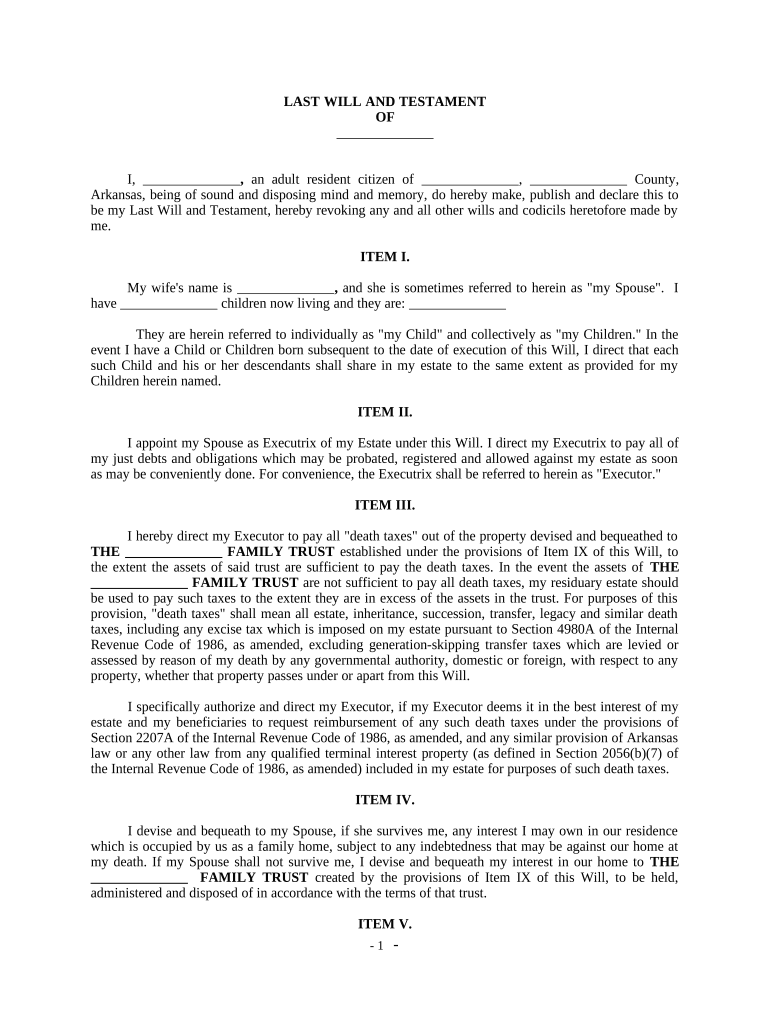

Complex Will with Credit Shelter Marital Trust for Large Estates Arkansas Form

Understanding the Complex Will with Credit Shelter Marital Trust for Large Estates

The Complex Will with Credit Shelter Marital Trust is a legal instrument designed to manage large estates effectively. This type of trust allows for the preservation of wealth while minimizing estate taxes. It typically involves two components: the marital trust and the credit shelter trust. The marital trust provides for the surviving spouse, while the credit shelter trust preserves assets for other beneficiaries, such as children, ensuring that these assets are not subject to estate taxes upon the death of the surviving spouse.

Key Elements of the Complex Will with Credit Shelter Marital Trust

Several key elements define the Complex Will with Credit Shelter Marital Trust:

- Marital Trust: This component allows the surviving spouse to access income generated by the trust, ensuring their financial security.

- Credit Shelter Trust: This trust holds a portion of the estate, exempt from estate taxes, benefiting the heirs directly.

- Tax Benefits: The structure of this trust can significantly reduce estate taxes, preserving more wealth for heirs.

- Flexibility: The trust can be tailored to meet the specific needs of the family, allowing for adjustments based on changing circumstances.

Steps to Complete the Complex Will with Credit Shelter Marital Trust

Completing the Complex Will with Credit Shelter Marital Trust involves several important steps:

- Consult with an Estate Planning Attorney: Engaging a professional ensures that the trust is set up correctly and complies with state laws.

- Determine Asset Allocation: Decide which assets will go into the marital trust and which will be placed in the credit shelter trust.

- Draft the Trust Document: The attorney will draft the necessary legal documents outlining the terms of the trust.

- Sign and Execute the Documents: Ensure all parties involved sign the documents in accordance with state laws to make the trust legally binding.

- Review Regularly: Periodically review the trust to ensure it still meets your family’s needs and adjust as necessary.

Legal Use of the Complex Will with Credit Shelter Marital Trust

The legal use of the Complex Will with Credit Shelter Marital Trust is governed by state laws. It is essential to ensure that the trust complies with the legal requirements in your state to be valid. This includes proper execution, witnessing, and notarization of the trust documents. Additionally, the trust must be funded correctly to ensure that the intended benefits are realized for the beneficiaries.

Examples of Using the Complex Will with Credit Shelter Marital Trust

There are various scenarios where a Complex Will with Credit Shelter Marital Trust can be beneficial:

- High Net-Worth Individuals: Those with substantial assets can use this trust to minimize estate taxes while providing for their spouse and children.

- Blended Families: In cases where there are children from previous marriages, this trust can ensure that all parties are fairly provided for.

- Business Owners: Business owners can protect their business interests and ensure a smooth transition of ownership to heirs.

Quick guide on how to complete complex will with credit shelter marital trust for large estates arkansas

Prepare Complex Will With Credit Shelter Marital Trust For Large Estates Arkansas effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Complex Will With Credit Shelter Marital Trust For Large Estates Arkansas on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronically sign Complex Will With Credit Shelter Marital Trust For Large Estates Arkansas with ease

- Locate Complex Will With Credit Shelter Marital Trust For Large Estates Arkansas and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or mask confidential information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid files, lengthy form navigation, and mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Complex Will With Credit Shelter Marital Trust For Large Estates Arkansas and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the main difference between a marital trust vs family trust?

The key difference between a marital trust vs family trust lies in their purpose and beneficiaries. A marital trust is designed to benefit a spouse, providing financial support during their lifetime, while a family trust can benefit multiple family members. Understanding these distinctions is crucial for effective estate planning.

-

How does airSlate SignNow facilitate the setup of a marital trust vs family trust?

airSlate SignNow simplifies the process of creating legal agreements by providing customizable templates. This allows users to easily draft documents related to marital trust vs family trust, ensuring they include all necessary legal language. Our platform streamlines e-signatures for a seamless user experience.

-

What are the costs associated with setting up a marital trust vs family trust?

The costs for setting up a marital trust vs family trust can vary signNowly based on complexity and legal fees. Using airSlate SignNow, businesses can reduce costs associated with document creation and e-signing, making it a cost-effective solution for achieving trust planning objectives.

-

What features does airSlate SignNow offer for managing marital trust vs family trust documents?

airSlate SignNow provides features like template creation, document tracking, and secure cloud storage for managing marital trust vs family trust documents. Additionally, our user-friendly interface allows for simple editing and collaboration, empowering users to maintain control over their legal documents.

-

What benefits do marital trust vs family trust provide?

Marital trusts provide benefits like tax advantages and financial security for a surviving spouse, while family trusts can offer more flexible asset management for multiple heirs. Understanding marital trust vs family trust benefits can help families make informed decisions regarding their estates and financial futures.

-

Can airSlate SignNow integrate with other tools for managing marital and family trusts?

Yes, airSlate SignNow can integrate with various tools and applications, which enhances its utility for managing marital trust vs family trust documents. By connecting with other software, users can streamline workflows, ensuring efficient management of all related documents and tasks.

-

Is it easy to make changes to marital trust vs family trust documents using airSlate SignNow?

Absolutely! airSlate SignNow allows users to easily edit and update marital trust vs family trust documents as needed. The platform's intuitive design ensures that making changes is hassle-free, providing users with greater control over their estate planning documents.

Get more for Complex Will With Credit Shelter Marital Trust For Large Estates Arkansas

- Quitclaim deed from individual to husband and wife rhode island form

- Warranty deed from individual to husband and wife rhode island form

- Quitclaim deed from corporation to husband and wife rhode island form

- Warranty deed from corporation to husband and wife rhode island form

- Quitclaim deed from corporation to individual rhode island form

- Rhode island corporation 497325018 form

- Quitclaim deed from corporation to llc rhode island form

- Quitclaim deed from corporation to corporation rhode island form

Find out other Complex Will With Credit Shelter Marital Trust For Large Estates Arkansas

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile