Publication 957 Internal Revenue Service Form

What makes the publication 957 internal revenue service form legally binding?

Because the world takes a step away from office working conditions, the execution of documents increasingly happens electronically. The publication 957 internal revenue service form isn’t an exception. Dealing with it utilizing digital means is different from doing so in the physical world.

An eDocument can be considered legally binding given that certain requirements are fulfilled. They are especially crucial when it comes to signatures and stipulations related to them. Typing in your initials or full name alone will not ensure that the organization requesting the form or a court would consider it accomplished. You need a reliable solution, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - major legal frameworks for eSignatures.

How to protect your publication 957 internal revenue service form when completing it online?

Compliance with eSignature laws is only a portion of what airSlate SignNow can offer to make document execution legal and safe. It also gives a lot of opportunities for smooth completion security wise. Let's quickly run through them so that you can be assured that your publication 957 internal revenue service form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: major privacy regulations in the USA and Europe.

- Dual-factor authentication: adds an extra layer of security and validates other parties identities through additional means, such as an SMS or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the data safely to the servers.

Submitting the publication 957 internal revenue service form with airSlate SignNow will give better confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete publication 957 internal revenue service

Finalize Publication 957 Internal Revenue Service effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents promptly without any holdups. Manage Publication 957 Internal Revenue Service on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Publication 957 Internal Revenue Service with ease

- Locate Publication 957 Internal Revenue Service and click Get Form to begin.

- Use the tools we provide to submit your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Publication 957 Internal Revenue Service and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 957 internal revenue service

The best way to generate an eSignature for your PDF file in the online mode

The best way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is the IRS publication for individuals?

Publication 17 covers the general rules for filing a federal income tax return. It supplements the information contained in your tax form instruction booklet. It explains the tax law to make sure you pay only the tax you owe and no more.

-

How do I get an IRS publication?

Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

-

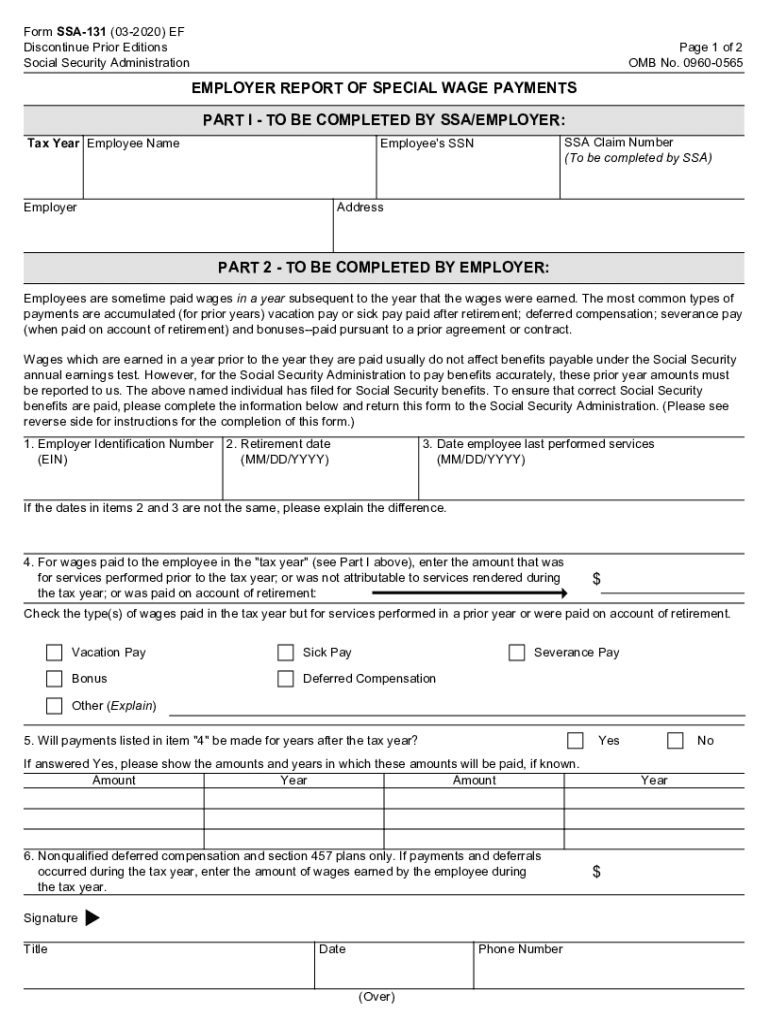

What is the SSA special wage payment form?

The SSA-131 "Employer Report of Special Payments” form was developed at the request of the payroll community, to be used in reporting special payments to SSA in individual situations. The intent is to have a standard form that employers are familiar with and that can be sent to employers and returned directly to SSA.

-

What is an IRS publication?

IRS publications are informational booklets written by the Internal Revenue Service that give taxpayers detailed guidance on tax issues.

-

What are the special wage payments for SSA?

Some special payments to employees include bonuses, accumulated vacation or sick pay, severance pay, back pay, standby pay, sales commissions, and retirement payments. Another example of a special payment is deferred compensation reported on a W-2 form for 1 year but earned in a previous year.

-

How do you calculate taxable income?

Steps to calculate taxable income Add up the different salary components to arrive at your gross salary. ... Next, deduct the non-taxable portion of partially taxable allowances, such as HRA and LTA. ... Actual HRA received. Actual rent per month minus 10% of basic monthly salary, or.

-

What is a 957 report?

IRS Publication 957: Reporting Back Pay and Special Wage Payments to the Social Security Administration [2023]

-

What part of salary is taxable?

The gross salary (minus the eligible deductions) is the taxable amount. Meanwhile, the net salary is what you get after deducting the income tax, pension, professional tax and other such amounts.

-

How do you get the $16000 Social Security bonus?

How to Get a Social Security Bonus Option 1: Increase Your Earnings. Option 2: Wait Until Age 70 to Claim Social Security Benefits. Option 3: Be Strategic With Spousal Benefits. Option 4: Make the Most of COLA Increases.

-

How much is backpay taxed?

As back pay is deemed to be a supplemental wage, withholding income tax depends on how you made the back payment: For separate payrolls: a flat 22% in income taxes should be withheld. For combined back pay and normal wages: use the sum to figure out the appropriate income tax withholding.

-

Is bonus taxable?

A bonus is an additional income for the employee and, therefore, is taxable. Along with the joy of receiving a bonus comes the hassle of its taxation. To make it a little simple, we have created this guide to help you understand how the bonus received from your salary is taxed.

-

What is a special wage payment?

The Internal Revenue Service defines special wage payment (SWP) as “an amount paid by an employer to an employee (or former employee) for services performed in a prior year.” SWPs include: Back pay. Severance pay. Accumulated vacation or sick pay.

Get more for Publication 957 Internal Revenue Service

Find out other Publication 957 Internal Revenue Service

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement