Form 3537

What is the Form 3537

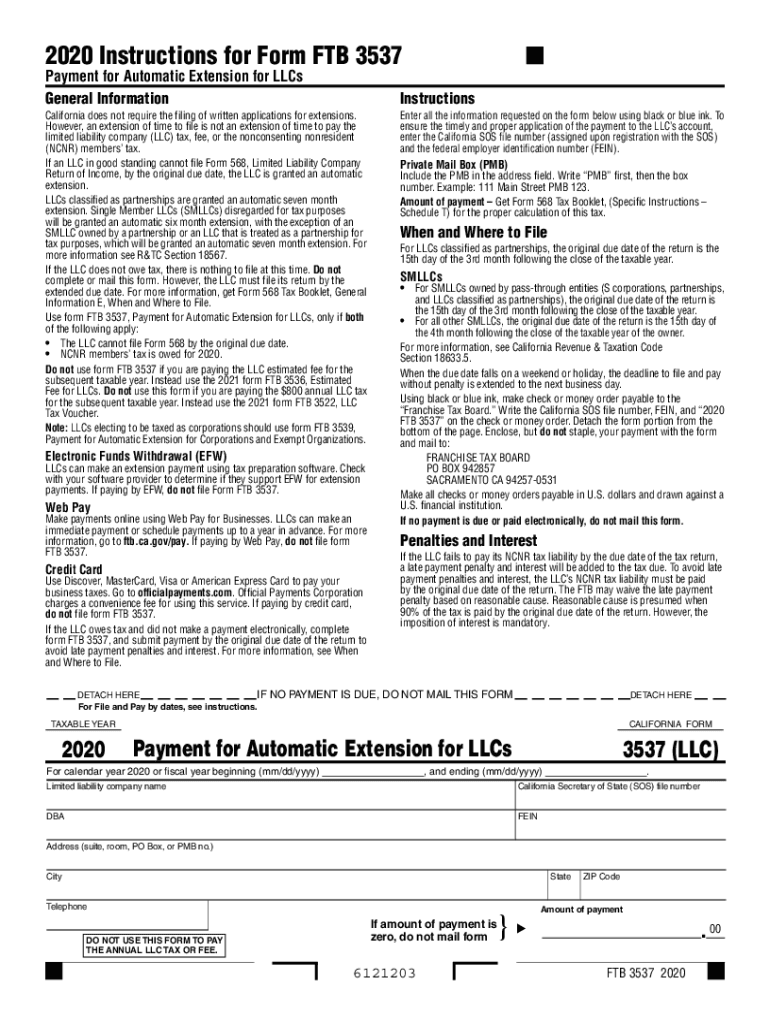

The Form 3537, also known as the 2018 LLC Extension Form 3537 California, is a document used by limited liability companies (LLCs) in California to request an extension for filing their California tax returns. This form is essential for LLCs that need extra time to prepare their tax documents without incurring penalties. It is specifically designed for the 2018 tax year, ensuring compliance with state tax regulations.

How to use the Form 3537

Using the Form 3537 involves a straightforward process. First, ensure that you meet the eligibility criteria for filing an extension. Next, accurately complete the form by entering the required information, such as your LLC's name, address, and tax identification number. After filling out the form, submit it to the California Franchise Tax Board (FTB) by the specified deadline. This will grant you an extension for filing your tax return, allowing you additional time to gather necessary documentation.

Steps to complete the Form 3537

Completing the Form 3537 requires careful attention to detail. Follow these steps:

- Obtain the form from the California Franchise Tax Board website or a reliable source.

- Fill in your LLC's legal name and address as registered with the state.

- Provide your tax identification number, which is crucial for processing.

- Indicate the type of extension you are requesting and the tax year.

- Review all entries for accuracy before submission.

Once completed, ensure the form is submitted by the deadline to avoid penalties.

Legal use of the Form 3537

The Form 3537 is legally recognized as a valid request for an extension under California tax law. To ensure its legal standing, it is important to comply with all filing requirements and deadlines. The form must be submitted to the appropriate state agency, and it should be filled out accurately to avoid any issues with tax compliance. Utilizing a reliable electronic signature tool can also enhance the legal validity of the submitted document.

Filing Deadlines / Important Dates

For the 2018 tax year, the filing deadline for the Form 3537 typically aligns with the original due date for LLC tax returns. It is crucial to submit the form by this deadline to receive the extension without penalties. Keep track of any changes in deadlines announced by the California Franchise Tax Board to ensure compliance.

Form Submission Methods

The Form 3537 can be submitted through various methods to accommodate different preferences. You can choose to file the form online via the California Franchise Tax Board's website, which offers a secure and efficient way to submit your request. Alternatively, you can mail the completed form to the appropriate address provided by the FTB. In-person submissions may also be available at designated FTB locations, allowing for direct interaction with tax officials.

Quick guide on how to complete form 3537

Effortlessly Prepare Form 3537 on Any Device

Digital document management has increased in popularity among both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 3537 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to adjust and eSign Form 3537 with minimal effort

- Obtain Form 3537 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 3537 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3537

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What are the key features included in the form 3537 instructions 2018 with airSlate SignNow?

The form 3537 instructions 2018 feature comprehensive eSigning capabilities, customizable templates, and automated workflows. These elements streamline the documentation process, allowing businesses to optimize their operations and improve efficiency. With airSlate SignNow, users can track document statuses in real-time, ensuring a smooth signing experience.

-

How does airSlate SignNow simplify the form 3537 instructions 2018 process?

airSlate SignNow simplifies the form 3537 instructions 2018 process by providing a user-friendly interface that guides you through each step. You can easily upload, edit, and send your documents for eSignature, reducing the time traditionally spent on paperwork. Moreover, automated reminders help you keep track of pending signatures, ensuring nothing falls through the cracks.

-

What is the pricing structure for using airSlate SignNow for form 3537 instructions 2018?

The pricing for using airSlate SignNow for form 3537 instructions 2018 is competitive and designed to fit various business sizes. Plans typically include monthly or annual subscriptions with options for additional features as businesses grow. You can explore the pricing on the website, allowing you to choose a plan that best fits your needs without breaking the bank.

-

Can I integrate airSlate SignNow with other software for form 3537 instructions 2018?

Yes, airSlate SignNow offers numerous integrations with popular software applications to enhance your form 3537 instructions 2018 experience. You can seamlessly connect it with CRM systems, cloud storage solutions, and productivity tools. This level of integration provides a holistic approach to document management, improving workflow efficiency across platforms.

-

What benefits does airSlate SignNow provide specifically for handling form 3537 instructions 2018?

Using airSlate SignNow for form 3537 instructions 2018 provides numerous benefits, including increased accuracy and reduced processing time. The digital signature process eliminates the risks associated with paper-based forms, such as lost documents or illegible handwriting. Additionally, users can store and access their signed forms securely in the cloud, making retrieval easy.

-

Is airSlate SignNow compliant with regulations for managing form 3537 instructions 2018?

Absolutely, airSlate SignNow is designed to be compliant with industry regulations, including eSignature laws such as ESIGN and UETA, to ensure your form 3537 instructions 2018 are handled securely. The platform employs encryption and other security measures to protect sensitive data. This compliance is critical for businesses that need assurance when managing important documents.

-

How can I get support if I have questions about form 3537 instructions 2018?

If you have questions about form 3537 instructions 2018 while using airSlate SignNow, you can access comprehensive customer support through various channels. The platform offers a knowledge base, live chat, and email support to assist users efficiently. Additionally, you can find helpful resources and tutorials on the website to guide you through common queries.

Get more for Form 3537

- Ap statistics test b data analysis part 1 form

- Reimbursement request form 6585533

- Montana bill of sale form

- One call care management appeal form

- Cjstc 68 form

- Hqs inspection form 17623029

- New prescription request form staywell guam

- Trianglesanta comimagestscommercialagreementts agreement commercial trianglesanta com form

Find out other Form 3537

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself