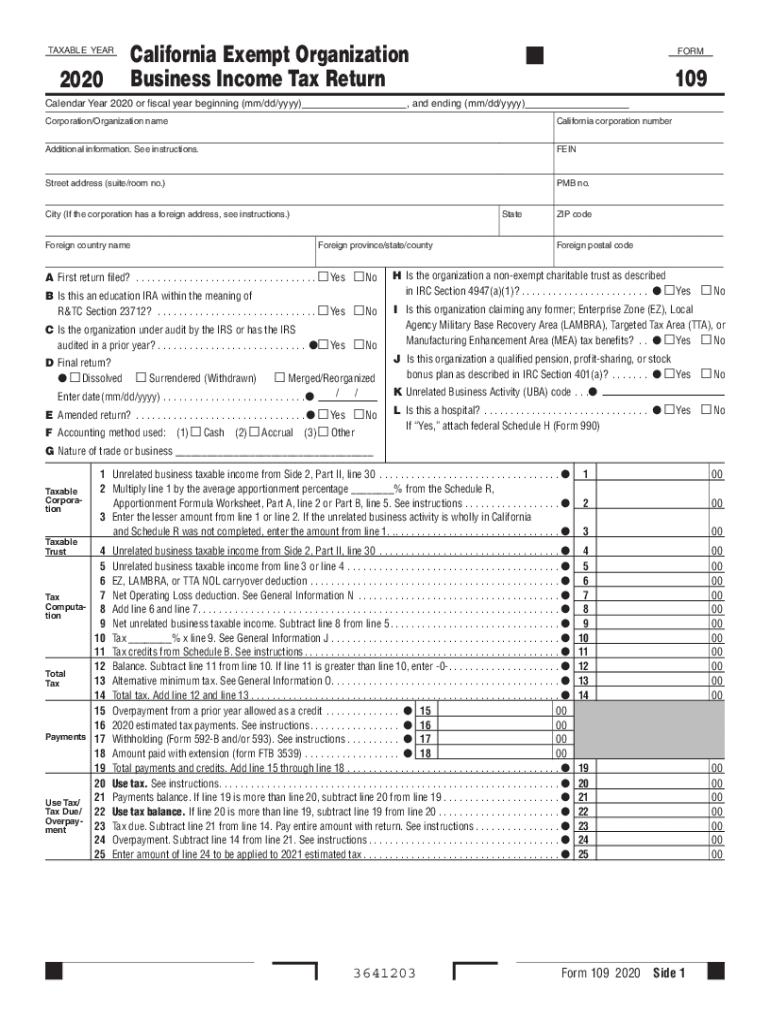

The 2020 California Form 109, commonly referred to as the 109 CA, is a tax form used by individuals and businesses in California to report income and calculate state taxes. This form is essential for ensuring compliance with California tax regulations and is typically required for those who have earned income during the tax year. The 109 CA serves as a record of income received, tax withheld, and any credits or deductions applicable to the taxpayer's situation.

How to use the Form 109

To effectively use the 2020 California Form 109, taxpayers must first gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Once the necessary information is compiled, the form should be filled out accurately, reflecting all sources of income. It is crucial to follow the instructions provided with the form to ensure that all entries are completed correctly. After filling out the form, taxpayers can submit it either electronically or via mail, depending on their preference and the requirements set by the California Franchise Tax Board.

Steps to complete the Form 109

Completing the 2020 California Form 109 involves several key steps:

- Gather all income documentation, including W-2s and 1099s.

- Download the 2020 California Form 109 from the California Franchise Tax Board website or access it through an e-signature platform.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately in the designated sections of the form.

- Calculate any applicable deductions and credits based on your financial situation.

- Review the completed form for accuracy to avoid potential errors.

- Submit the form electronically or print it for mailing to the appropriate tax authority.

Key elements of the Form 109

The 2020 California Form 109 includes several key elements that taxpayers need to be aware of:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Income Reporting: Taxpayers must report all income sources, including wages, interest, and dividends.

- Tax Withholding: This part details any state taxes that have been withheld from the taxpayer's income.

- Deductions and Credits: Taxpayers can claim various deductions and credits that may apply to their situation.

- Signature: The form must be signed to certify that the information provided is accurate and complete.

IRS Guidelines

When filling out the 2020 California Form 109, it is essential to adhere to IRS guidelines to ensure compliance. The IRS provides specific instructions on how to report income, what deductions can be claimed, and the deadlines for submission. Taxpayers should consult the IRS website or the instructions included with the form for detailed information on compliance requirements. Following these guidelines helps prevent issues with tax filings and minimizes the risk of penalties.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines related to the 2020 California Form 109. Typically, the deadline for filing state tax returns in California is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the California Franchise Tax Board website for the most current information regarding filing dates and any potential extensions.

Quick guide on how to complete form 109

Complete Form 109 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 109 on any platform using airSlate SignNow's Android or iOS applications and streamline your document-centric tasks today.

How to edit and eSign Form 109 without hassle

- Obtain Form 109 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 109 while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 109

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the 2020 California 109 form used for in business?

The 2020 California 109 form is essential for reporting income and payments made to independent contractors and other non-employees. It ensures compliance with tax regulations, helping businesses avoid penalties. Using airSlate SignNow simplifies the eSigning process for these forms, making it efficient and hassle-free.

-

How can airSlate SignNow help with the 2020 California 109 processing?

airSlate SignNow offers a streamlined solution for completing and signing the 2020 California 109 form electronically. Our platform allows for easy collaboration, ensuring all involved parties can access and sign documents anywhere, anytime. This enhances workflow and saves time during tax season.

-

Is airSlate SignNow cost-effective for completing the 2020 California 109?

Yes, airSlate SignNow is a cost-effective solution for completing the 2020 California 109 form. With flexible pricing plans, businesses of all sizes can benefit from our eSigning capabilities without breaking the bank. Our service emphasizes value, especially during tax season when timely submission is crucial.

-

What features does airSlate SignNow offer for managing the 2020 California 109 documents?

airSlate SignNow provides a user-friendly interface along with features like document templates, secure eSigning, and real-time tracking for the 2020 California 109 forms. These tools help you manage your documents efficiently while ensuring compliance with California's tax regulations. You can easily customize your documents for different needs as well.

-

Can I integrate airSlate SignNow with other software for the 2020 California 109?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions like CRM and accounting platforms, enhancing your ability to manage the 2020 California 109 forms. This integration boosts productivity by allowing you to pull data directly into your forms and maintain consistent records across your workflow.

-

What are the benefits of eSigning the 2020 California 109 with airSlate SignNow?

ESigning the 2020 California 109 with airSlate SignNow ensures that your documents are legally binding and processed quickly. The electronic format speeds up the signing process and reduces paper use, aligning your business practices with eco-friendly initiatives. Additionally, you can track the status of your documents in real-time, enhancing accountability.

-

How secure is airSlate SignNow when handling the 2020 California 109?

airSlate SignNow prioritizes security with features like encryption and secure data storage for handling the 2020 California 109 form. Your documents are protected throughout the eSigning process, ensuring that sensitive information remains confidential. Trust in our secure platform gives peace of mind when dealing with important tax documents.

Get more for Form 109

Find out other Form 109

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract